Homeowners are becoming more confident about putting their properties on the market – the latest figures show 40 per cent more homes available than 12 months ago.

PropTrack’s latest listings report revealed that the Australian property market recorded the strongest new listings for the month of April since 2021.

New listings rose 40.4 percent year-on-year across all capitals.

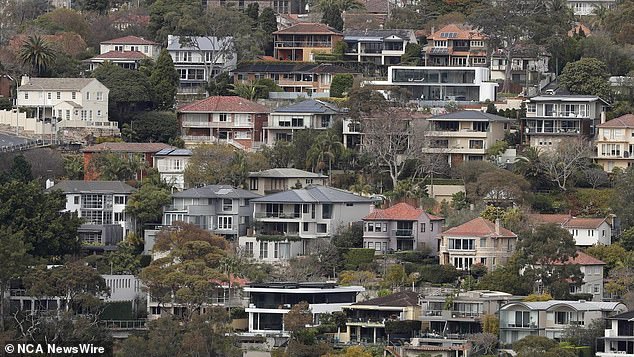

PropTrack economic research director Cameron Kusher said while there are new listings in each capital, Sydney and Melbourne remain the strongest markets.

PropTrack’s latest listings report revealed that the Australian property market recorded the strongest new listings for the month of April since 2021.

“If you look at Sydney and Melbourne, the number of listings has been higher year on year every month since July last year,” Mr Kusher said.

‘While house prices have remained buoyant into early 2024, the surge in new listings has seen the total number of properties advertised for sale increase, particularly in Sydney, Melbourne and Canberra.

“Despite the increase in properties available for sale, other indicators indicate buyer demand remains strong, such as average time on market decreasing and overall inquiries increasing compared to a year ago.”

New listings for April year after year:

- Sydney 44.9 percent

- Melbourne 52.7 percent

- Brisbane 34.4 per cent

- Adelaide 26.6 percent

- Perth 23.5 percent

- Hobart 11.1 per cent

- Darwin 2.7 percent

- Canberra 49.1 per cent

Kusher said the rise in new properties was not a total surprise, as homeowners reflected on how interest rates were impacting their budgets and continuing pressures on the cost of living.

“I think a lot of that was due to the number of new listings coming to the market before that, which was very low, when interest rates were changing every month in 2022 and then changing regularly in 2023,” Kusher said.

PropTrack director of economic research Cameron Kusher says many factors have played a role in why people decide to sell their properties now compared to 12 months ago. Image: Supplied

‘I think people were realizing that it wasn’t an ideal situation to sell at that time.

‘Now that interest rates have been more stable, although we have still had a couple of increases, but (they have been) more stable for almost a year, that has given people more confidence to put their properties on the market.

‘The next few months will be quite telling because obviously many people who own homes or are looking to buy them are expecting interest rate cuts later this year, but it looks more likely that interest rates will fall in the first half of next year.

“It’s going to be quite interesting to see how the market reacts to the expectations that have been postponed until now.”

But Kusher said there was a “combination of things” that had encouraged people to consider selling their properties.

“Certainly there is cost-of-living pressure that is forcing some people to sell, but equally I think there are other factors,” he said.

‘Property prices have increased a lot in a short period of time.

‘Some people look at the level of equity they have in their property and use it to improve on the market.

‘I think there are also other factors why people have been delaying the sale and are now in a house that no longer suits them.

“It is very expensive to do a major renovation of a property because material and commercial costs have increased so much, which is encouraging people to move.”

Sydney, Melbourne, Hobart and Canberra also saw an increase in total listings for sale in April 2024 compared to the previous year at 16.1 per cent, 21.4 per cent, 1.1 per cent and 29 .7 percent respectively.

However, Kusher warned that the latest year-on-year figures could “exacerbate” around March and April, depending on when Easter falls.

Sydney, Melbourne, Hobart and Canberra also saw an increase in total listings for sale in April 2024 compared to the previous year at 16.1 per cent, 21.4 per cent, 1.1 per cent and 29 .7 percent respectively.

But things haven’t been as good in Brisbane, Adelaide, Perth and Darwin compared to 12 months ago.

Compared to a year ago, total contributions decreased in those capitals by 6.3 percent, 9.4 percent, 23.2 percent and 0.5 percent respectively.

Kusher said those capital cities had seen less new construction, reducing the number of options available on the market.

“There are just a lot more options for someone wanting to buy in Sydney and Melbourne than there has been until now,” he said.

Listings have not been as strong in Brisbane, Adelaide, Perth and Darwin compared to 12 months ago.

Meanwhile, Kusher said that while the property market continued to strengthen, the rental market remained strained due to a lack of available rental stock.

“In Sydney and Melbourne, demand (for rentals) has fallen a little bit from 12 months ago,” Mr Kusher said.

‘In most capital cities there is still very little competition in stock and rental.

“We know the rate of people migrating to Australia is starting to slow, but there isn’t much building going on in these cities for the rental market, so there isn’t a significant increase in supply on the horizon.”

‘We’re getting to the point where people are going to challenge the ability to pay the prices that people are looking for.

‘What that means is that people will move to smaller properties, less desirable locations or shared accommodation to save on rental accommodation.

“I think the rental market will remain tight for probably several years, but we probably won’t see rents rise as quickly as we have because people’s salaries aren’t keeping up with rent growth.”