<!–

<!–

<!– <!–

<!–

<!–

<!–

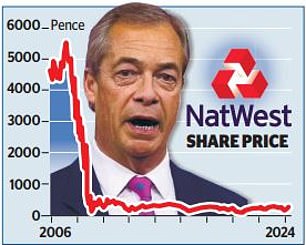

Debanked: Former UKIP leader Nigel Farage

Nigel Farage warned yesterday that his banking dispute with NatWest is “far from over” as the Chancellor confirmed his plans to sell shares in the lender to the public this summer.

Jeremy Hunt said he will press ahead with a multibillion-pound retail bid to offload part of the nearly 32 per cent stake in NatWest still held by the Government.

It will be the highest-profile public share offering since Royal Mail more than a decade ago, although analysts hope a steep discount will convince the public to take part.

But former UKIP leader Farage said his battle against the bank will continue.

NatWest – then known as RBS – received a £45bn bailout from taxpayers during the 2008 financial crisis.

The Government remains the largest individual shareholder, although its stake has been reduced from more than 80 percent.

Although shares are up 15 percent so far this year, they are still 95 percent below their 2007 high.

Reacting to yesterday’s announcement, Farage told Sky News: ‘For a retail sale of NatWest shares to work, as outlined by Jeremy Hunt in the Budget, investors must have confidence in the bank.

“Until they provide full information and apologize for their behavior, why should a retail customer trust them?”

A dispute broke out between Farage and NatWest last summer after his bank account at elite private bank Coutts, owned by the lender, was closed.

Former NatWest chief executive Alison Rose was forced to resign after admitting telling a BBC journalist that the leading Brexit supporter’s account had been closed for commercial reasons.

Internal reports showed that Farage’s political leanings had been a factor in the decision.

According to the budget documents, a share sale will take place “as soon as possible, provided market conditions are favorable and value for money is achieved.”

Richard Hunter of Interactive Investor said: “Any offering would inevitably have to be at a discount to the current price to attract investors and be subject to the risk warnings that come with owning shares in individual companies.”