Reserve Bank governor Michele Bullock has openly mocked Treasurer Jim Chalmers by suggesting he could hypothetically “wreck the economy” with further rate rises.

The cash rate remained unchanged at a 12-year high of 4.35 percent on Tuesday, even though the United States, the United Kingdom, Canada, the EU and New Zealand had already cut rates this year.

But Ms Bullock has used as a weapon Dr Chalmers’ criticism of the most aggressive rate rises in a generation, just three weeks after the Treasurer accused the Reserve Bank of “wrecking the economy”.

“That could be an alternative strategy which is to go up very high, destroy the economy – to use a term – and then come back down, be prepared to come back down very quickly,” he told reporters on Tuesday, who responded with laughter.

Dr Chalmers said earlier this month that the RBA’s rate hikes had significantly slowed the economy, before official data showed Australia’s annual growth pace of 1 per cent in 2023-24 was the slowest since 1991, the year of a recession, outside of a pandemic.

“With all this global uncertainty coupled with the impact of rate hikes destroying the economy, it would not be a surprise if Wednesday’s national accounts showed growth was soft and moderate,” he said.

The Treasurer remains committed to boosting the RBA’s independence and wants to remove the government’s power to override the Reserve Bank’s decision on interest rates.

The policy has never been used since the Reserve Bank of Australia was established by law in 1959, but the Greens will only back Labor’s RBA reforms in parliament if they force the central bank to cut rates.

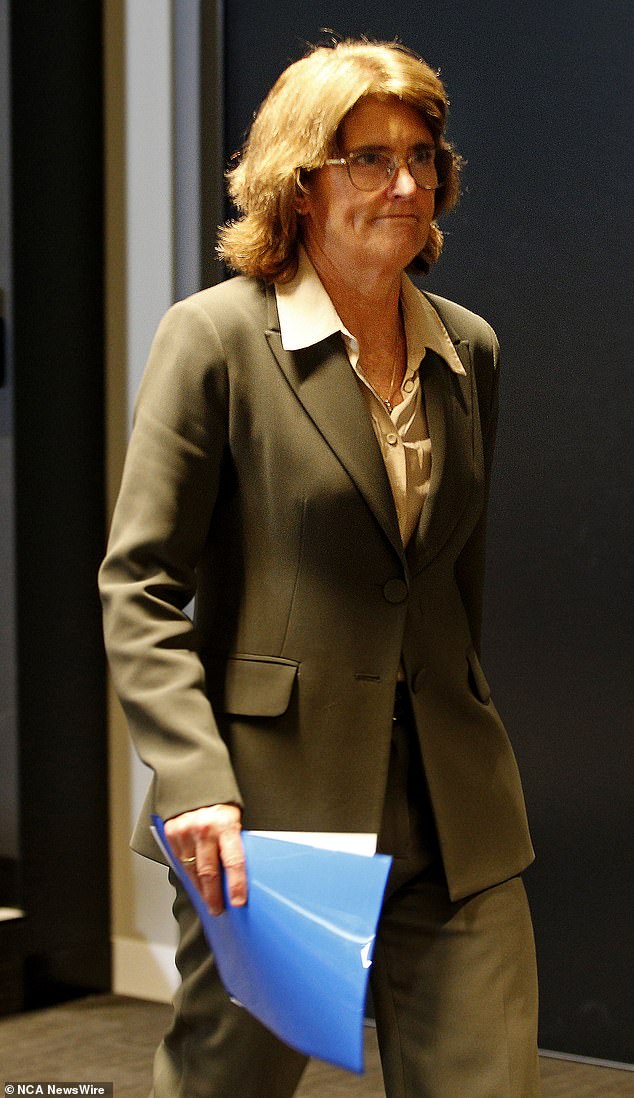

Reserve Bank Governor Michele Bullock (pictured on Tuesday) told reporters it could “wreck the economy”, just three weeks after the Treasurer accused the Reserve Bank of “wrecking the economy”.

Treasurer Jim Chalmers (pictured on Tuesday in Toowoomba) held a press conference 30 minutes before the RBA boss.

Ms Bullock has also suggested that the federal government’s $300 energy rebates, which came into effect on July 1, would do little to reduce underlying inflation, the RBA’s preferred measure of monetary policy.

This came despite expectations that monthly inflation data for August, due on Wednesday, would show headline inflation easing to within the RBA’s 2 to 3 percent target.

“That will reduce energy prices, fuel prices have also come down in recent months, so it may well be, on current forecasts, that the headline inflation rate does in fact end the 12 months below 3 per cent,” the RBA governor said.

‘That’s important because it reflects a relief in the cost of living and therefore is reflected in the prices that people see.

“But that doesn’t really reflect the underlying inflationary pulse, which is rather what we’re seeing actually happening with services, which is the crux of the matter.”

The RBA board stressed that its preferred measure of underlying inflation, known as the trimmed mean, is unlikely to fall below 3 percent until the end of 2025.

Core inflation, excluding volatile price movements, was 3.9 per cent in the year to June, well above the RBA’s 2 to 3 per cent target.

“Inflation is still above our target and is proving to be persistent,” Bullock told reporters on Tuesday.

Ms Bullock (pictured) also suggested that the federal government’s $300 energy rebates, which came into effect on July 1, would do little to reduce underlying inflation.

‘Progress in reducing underlying inflation has slowed and is likely to have remained sluggish in the September quarter.

“It’s not really anticipated that he’ll be back in the band on a sustainable basis until 2026.”

Headline inflation was slightly lower at 3.8 per cent due to softer petrol prices, but this is not the RBA’s preferred measure of inflation because it is more erratic.

The Reserve Bank also criticised the high level of immigration and international students which keep inflation high.

“Previous declines in real disposable incomes and the lingering impact of tight financial conditions continue to weigh on consumption, particularly discretionary consumption,” Bullock said.

‘However, aggregate consumer demand growth, which includes spending by temporary residents such as students and tourists, remained more resilient.’

The Treasurer (pictured) remains committed to boosting the RBA’s independence and wants to remove the government’s power to override the Reserve Bank on interest rates.

In a sign of tension with the RBA, Dr Chalmers scheduled a press conference at 3:00pm AEST on Tuesday afternoon, ahead of Ms Bullock’s press conference at 3:30pm.

He reiterated that immigration levels had fallen, although annual growth of 432,150 in the year to July was just shy of March’s near-record pace of 509,800.

“We have a sensible, methodical and thoughtful way of managing net overseas migration. It has started to slow,” he told reporters in Toowoomba.

“The data does not yet reflect that.”

The Reserve Bank’s 13 interest rate hikes in 2022 and 2023 were the most aggressive since the late 1980s.

But the 12-year high cash rate of 4.35 percent is still below levels reached in the United States, the United Kingdom, Canada and New Zealand, which all started with a “five.”

“The economic circumstances here are a little different than abroad,” Bullock said.

‘New Zealand and Canada, for example, have seen fairly sharp increases in their unemployment rates; some of those countries have seen inflation fall more than we have at the moment, so their disinflation process is further along than ours.’