Table of Contents

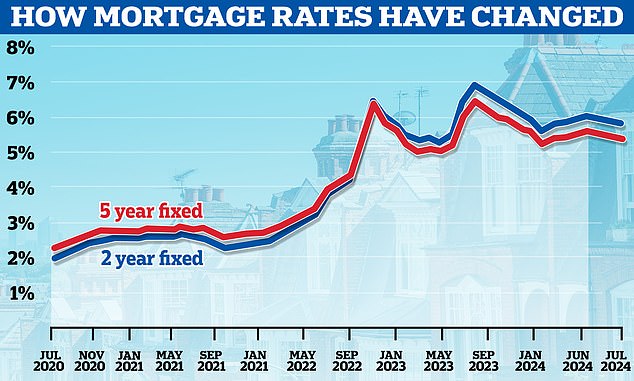

Mortgage rates continued to fall this week as HSBC and Barclays became the latest lenders to cut the cost of home loans.

HSBC is the third lender to reintroduce a five-year fixed deal below 4 per cent, following mortgage rate cuts by Nationwide and NatWest in recent days.

HSBC’s lowest five-year fixed rate has been cut by 0.19 percentage points and now offers a market-leading 3.95 per cent with a fee of £999.

However, Barclays has also announced that it will cut its lowest five-year fixed rate from 4.04 percent to 3.84 percent from tomorrow.

The leader: Barclays set to overtake HSBC with fresh five-year correction tomorrow

Rate cuts intensified last week after the Bank of England cut interest rates for the first time in more than four years.

The central bank cut the base rate from 5.25 percent to 5 percent on August 1 and markets are forecasting a further cut later this year.

HSBC’s best fixed rate mortgage offer

HSBC is offering a five-year fixed rate of 3.95 per cent to both new and first-time home buyers with a deposit of at least 40 per cent.

Someone getting this rate on a £200,000 mortgage repaid over 25 years could expect to pay £1,050 a month.

But Barclays has gone a step further, at least for home-movers. Its 3.84 per cent offer, aimed at those buying with at least a 40 per cent deposit, is set to lead the market by some distance when it is launched on Thursday.

Someone with a £200,000 mortgage to be paid off over 25 years could expect to pay £1,038 a month with Barclays.

Stephen Perkins, managing director of brokerage Yellow Brick Mortgages, told Newspage: “Barclays has made a real statement of intent here.

‘The mortgage market is in full swing. It is welcome that more lenders are offering rates below 4 percent.

‘The hope now is that these competitive rates will filter down the loan-to-value ratio brackets to help more borrowers.’

Ranald Mitchell, director of Charwin Mortgages, believes falling rates are likely to revive the housing market.

“Barclays’ decision to cut mortgage rates to below 4 percent is a breath of fresh air for borrowers and a welcome boost for the housing market,” Mitchell said.

‘This bold move is sure to spark interest among prospective buyers who have been on the fence, waiting for better rates.’

In addition to Barclays’ excellent sub-4 per cent offering, the bank has also claimed the top spot in two-year fixed-rate products.

Its two-year fixed rate of 4.22 per cent has a fee of £899 and is available to home buyers who purchase with a deposit of at least 40 per cent.

HSBC has the next best two-year fixed offer at 4.41 percent.

With the average market rate for a two-year fixed loan standing at 5.74 per cent, according to rates watchdog Moneyfacts, this will seem rather low to many borrowers.

Someone getting the Barclays rate on a £200,000 mortgage repaid over 25 years could expect to pay £1,080 a month, compared with the market average of £1,257 a month.

Statement of intent: Instead of making marginal rate cuts, Barclays has offered a rate of 3.84%, undercutting the competition by more than 0.1 percentage points.

In addition, homeowners currently refinancing their mortgages will benefit from Barclays’ latest move. According to UK Finance, there are around 700,000 fixed-rate deals due to end in the second half of this year.

Barclays’ lowest five-year fixed rate for homeowners who remortgage their home with at least 40 per cent equity (a loan-to-value ratio of 60 per cent) will fall to a market-leading 4.06 per cent, with a fee of £999.

The next best lender is MPowered Mortgages, which charges 4.19 percent.

Those with 25 per cent equity in their home can get as little as 4.2 per cent with Barclays from tomorrow by locking in a five-year bond.

Again, the next best lender is MPowered Mortgages which charges 4.35 percent.

HSBC has also cut rates for home movers and first-time home buyers with a 25 per cent deposit, as well as rates for those refinancing their mortgage.

What will happen to mortgage rates?

Mortgage brokers expect more big lenders to follow the lead of Barclays and HSBC in the coming days or weeks.

This is partly because lenders are competing for new business to keep them going and meet annual targets.

However, it is also driven by money markets and expectations about future interest rates.

These expectations are reflected in Sonia’s interest rate swaps, which are agreements in which two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable interest payments, based on a stated amount.

Is it going down again? In recent weeks, mortgage lenders have been cutting rates

Mortgage lenders enter into these agreements to protect themselves against the interest rate risk involved in providing fixed-rate mortgages.

In simpler terms, swap rates show what financial institutions believe the future will hold in terms of interest rates.

As of Monday, five-year swaps were at 3.57 percent and two-year swaps at 4 percent.

This figure represents a reduction from 3.89 percent and 4.4 percent respectively at the beginning of last month and from 4.73 percent and 5.41 percent a year ago.

Darryl Dhoffer, a mortgage broker at The Mortgage Expert, told Newspage: ‘Sonia swaps are continuing to fall and that is probably fuelling these rate cuts by the likes of HSBC and Barclays.

“Every cut counts when it comes to mortgages, so we’re headed in the right direction. It’s shaping up to be an unusually busy month of August.”

However, Nicholas Mendes, mortgage technical manager at brokerage John Charcol, had a warning.

“While it may be tempting to wait in the hope that mortgage rates will continue to fall, it’s important to note that nothing is guaranteed,” Mendes added.

‘If something disrupts the market, we could see a delay or pause in the current downtrend.

“For this reason, it is advisable to secure an interest rate in advance. You should continue to analyse the market and, if rates continue to fall, you can change your offer with the same lender or opt for another one. If rates rise, at least you have achieved favourable conditions,” he said.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.