Table of Contents

Buy-to-let investors are experiencing mixed results at times.

On the one hand, they are fighting high interest rates and inflation, which are driving up the costs of homeownership.

On the other hand, they benefit from strong rental growth and tenant demand. But the national picture doesn’t tell the whole story.

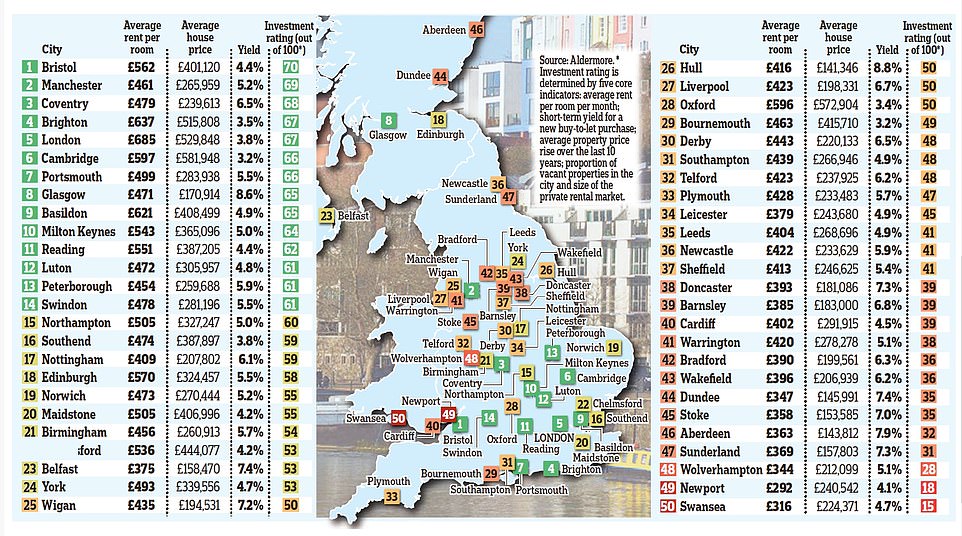

Landlords’ fortunes have varied greatly from city to city, with rental yields (the main measure of the return on their investment) ranging from 3.2 percent to a healthy 8.8 percent.

Bristol has been crowned the best place in the UK for homeowners to invest, according to analysis carried out for Money Mail by Aldermore Bank.

Today we can reveal the full list of the 50 best UK cities for buy-to-let investment.

While rental yields are typically the only major metric used in most analyzes of the buy-to-let property market, it is just one of several key criteria that landlords should study.

When compiling the rankings, researchers evaluated cities based on a variety of additional factors, including long-term house price growth, the size of the rental market and how many vacant properties there are in the area. And Bristol isn’t the only city enjoying a buy-to-let boom.

We spoke to estate agents in some of the UK’s thriving buy-to-let markets to find out why they are hot investment hotspots and those in markets struggling to compete.

Jon Cooper, mortgage director at Aldermore, said: “Normally a few regions dominate, but this year we are seeing a wider range make the top ten.” “Each region is made up of multiple smaller markets with unique conditions and challenges.”

West Country captivates travelers

Bristol is the UK’s number one city for landlords, largely thanks to its high average room rents of £562 per month, 24 per cent higher than the top 50 city average.

House prices there have grown by 6.6 per cent annually over the past decade, compared to average annual growth of 4.8 per cent across the UK.

And many tenants need a property: only 0.8 percent of rental properties are vacant. Rental yields sit at 4.4 per cent, lower than the 5.5 per cent average across all 50 cities, due to high house prices in Bristol.

Rental yield means how much rent the property generates compared to the price paid for it.

And the average house is now valued at £401,120, making it more expensive for homeowners to generate income.

The city’s popularity, says Ben Chapman, lettings partner at Romans Lettings, is down to its now commutable distance from London and Birmingham.

Renters have been willing to travel more since the pandemic, as many businesses now allow staff to work from home for part of the week. And Mr Chapman says: “You can still get a lot of property for your money here.”

Although rents are higher than average, they remain affordable for Bristolians, unlike London rents, which have overtaken wages. But astute owners don’t settle for low returns.

Chapman adds: “Most landlords are looking for a rental yield of between 7 and 8 per cent, so they buy bargain properties at auction for around £290,000 and renovate them to rent for £600 per room”.

