Table of Contents

I am about to turn 24 and have been a member of David Lloyd Fitness Club in Northwood, North West London, for nearly ten years, using it mainly for tennis.

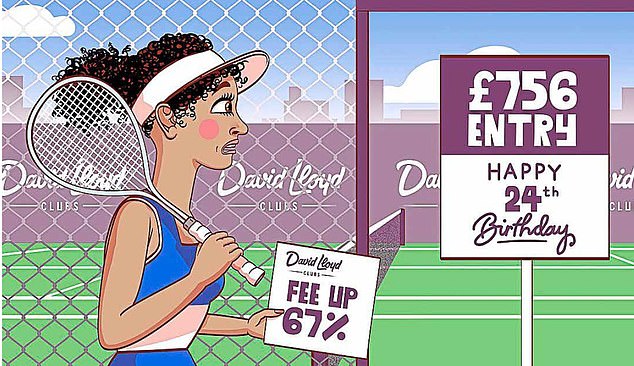

For the past few years I have had an 18-25 year olds contract, which gave me full access to the club, racket sports and spa. When it came time to renew my annual membership in June, I was informed that my fee would increase by 67%, from £1,335 to £2,232.

The club told me that the discount they had previously given me no longer applied. I didn’t like it, but I reluctantly accepted the new price and believed I would have the same access as before.

I paid in advance because it was cheaper than paying monthly, but when I went online to book a tennis session, I was told I was no longer a Racquets member. I complained and was told that adding tennis and the spa would cost another £756 a year.

LH, Pinner, North London.

Sally Hamilton responds: You felt like you had been beaten by leisure company David Lloyd when you renewed your membership. With the fee more than doubling to £2,988 if you wanted to continue playing tennis, you feared it was game over.

Also, if you weren’t happy, you would have to give three months’ notice to leave. You tried to sort things out on your own. You asked to become a joint partner with your mother, who has been a partner for many years, as that would reduce the fees. But you were refused, as only couples can be joint partners.

You asked for a refund of what you had already paid and then to have the new monthly rate charged to you so that you could manage your bills more easily. They replied that this was not possible.

You asked if you could at least spread the burden of the additional £756 charge for tennis and spa over monthly instalments, but this was also refused.

You were so furious that you asked me to arbitrate the dispute. After I made your complaint to David Lloyd, a member of staff offered you what you later described as an “unbelievable deal”. It turned out to be a membership with access to tennis and spa for a cost of £2,376, which is just £144 more than the quoted price without these extras. My intervention saved you £612.

Apparently he was given misdirection about the age discount. He was told that the youth discount used to apply to people aged 18-25, and that this had changed, while David Lloyd says there must have been a mistake, for which he apologises as the discount has only applied to people aged 18-23 for a long time.

A spokesperson said: “We aim to offer a wide range of packages to suit members’ lifestyles and ages. We regret any miscommunication. LH is a long-standing member of the club and we hope he continues to enjoy his time with us.”

Managing gym membership fees is an obstacle course, but it can be worth negotiating. If the receptionist or the person on the other end of the chat won’t budge, try speaking to a manager. In general, gym-goers who want to cancel a contract may have to give notice, the timeframe for which varies from gym to gym. Exceptions include if a member becomes seriously injured or ill, or loses their job.

If a gym is intransigent, members should cite the Competition and Markets Authority, which says a gym contract is unfair if it does not allow a member to cancel their membership due to serious injury or illness or a change in their personal circumstances that prevents them from paying fees. If a club will not agree to this, contact Citizens Advice for help.

My brother and I are executors of our late father’s will and beneficiaries of his lifetime health insurance policy, which we estimate to be worth in excess of £80,000. Our father paid monthly premiums from October 1992 until his death in September 2023.

When he died, we commissioned our solicitor to handle matters. His first correspondence with Clerical Medical was on 4 October. Ten months have passed and the policy has still not been paid, despite the solicitor’s best efforts.

In June and July of this year I sent an email to the insurer, but received no response. I did receive a response to a letter I sent in July, but it simply requested the documentation we had already provided.

EN, Blackpool, Lancs

Sally Hamilton responds: It seems that the administrative side of Clerical Medical needs some medical attention. Ten months is not an acceptable period to wait for a policy payment.

I contacted Clerical Medical and they got to work, confirming that the money would be in the hands of their lawyers the next day. And so it was.

She apologised for the delay, saying it was caused by the company failing to communicate clearly with her lawyers that one of the trustee names on her father’s policy needed to be corrected, and then requesting a trust registration from HM Revenue & Customs when it was not required.

He appreciated my help but was shocked to receive only £58,903, when he believed the sum should have been more than £80,000. Premiums are lower for this type of cover than other forms of life insurance because the sum paid is reduced over the term of the policy.

Many opt for decreasing term life insurance in conjunction with a home loan, for example, with coverage that reduces to reflect the declining size of the loan over time. Others choose it to provide a payout to support the family if the breadwinner dies prematurely, calculating that less money will be needed for older children.

The sum insured was initially £83,536, but by the time his father died it had been reduced to £9,932.

The remainder of her payment was made up of a fund value of £16,464, a final bonus of £29,982 and further bonuses of £8,853. The final payment she received included £2,571 in interest covering the delay period. Clerical Medical also paid her an additional £980 for the inconvenience caused.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.