Table of Contents

Australian bidders targeting Rightmove held tense talks with the company’s shareholders this weekend ahead of tomorrow’s key deadline.

REA, the Australian housing website, a division of billionaire Rupert Murdoch’s media empire, must make a firm offer for the FTSE 100-listed property website at 5pm tomorrow or withdraw for six months, although it You can request an extension of the process.

REA bosses have flown to London to defend their offer of £6.2bn in cash and shares, although the view is that they must pay £7bn, all in cash.

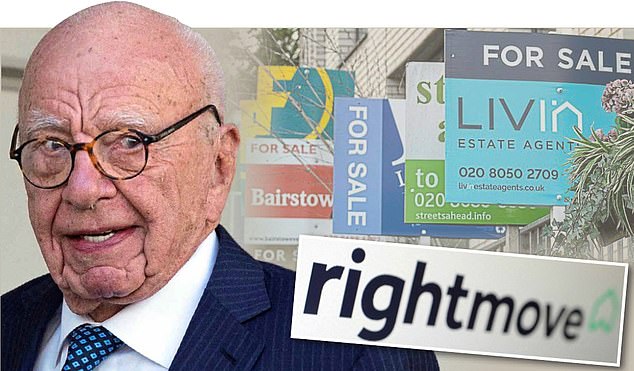

Deadline: Rupert Murdoch’s REA has until 5pm tomorrow to make a firm bid for Rightmove or walk away for six months

Whatever the outcome of the bid, REA’s ardent pursuit of Rightmove has exposed both companies to brutal scrutiny of their strategies.

If REA succeeds, it is rumored that it could attempt to radically alter the way homes are marketed on Rightmove, shifting the cost of several thousand pounds from the estate agency to the property seller.

REA charges sellers to advertise their properties, but also earns fees from real estate agents for introducing leads and other services.

In Britain, sellers pay commissions to estate agents who may try to get the client to pay for advertising, although this is difficult in the ultra-competitive market for estate instructions.

This month, REA has made four attempts to acquire Rightmove, which has a near-monopoly in the UK property listings sector and attracts 80 per cent of searches.

But the Australian suitor has been ignored. There is growing bewilderment over Rightmove’s refusal to speak to REA, which on Friday made a fourth consecutive bid for its quarry.

The £7.81 per share offer – under which investors would receive £3.46 in cash per share, 0.0417 of a new REA share and a special cash dividend of 6p – puts Rightmove worth £6.1 billion.

One observer expressed astonishment at Rightmove bosses’ unwillingness to negotiate, commenting: ‘That’s a huge premium on Rightmove’s average share price of £5.40 this year; too good a price for Rightmove to refuse to participate.

“No wonder REA is encouraging shareholders to put pressure on Rightmove’s board to start a debate.”

Some shareholders have called for negotiations to begin. But Lindsell Train’s Nick Train, manager of the Finsbury Income & Growth Trust and other popular funds, is staying silent, telling The Mail on Sunday it was too early to comment on the situation.

Train has a 7 per cent stake, accumulated in October 2023, when Rightmove shares had plummeted to around £4.80, following the purchase of smaller website OnTheMarket by US property analytics group CoStar.

There was talk at the time that OnTheMarket could become the number one website in the UK, but to date that hasn’t happened.

The mood of Rightmove investors may start to become more restless in the coming days.

But some Australian investors are unhappy and alarmed by the prospect of their stakes being diluted to finance the acquisition. REA has been a highly rated growth stock.

Shares are up 30 percent in the past 12 months. But if you fail to buy Rightmove, more questions will be asked about your

ability to expand beyond its Australian heartland.

Rightmove’s plans to turn its website into a one-stop shop for anyone looking for a home to buy or rent are likely to form the basis of its defense should REA’s bidding become aggressive.

Mortgages would be at the center of this expansion, described months ago by CEO Johan Svanstrom.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.