Top spot: Bristol has been crowned the best place in the UK for homeowners to invest, according to analysis carried out for Money Mail by Aldermore Bank

Manchester and London remain strong

Manchester took second position in our rankings, while London dropped to fifth place.

Manchester’s strengths, says Baljit Arora, managing director of agency Orlando Reid, lie in its affordable housing and growing population of young professionals looking to rent.

Landlords charge an average rent per room of £461 per month. A fraction higher than the £455 average across all 50 cities, but lower than the top ten cities, Coventry, Brighton and Portsmouth.

Landlords can expect a slightly below-average yield of 5.2 per cent, but Arora says that is not a deterrent for Manchester landlords. “Rental demand is so strong that the property is less likely to sit vacant,” he says.

Only 0.9 per cent of rental properties are empty and almost a third of the city’s residents rent privately in Manchester, reflecting London’s competitive market, according to Aldermore.

In the capital, dramatic increases in rental prices have led to a recent slowdown in tenant demand. High interest rates on buy-to-let mortgages have also made things difficult for landlords.

According to property data experts Hometrack, the proportion of landlords who have lowered rental prices by more than 5 per cent is highest in London.

The average rent per room in the capital is £685 a month, the most expensive in our table. But with house prices so high, the average yield is low: 3.8 percent.

Coventry is a rising star

Coventry is one of the most improved cities and one of the most promising locations for buy-to-let homeowners, says Aldermore.

Compared to the bank’s analysis of previous years, the city rose seven places between 2022 and 2023 to occupy third position.

Offering an attractive rental yield of 6.5 per cent, the city also has strong tenant demand thanks to its two universities, Coventry and Warwick, and employment opportunities offered by big manufacturing names such as Jaguar Land Rover.

Laura Green, director of Shortland Horne, said: ‘Coventry is an improving city, it is green and the city center is developing. With just an hour’s train journey to London, it’s an attractive option for commuting to work.’

Last year, rents for a two-bedroom property increased from £800 to £900 a month, but this remains affordable for many potential tenants.

Getting better: Coventry offers an attractive rental yield of 6.5%, the city also has strong tenant demand thanks to its two universities, Coventry and Warwick.

Hull and Glasgow offer the best returns

Yield seekers looking to quickly offset the cost of a purchase could look to Hull, which has the best yield of the UK’s 50 cities: 8.8 per cent.

Landlords charge an average of £416 per room for properties in the Yorkshire city, less than the average of £455 elsewhere.

This equates to an estimated £12,480 in rental income each year, and the average property has 2.5 bedrooms. But the lower rent is offset by its relatively cheap housing stock, with the typical property costing just £141,346.

Despite being the top performer, Hull sits in the middle of our table, in 26th place. It scores poorly on annual house price growth over the last decade (3.7 per cent vs. 4. 8 percent average of the cities on our list) and in their number of vacant properties.

Glasgow has the second best rental performance of any UK city, at 8.6 per cent. But it ranks much higher than Hull when other key indicators are included, coming in eighth place.

This is because landlords can expect rental income of £14,700 per average property, which costs £170,914. Annual house price growth stands at a healthy 5.3 per cent, above average, and there are few vacant properties. Its only weakness is that only 19 percent rent privately.

Low yields cause Oxford sadness

After missing out on 10th place in 2022, Oxford fell 17 places to 28th place.

Rental yields per room are higher than the national average (£596) and there is a high proportion of renters, but yields are one of the lowest of all cities at 3.4 per cent due to high prices of the properties.

Rhys Hathaway, director of family business Hathaway’s Estate and Lettings Agency, says house prices in Oxford soared during the stamp duty holiday in 2020 and 2021 and many homeowners decided to take advantage of the situation and therefore , they abandoned the market completely.

“Most of the owners we have here are small accidental owners, not big professionals,” he added.

‘Demand for flats and houses has fallen in the last 12 months. “We received ten to twenty inquiries per property, now it’s more like five to ten.”

However, he said homes are still renting quickly and demand for home shares is strong.

…And the worst places to invest?

The Welsh cities of Newport and Swansea are ranked 49th and 50th for the third year. They attract low rents of £292 and £316 a month respectively.

Properties are priced below average, but cost more than in Bradford, for example, where they rent for £390.

Buy-to-let broker Sunny Budhdeo, director of Unique Property Finance, says Swansea is popular with landlords buying large houses or commercial properties to convert into high-end student accommodation.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.