Table of Contents

- Rachel Reeves is not prepared to offer the Government’s £5.6bn stake to ordinary investors

- Reeves wants pension funds, insurers and asset managers to benefit

- Critics say the move is a missed opportunity

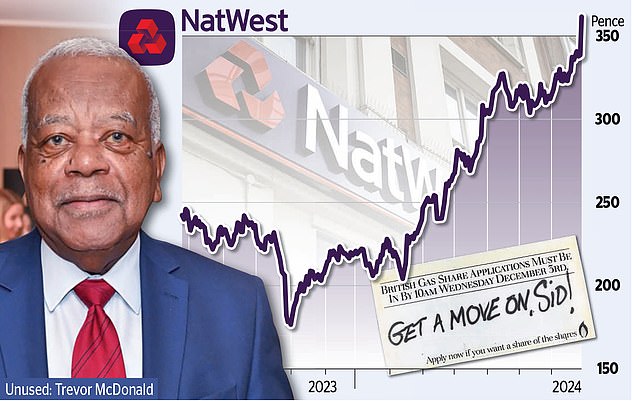

Hopes of a Tell Sid-style sell-off of NatWest shares have been dashed as Labour prepares a sale to institutional investors.

Chancellor of the Exchequer Rachel Reeves is prepared to offer the government’s £5.6bn stake to pension funds, insurers and asset managers rather than ordinary investors, sources say.

The move is a blow to the bank and retail investors, with critics saying it is a missed opportunity to encourage more people to develop long-term savings and investment habits.

The last Labour government bailed out the lender during the 2008 financial crisis and at its peak the taxpayer’s share was 84 per cent.

This month it fell below 20 per cent. The Conservatives planned a sell-off this summer and former chancellor Jeremy Hunt set up M&C Saatchi to launch an advertising campaign called “Tell Sid” – the slogan used to encourage people to buy British Gas shares in 1986.

But NatWest said it had to spend £24m on a campaign that never saw the light of day.

In the 1980s, presenter Sir Trevor McDonald asked audiences: “Are you in?” in a television campaign aimed at boosting the beleaguered stock market.

Danni Hewson, director of financial research at AJ Bell, said: “Leaving aside the hype of a ‘Tell Sid’ style campaign could be a missed opportunity to get people investing for the first time. Rachel Reeves wants investments in big British companies primarily through our pension schemes.

‘With so much of people’s savings still locked up in cash, a retail offering could be a catalyst for change.’

Mark Northway, of non-profit investment group ShareSoc, added: “It would be a huge mistake to exclude retail and individual investors.

‘This is an opportunity to redistribute money to British taxpayers who have shouldered the burden of NatWest over the past few years.’

Meanwhile, NatWest posted bumper first-half financial results. Chief executive Paul Thwaites praised the strong performance, which included profits of £3bn and an interim dividend of 6p, up 9 per cent on last year’s shareholder giveaway.

The shares rose 7 percent, or 23.8 pence, to 361.9 pence, adding to gains of just under 60 percent in six months. And the bank also agreed to buy £2.5 billion of UK prime residential mortgages from Metro Bank.

Thwaites said: “Customers are starting to feel more confident, with activity picking up, and we are well positioned to help unlock growth across our regional network.”

Details of the share sale are expected to be known in the autumn. Neither Nat West nor the Labour Party would comment on whether a public share sale was likely.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.