Jeremy Hunt will show greater interest than usual when Natwest kicks off the banking reporting season next week.

The Chancellor hopes to launch a ‘Tell Sid’-style campaign as early as June to sell shares in the lender to the public, an effort to generate some support for popular capitalism before the election.

However, a repeat of the fervor that surrounded Margaret Thatcher’s privatization program in the 1980s (including British Gas and British Telecom) seems highly unlikely.

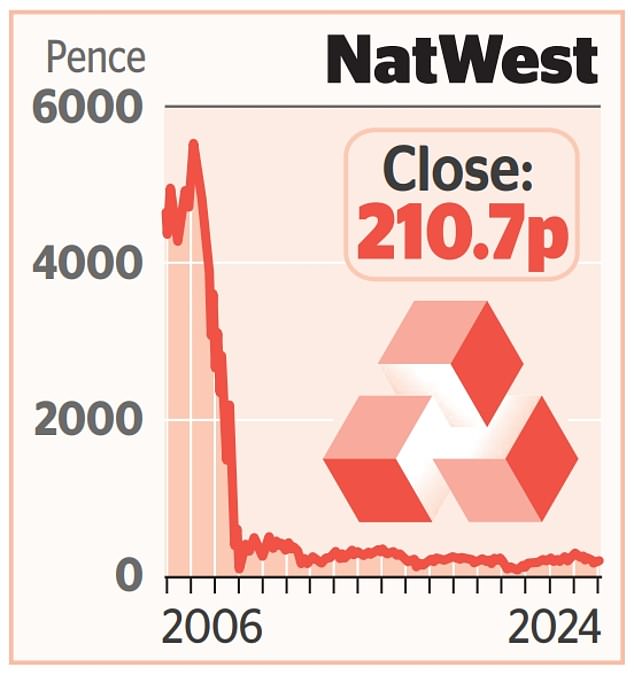

Natwest – or Royal Bank of Scotland, as it was previously known – has gone from crisis to crisis since taxpayers bailed it out to the tune of £45bn during the 2007-2009 financial crisis.

That saddled the Government with an 84 per cent stake in the bank, which has since been reduced to around 35 per cent.

But shares continue to languish, and missteps such as Nigel Farage’s debanking scandal have helped little. Therefore, generating enthusiasm among a weary public to participate in a stock sale can be difficult.

A series of decent figures on Friday would help, as would the appointment of a permanent successor to Alison Rose, who lost her job as chief executive after the Farage debacle.

Analysts expect annual profits to have risen to £6bn in 2023 from £5.1bn in 2022, although they are then forecast to fall to £4.8bn this year.

The dividend is expected to increase to 16.8 per share. Anything better than this would be helpful to Hunt.