Table of Contents

- Thousands of women were left without receiving higher state pension payments

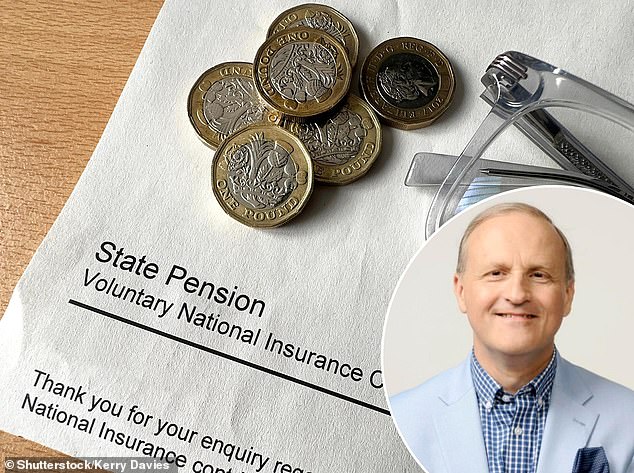

- Our pensions expert, Sir Steve Webb, has campaigned to fix the problem.

A full investigation has been launched into a long-running battle over tens of thousands of married pensioners who did not receive state pension payments.

Sir Steve Webb, LCP partner and This is Money resident pensions expert, has been campaigning on the issue for three years.

Before a rule change in March 2008, married women could claim their state pension at age 60 based on their own National Insurance contribution history.

Pension blunder: Sir Steve Webb has campaigned to compensate women who missed out on state pension payments

This meant that if they had spent some time out of work raising a family, this could represent as little as 25 per cent of the full basic pension.

However, this pension could be raised to a 60 per cent pension based on her husband’s contribution once he collects his state pension.

Since 2008, the increases are supposed to be automatic, but previously women had to apply to receive the full amount they were entitled to.

An increase in the state pension would only occur if another state pension claim was made once her husband retired.

This meant thousands of women were left out because they assumed they would be paid the correct rate and would not have to reapply.

If a second claim was not filed and a married woman found out years later, she was only allowed to roll back the increase by one year, meaning some women would have potentially lost more than a decade of increased payments.

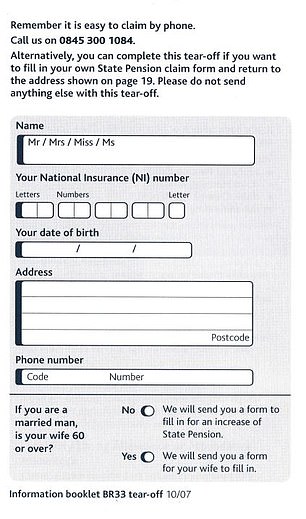

In his battle against an “archaic and sexist system”, Sir Steve also discovered that husbands had to tick a box on their state pension package, after which he was sent two state pension applications, of which one was passed to his wife. .

Before 2008, husbands had to tick a box in their state pension package to receive a form that would be passed on to their wife.

This meant that married women could miss out if their husbands did not tick the box, the DWP issued only one form instead of two, or if their husbands did not approve the second form.

The Parliamentary Ombudsman’s decision to launch an investigation could, if successful, cost the Government hundreds of millions of pounds in state pension arrears.

The inquiry will look at seven “main cases” brought with the support of Sir Steve along with other complainants.

Sir Steve said: ‘This is an important milestone in a long-running campaign for justice for thousands of married women. I am pleased that the Parliamentary Ombudsman has decided to launch an in-depth investigation into these complaints.

‘In my opinion, these women were victims of a fundamentally sexist and archaic system that relied heavily on married men ticking boxes and passing claim forms to their wives.

‘The women I have spoken to are all intelligent people who are not ignorant of official correspondence and who clearly would have claimed their increased pension if they had realized that a second claim was necessary once their husband retired.

‘The fact that they did not know this was necessary indicates a system that has let them down and has cost them in many cases thousands of pounds through no fault of their own.

“I look forward to seeing what the Ombudsman concludes at the end of his investigation.”

In some cases the complaints process has taken up to three years to reach the Ombudsman, who this week wrote to address complaints to say a “detailed investigation” will be carried out.

Sir Steve says that, if successful, the ruling could apply not just to the main claimants but to all the women who have lost out, including thousands of people who died without ever receiving the correct pension.

It predicts it is likely to affect “high tens of thousands” and potentially more than 100,000 women.

This is Money’s Sir Steve and Tanya Jefferies were the first to highlight the problems surrounding underpaid state pensions.

Since her intervention, older women could be hit with almost £1bn in state pension arrears after being defrauded for decades.

SAVE MONEY, MAKE MONEY

Investment boost

Investment boost

5.09% on cash for Isa investors

5.2% savings rate

5.2% savings rate

Account rate increase with 90 days notice

free share offer

free share offer

No account fee and free stock trading

4.84% cash Isa

4.84% cash Isa

Flexible Isa now accepting transfers

Trading Fee Refund

Trading Fee Refund

Get £200 back in trading fees

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.