Table of Contents

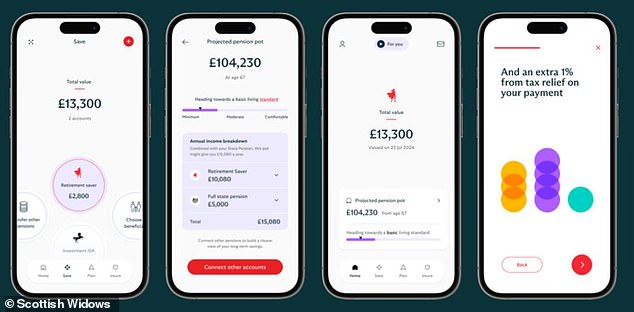

Scottish Widows is planning to ‘supercharge’ pensions engagement with the launch of a revamped app and TikTok channel in a bid to encourage young people to pay attention to their pensions.

The life insurance and pensions firm said it is investing £100m to improve its digital offering, including the launch of its TikTok channel ahead of “pensions engagement season”, This is Money can reveal.

According to data from Scottish Widows, one in four people aged between 20 and 30 are not saving anything for retirement and 38 per cent of them are not in a position to save to cover their minimum lifestyle needs.

Scottish Widows has rebranded its app platform and invested £100m to boost digital engagement

Jackie Leiper, managing director of Scottish Widows, told This is Money: ‘People use their online banking accounts almost every day.

We know that pensions and investments do not even come close to achieving that level of interaction and commitment from people.

“The investment we are making is to create an ecosystem and a digital experience that allows people to not only look at their products with us, but also connect accounts with other providers.”

Scottish Widows hopes that by launching a TikTok channel it can reach viewers, especially younger ones, who are keen to improve their pension and before it is too late to make a real difference.

Leiper added: “If you’re in your 20s or 30s, you’re not really thinking about retirement, are you? But we actually know that people in their 20s and 30s can make the biggest difference with small steps that they take.”

People generally don’t start paying attention to their pensions until they’re in their 40s, Leiper said, “at which point they have a fairly short window of time to actually make a real difference or take any real action.”

Working with TikTok, Scottish Widows found that searches for “#retirementplanning” had increased by 300 per cent in the first quarter of 2024 compared to the previous year, while “#retirement” had increased by 60 per cent.

Meanwhile, 81 percent of TikTok users said they want to learn more about personal finance, with a third actively seeking out such content on the platform.

The hashtag ‘#retirementplanning’ had over 10 million views in the first quarter of 2024.

Scottish Widows: Leiper says most people don’t expect a traditional business to be at the forefront of digital engagement

Scottish Widows said young people could gain more by getting involved in their pensions early in life, arguing that if the automatic enrolment age threshold was lowered to 18 and the lower earnings limit was lowered, savers could add an extra £46,000 to the average future pension pot – a 45 per cent increase.

“This generation of people in their 20s and 30s aren’t going to have any of the fancy retirement plans that maybe my generation had, so steps they can take now could really make a big difference for them,” Leiper said.

‘The TikTok channel is pretty experimental, but it’s proving that there’s demand there and that if we can get to where people are going, that’s probably our best chance of making the biggest difference.’

In addition to the TikTok channel, Scottish Widows is also updating its brand and app, including introducing gamification features that it hopes will help explain difficult concepts to users more easily.

The company’s in-app compound interest game, launched just a few weeks ago, has already received 53,000 visitors, or one in five app visitors.

Leiper said his games Beat the Gap and Pension Mirror have had “incredible engagement and have really helped simplify messaging and help people make decisions more easily.”

“The gamification team is miles ahead of our competitors and no one else is doing this in the pensions and investment space, especially in the UK,” Leiper added. “Most people wouldn’t expect to see this from a company as traditional as ours.”

Scottish Widows is currently recruiting a full gamification team, with the aim of creating standalone games that everyone can play, as well as expanding their capabilities to other aspects of their business.

“Ultimately, what we hope people will do is start taking steps to close the gap that they have, so that they have what they need for retirement,” Leiper said.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 4.92%

Cash Isa at 4.92%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible ISA now accepting transfers

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.