The father of Australia’s youngest property investor, eight-year-old Ruby McLellan, has hit back at critics who have torn his daughter apart, saying many are envious and don’t have the ability to make the sacrifices required.

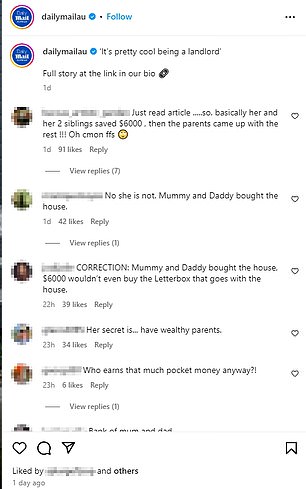

Online negative reactions flooded Instagram And X after Daily Mail Australia reported how Ruby and her two siblings bought a $671,000 house in Clyde, Victoria, instead of spending pocket money on candy and toys.

With $6,000 of their pocket money, Ruby, Angus, 14, and Lucy, 13, made a payment on a four-bedroom house on the southeastern outskirts of Melbourne two years ago.

Home values have already increased to around $960,000 as property prices skyrocket across the country.

It seems like a wise investment, but online critics have lambasted Ruby’s parents as shameful and exploitative and others have speculated that it was tax evasion, possibly illegal – and in any case , poor education.

Ruby McLellan, 8, and her two siblings saved $6,000 in spending money and bought a home worth almost $1 million in Melbourne through a trust set up by their parents.

Ruby’s father, Cam McLellan, who runs property group OpenCorp, ignored the criticism and told Daily Mail Australia his children would not read the personal attacks.

“It’s easy for someone who doesn’t have property or hasn’t made sacrifices to be angry about it and easy to target a young child who has a leg up,” Ms. .McLellan.

He said those preying on early-stage home buyers would be better off putting their energy into finding additional work, cutting back on discretionary spending and saving money for their first home.

The lifestyles of “young adults” are very flamboyant these days. I worked three jobs, I didn’t go out, I sold my car,” Mr. McLellan said.

“Eating in cafes and shopping has drained people’s money. Even if they own a car, they like to change it every five years. I had the same car for ten years.

“You don’t want to aggressively impose this on the younger generation, but they have to make sacrifices and delay gratification.

“There is no silver bullet, but while my children will have enough to start with, they are not silver spoons. They have a head start, but so does anyone in Australia.

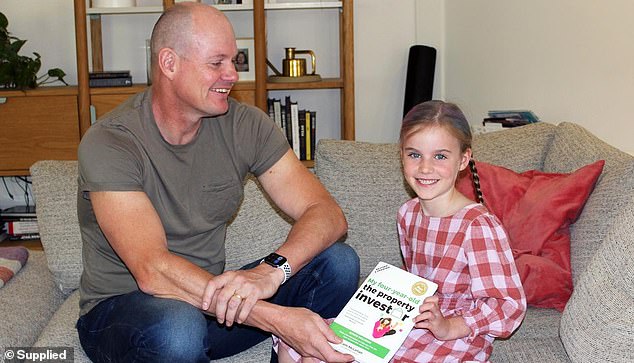

Cam McLellan said he wasn’t worried about the negative comments in response to his daughter Ruby’s story (above father and daughter together) and wondered why not every parent would want to give a “help” for their children on the real estate market.

The three children’s purchase is completely legal: their names appear on the title deed and, once adults, they will share in the profits from the sale, as well as the capital gains tax.

In the meantime, the house will be rented, and while Mr. McLellan understands why tenants may find it humiliating to pay rent to their children, he said the purchase was motivated entirely by pragmatism, without wanting to prove anything. either.

“I want to save them from having to save for later deposits,” he said. “I want to help them become smart real estate investors.

“When I started, I made $40,000 and the deposit (on a house) was $7,000. It is now much harder to get a deposit if you earn $60,000 and the deposits are $120,000.

