New York-based RTW has been successfully investing in life sciences companies for the past 15 years.

But founder Roderick Wong has never been more enthusiastic than now about the investment case for life sciences and, in particular, biotechnology.

Wong, who has built a business overseeing more than $7bn (£5.5bn) in investments with support offices in China and London, says biotech is at a “historic moment in terms of investment opportunities.” “.

His optimism is based on two tendencies. First, biotech is now emerging from a three-year bear market triggered by a combination of high interest rates, rampant inflation and a resulting shortage of companies making the jump from private to publicly traded.

Secondly, and more interestingly, Wong believes the sector is in the “early stages of an innovation supercycle”.

He says: “It is driven by new technology that is leading to exciting new discoveries in a wide range of areas, from gene and cell therapy to small molecule therapies.”

While Wong thinks it’s understandable that many investors’ eyes have been transfixed by artificial intelligence and the rise of AI giant Nvidia, he says they should also pay attention to biotech.

“It’s not getting the attention it deserves,” he adds.

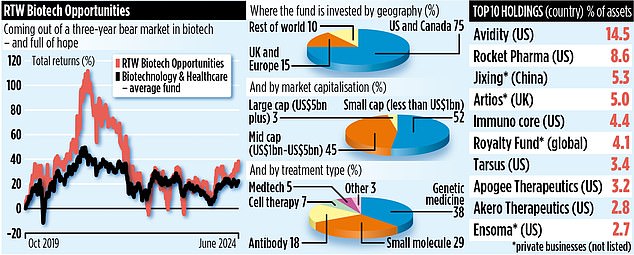

For UK investors, Wong’s company runs a stock market-listed investment trust called RTW Biotech Opportunities.

Capitalized at £522 million, it invests in a diverse portfolio of biotech stocks, from start-ups to established companies listed on a public stock market.

Wong is the portfolio manager along with Naveen Yalamanchi. Ideally, he likes to invest throughout the life cycle of a company.

He says: ‘We like to be present from the beginning when a company is private. We do our due diligence and then work closely with them, perhaps taking a seat on the board and gaining trust as we go.

‘However, unlike venture capitalists, we don’t exit when the company goes public. Often, we will maintain our investment and reap greater rewards as a result.”

He has taken this approach with gene therapy specialist Rocket Pharmaceuticals, a US company he helped found almost nine years ago.

Rocket went public in early 2018 and is now one of the largest gene therapy companies in the world, leading the fight against cardiovascular disease.

Wong is the president of the company and says that “the future looks more exciting than the past.” His largest holding in his portfolio is in Avidity Biosciences, which is listed on the US stock exchange.

This year, its share price has risen more than 300 percent, thanks to impressive results from a study into the treatment of a rare form of muscular dystrophy.

RTW Biotech’s assets increased earlier this year when it absorbed Arix Bioscience. In terms of performance, the trust’s shares have generated a return of 45 per cent since the fund was launched in October 2019.

This is better than the biotechnology and healthcare sector’s average return of 22 percent. It’s also a gain made despite having to endure the three-year biotech bear market.

Its rivals include Biotech Growth and International Biotechnology. Like RTW, both are listed on the London Stock Exchange.

RTW Biotech’s total expenses are high at 2.78 percent. Its stock identification code is BKTRRM2 and its ticker is RTW. Its shares are traded in both US dollars and pounds sterling.

Currently, they are at a 14 percent discount to the value of their underlying assets.