Self-employed workers could be encouraged to save for their pensions when filing their annual tax returns, under plans proposed by an influential think tank.

One of his ideas is to force them to make an active decision about the size of pension contributions they want to make (with “zero” being an option) into their own pension plan or a default retirement plan or lifetime ISA when they complete their self-assessment return.

Another is to automatically enroll them in a fixed level of contribution that would increase over time, but from which they could opt out, according to proposals from the Institute for Fiscal Studies.

More than half of self-employed workers have no private pension savings, according to the IFS

The self-employed now make up just over one in eight members of the workforce, but the proportion of those earning more than £10,000 and saving for pensions has plummeted from 60 per cent in the late 1990s to 20 per cent since the early 2010s, the IFS says.

About 80 percent of employees earning that salary or more now have a pension thanks to the successful automatic enrollment program.

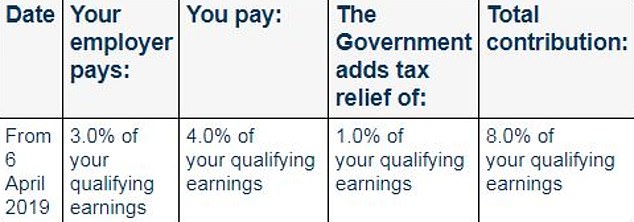

Unless they actively opt out, employees save a minimum of 8 per cent of their qualifying income (between £6,240 and £50,270 of salary), made up of a combination of personal and employer pension contributions, plus government tax relief.

According to the IFS, 52 percent of self-employed workers have no private pension savings at all, saying: “The status quo, where self-employed workers have to organise their own pension plans, is not adequate.”

‘Among those self-employed people who save in a private pension fund, many end up making the same cash contributions year after year, and inflation erodes the real value of those contributions over time.’

Self-employed workers are found to have similar levels of wealth to private sector employees (not counting those who still have access to more generous defined benefit pensions), but tend to have less in pensions and more in housing, business and other savings.

The IFS adds: ‘Many self-employed people have private pensions from previous employment, saved in other forms of wealth, or are married to or cohabiting with someone who does have a workplace pension.

‘The state pension system has also become more generous for the self-employed since the introduction of the new state pension in 2016.’

But despite the help from these sources, the IFS estimates that between one-fifth and one-third of self-employed people will not have sufficient savings when they retire.

Two alternative reforms are outlined that the Government could consider to assist them.

1. Require all self-employed people to actively choose the level of pension contributions they wish to make when completing a self-assessed tax return, with zero being the option.

That money would then be placed into a designated private pension plan, a default pension chosen by the Government or a lifetime ISA.

2. Include people in a pension or lifetime ISA by default when they complete a self-assessment return, unless they choose not to.

Contributions could start at a moderate amount, but increase over time to the same level used for employees under automatic enrollment (see below).

In addition, arrears on contributions by direct debit could be automatically increased in line with inflation.

Who pays what: breakdown of minimum pension contributions for automatic enrolment (qualifying income is between £6,240 and £50,270 of salary)

Laurence O’Brien, a research economist at the IFS, said: ‘Successive governments have made a huge effort to introduce automatic enrolment for employees to make it easier for them to save for retirement and have done so with great success.

‘On the contrary, the self-employed are left to their own devices.

‘People who spend a lot of time self-employed too often end up relying on their state pension, some other modest savings and possibly their partner’s pension or an inheritance to cover their needs in retirement.’