“Ten years from now it will be worse and my kids won’t be able to save that bail – four kids, so instead of four times a $200,000 bail, (my wife) Felicity and I are giving them a boost now for have a house later.

Cam, 50 (pictured with his wife Felicity and their children Hannah, 17, Ruby, 8, Lucy, 13, and Angus, 14) taught his children the basics of investing to get a foothold in the estate market.

He appreciated the frustration of those struggling to access housing as mass migration and the resulting shortage of housing – both to buy and to rent – triggers a relentless price spiral.

“There is unfortunately a growing gap between the haves and the have-nots. This does not mean that it is the owners who are behind this phenomenon,” he said.

“It’s simply that wage growth is slower than house price growth. Wouldn’t every parent like to educate and help their children acquire assets?

“Historically, every seven to ten years, property values double.

“I have been investing for 30 years and now is the perfect time to invest based on falling inflation and expectations of falling interest rates.”

Ruby, 8, said it was pretty “cool” to own a house while giving up toys and candy and that she hadn’t personally told her friends about it yet.

Ruby told FEMAIL it was “pretty cool” to be a landlord, but she hadn’t told any of her school friends yet.

Already, she and her siblings are planning their second property purchase, borrowing against the equity of the first, still with all their names on the title deed.

The family will hold the property until Lucy and Angus are in their early 20s, meaning they will have waited out a “full growth property cycle” and expect the value to exceed far from a million dollars.

Once sold, the children will receive an equal share of the after-tax profits.

Cam and Felicity McLellan (above) have invested in real estate to the point where they can spend more time with their children.

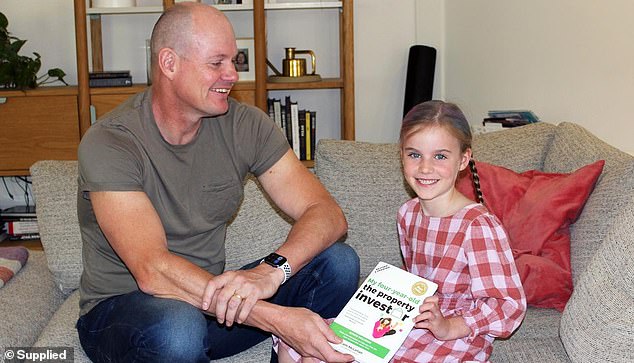

Mr McLellan wrote a book ‘My Four-Year-Old Property Investor’ 13 years ago which had his eldest, Hannah, who is now 17, in mind.

He updated it with new market realities and the dangers Ruby and young children will encounter in future real estate transactions.

“I love this industry, but it has a dark side because it’s not regulated,” Mr. McLellan said.

As a teenager himself, he bought an investment property and was “lucky enough to learn the basics from a friend’s father.”

“I had acquired rent in Elwood, a seaside suburb of Melbourne, and I was safe from the seminary sharks,” he said.

How to protect yourself from these “sharks” is something he addresses in his book with “50 Questions People Should Ask Before Investing and How to Avoid Scammers Who Say ‘I’ll Make You a Real Estate Millionaire’ and You will sell bad properties in no time. t zone and get a bribe.”

Ruby (above with her parents Cam and Felicity) started learning about investment real estate at the age of six, but had to realize she couldn’t go live there or take her friends there.

Cam McLellan said he wasn’t bothered by skeptics on social media and wanted to help people and parents get their children into home ownership. His recently revised book (top right) explains how to avoid pitfalls

Before purchasing the Clyde property, Cam said he guided the children through the process using “lots of illustrations” to help them understand, but as Ruby was only six at the time, he admitted that she didn’t understand how it all worked.

He had to constantly tell her that she couldn’t live on the property or bring her friends there.

Cam and Felicity bought their first property together in their early twenties with the aim of becoming “financially free”.

The result: the couple hasn’t had to work as much over the past 15 years. For Cam, a normal week involves working “four hours every other day.”

Every year he takes three months off, including all school holidays, to maximize time spent with his four children.

‘