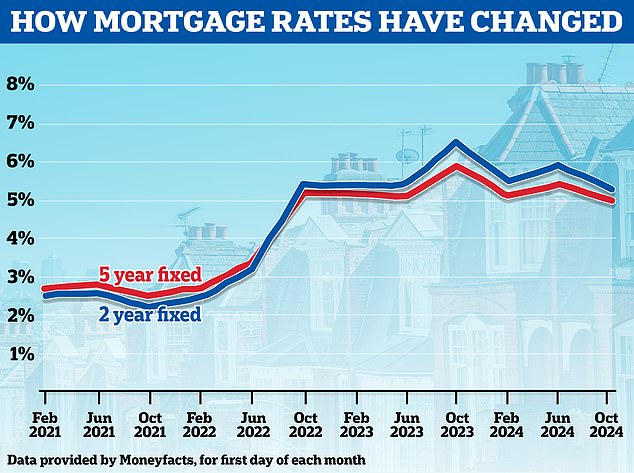

Experts warn that mortgage rates may be about to start rising again, after Coventry Building Society announced it will increase home loan costs.

Mortgage rates have been falling steadily in recent months and last week, five major mortgage lenders announced rate cuts on the same day.

Since the beginning of July, the lowest five-year fixed-rate mortgage has fallen from 4.28 percent to 3.68 percent.

Meanwhile, the two-year lowest fix fell from 4.68 percent to 3.84 percent during that time.

Rising again: Two mortgage experts say rates may be about to rise after events of recent days have rattled markets. Pictured: Nicholas Mendes (left) and David Hollingworth (right)

However, there are signs that the bearish momentum may be about to stop or even reverse.

Coventry Building Society has announced that a number of fixed rate offers will increase from Friday.

The Co-operative Bank has also announced that it will withdraw some of its lowest rates tomorrow night.

The events of recent days have disrupted the markets, according to Nicholas Mendes, mortgage technical director at broker John Charcol. This has caused bond yields and swap rates to rise.

“First, Andrew Bailey’s recent comments, in which he indicated expectations of larger or more frequent rate cuts, have introduced some uncertainty,” Mendes said.

‘Several MPC members have expressed opposing views, indicating possible caution in future electoral behaviour.

“Markets had been pricing in rate cuts for November and December, but expectations for December have softened slightly, reflecting this uncertainty.”

‘In addition, geopolitical tensions, particularly concerns over the Middle East conflict and its potential impact on oil prices, have increased market volatility.

‘Although fears increased last week, talks in the United States have helped to stabilize the situation to some extent. However, any additional disruption could push up inflation.”

Changing course: Coventry Building Society has announced that several fixed rate offers will increase from Friday

Mendes says this is likely to start to impact the mortgage market, especially as lenders adjust to changing conditions.

‘Given these factors, we expect to see some lenders begin to reprice their products, especially among specialist lenders and smaller building societies.

‘If swap rates continue to rise, it is likely that the best mortgage deals, which already have low margins for lenders, will begin to revalue with a slight upward adjustment, with more widespread revaluations if competitors follow suit.

“Lenders typically set prices a fortnight in advance, so any price changes are likely to come ahead of budget if this trend continues.”

Clear signs that mortgage rates are about to rise?

Mortgage lenders price their fixed mortgage rates based on Sonia swap rates, funding targets, borrower demand and general economic sentiment.

Sonia swaps are the easiest way to interpret where fixed rates are headed.

Simply put, Sonia swap rates essentially show what lenders believe the future will hold with respect to interest rates.

When Sonia swaps rise high enough, it often results in fixed mortgage rates rising and vice versa when they fall.

In recent days sonia swaps have risen again. As of October 7, two-year swaps were at 4.07 percent and five-year swaps were at 3.81 percent.

This is a big increase compared to September 20, when two-year swaps were at 3.82 percent and five-year swaps were at 3.52 percent.

Make up your mind: Mortgage lenders have been cutting rates in recent months

David Hollingworth, associate director at L&C Mortgages, said: ‘The mortgage market has seen rates fall in recent months, but that may be coming to an abrupt halt.

‘The price of the fixed rate depends on what the market anticipates may happen with interest rates and uncertainty over the next budget, contradictory messages from the Bank of England and global unrest are causing costs to rise again for the lenders.

‘Swap rates are a good indicator of the direction of fixed rate prices and have risen again.

“If this persists, improvements in fixed interest rates will stop abruptly and rise again.”

John Charcol’s Nicholas Mendes, however, stresses that he still expects the direction of longer-term mortgage rates to be downwards.

Still, he recommends anyone entering the last six months of their current mortgage to consolidate now.

“Any increase in mortgage rates will likely be temporary and will not necessarily reflect the overall path of rates over the next 12 months,” Mendes added.

‘It is important to stress that anyone approaching the end of their fixed rate mortgage gets a new deal now.

‘Continuously monitor the market, or better yet, use a broker who can monitor it for you and alert you when a better deal becomes available.

“While nothing is guaranteed and several factors can delay the implementation of rate reductions, it is important to take proactive steps to secure the best deal, rather than taking a ‘wait and hope’ approach.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.