<!–

<!–

<!–

<!–

<!–

<!–

Real estate brokerage Compass has agreed to pay $57.5 million to settle claims that it conspired to overcharge U.S. home sellers by billions of dollars.

Compass is the first major firm to reach a settlement sum since the National Association of Realtors (NAR) agreed to pay $418 million last week on behalf of smaller brokers.

Tens of millions of Americans who sold homes in recent years are likely to receive a payout from the deals, including the latest from Compass, but details on who will qualify are scarce.

The NAR has refused to respond to repeated requests from DailyMail.com asking how sellers can claim compensation, which now amounts to nearly $700 million in several cases.

Compass is one of many large brokerages facing accusations of violating antitrust laws.

A judge still needs to approve the Compass deal, which is believed to be a formality. Once they do, news will be posted on how to claim.

Real estate brokerage Compass has agreed to pay $57.5 million to settle claims that it conspired to overcharge U.S. home sellers by billions of dollars. He has denied any wrongdoing

Previously, the buyer’s agent could see which properties had the highest sales commission and “guide” buyers to them.

New York-based Compass also agreed to change its business practices to ensure moving companies understand how brokers and agents are compensated.

Chief Executive Robert Reffkin said today that the company, which denied any wrongdoing, was pleased to resolve the claims to “minimize distractions.”

The decision was welcomed by Mike Ketchmark, an attorney representing the home-seller plaintiffs.

He said: ‘Runners across the country continue to join the NAR to abandon the broken system. We look forward to many more settlements in the coming months.”

The case concerns a long-standing practice designed to keep rates high and get the biggest commission possible.

Among the changes it agreed to make, Compass will require its brokerages and agents to clearly disclose to clients that commissions are negotiable and not set by law.

They must also indicate that the services of agents representing home buyers are not free.

It also agreed to require its agents representing home buyers to immediately disclose any offer of compensation by the broker representing a seller.

Three other large brokerage firms have made similar agreements to resolve the litigation.

Re/Max Holdings and Anywhere Real Estate agreed to pay a combined $140 million last fall.

Meanwhile, Keller Williams Realty reached a $70 million deal in February.

Combined with the NAR’s $418 million settlement, it means the industry has agreed to pay $684 million in total.

The decision was welcomed by Mike Ketchmark (pictured), an attorney representing the home seller plaintiffs.

Americans are likely to see a dramatic drop in the cost of selling their homes after a landmark legal settlement was reached Friday morning.

Currently, commissions for buyer and seller agents amount to between 5 and 6 percent of the sales price of a home. This is usually split between the two agents.

But it is much higher than in other countries – around double the average rates paid by removal companies in the UK, for example.

The NAR is the largest trade association in the U.S. and only its paying members are allowed to call themselves “real estate agents.” They are also the only people with access to their proprietary database of properties available for sale.

Those databases are called “multiple listing services” or MLS and require the seller’s agent to list the amount of commission their client pays.

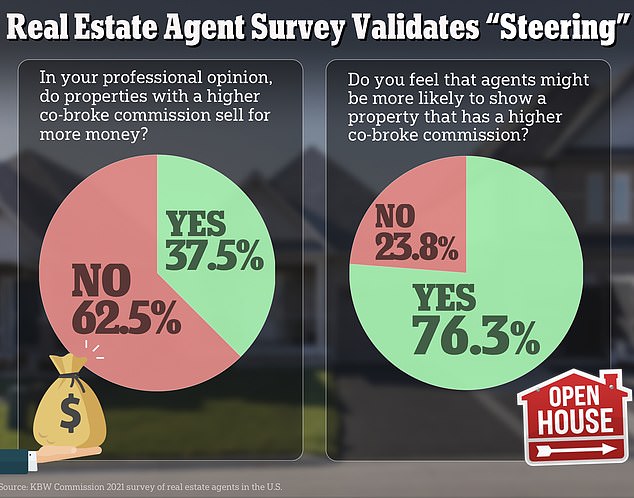

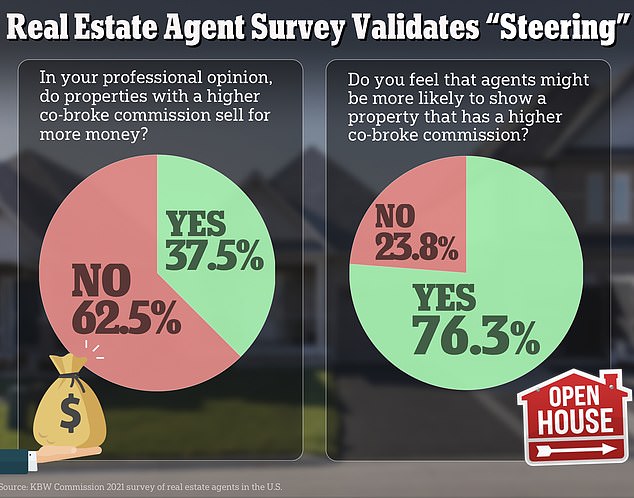

This, in theory, allows the buyer’s agent to “steer” buyers toward homes where the commission is higher and where they can make more profit in the event of a sale.

According to a survey by consulting firm 1000watt, more than 76 percent of 640 real estate agents in the United States said buyer’s agents would be more likely to show a property if they knew the seller was paying a higher commission.

This system, in turn, allows the seller’s agent to tell sellers that if they don’t offer enough commission, buyers will never see their home.