Table of Contents

Chancellor Jeremy Hunt is expected to reduce National Insurance contributions by 2p in the spring budget tomorrow.

It comes just months after another 2 percentage point cut to National Insurance (NI) came into force in January, following an announcement in the Autumn Statement.

There was some expectation that Mr Hunt could cut income tax in what is expected to be the last budget before the general election.

We explain why the Chancellor has proposed cutting Social Security and what benefit this will bring to workers.

Chancellor Jeremy Hunt expected to cut national insurance by 2p in budget

Who will benefit from a cut in Social Security?

National Insurance (NI) is a tax on earned income and is paid by employees and the self-employed.

The amount of NI contributions paid will depend on how much you earn and your personal circumstances.

Employees currently pay 10 per cent on earnings of £12,570 to £50,270, after a 2p cut to NICs that came into effect in January.

Hunt also made changes to the rates freelancers pay.

From April 6, the main rate on Class 4 standalone NICs will be reduced from 9 percent to 8 percent and Class 2 standalone NICs will be abolished entirely.

Therefore, a cut to NI will reflect the effect of an income tax cut and increase take-home pay, but will have no impact on those who are above state pension age and do not pay NI.

However, in the autumn statement, the Chancellor confirmed that thanks to the triple lock, pensioners will see their state pension increase by 8.5 per cent.

Laura Suter, personal finance director at AJ Bell, said: “The move will also help quell some of the claims of generational injustice, with those receiving the state pension likely to receive another substantial rise through the triple lock.”

“As Jeremy Hunt has already made cuts to National Insurance, he could also point to the overall tax savings for individuals from the combined cuts, offering a juicier headline to win over voters.”

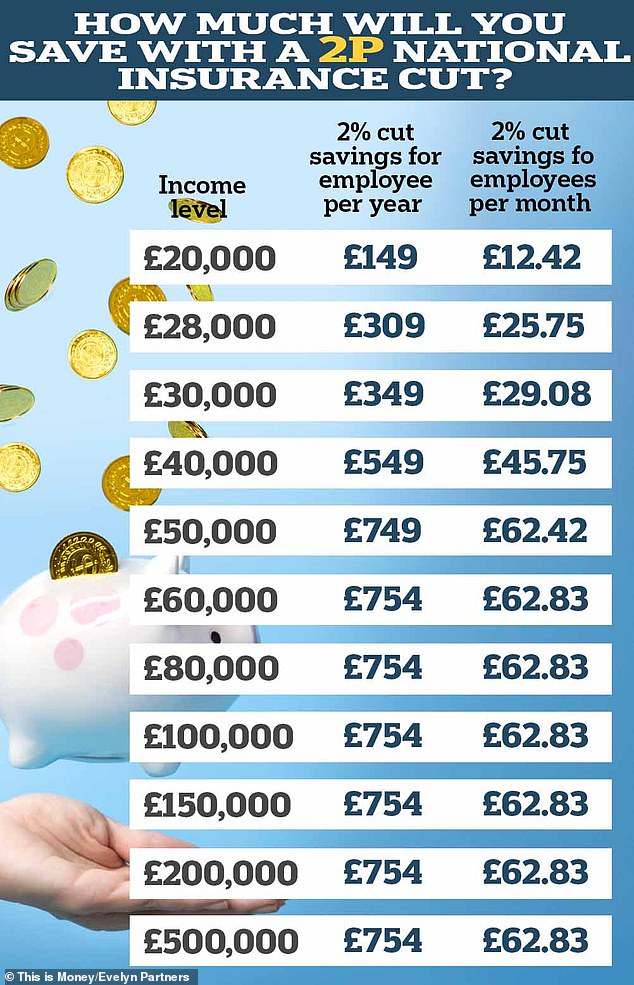

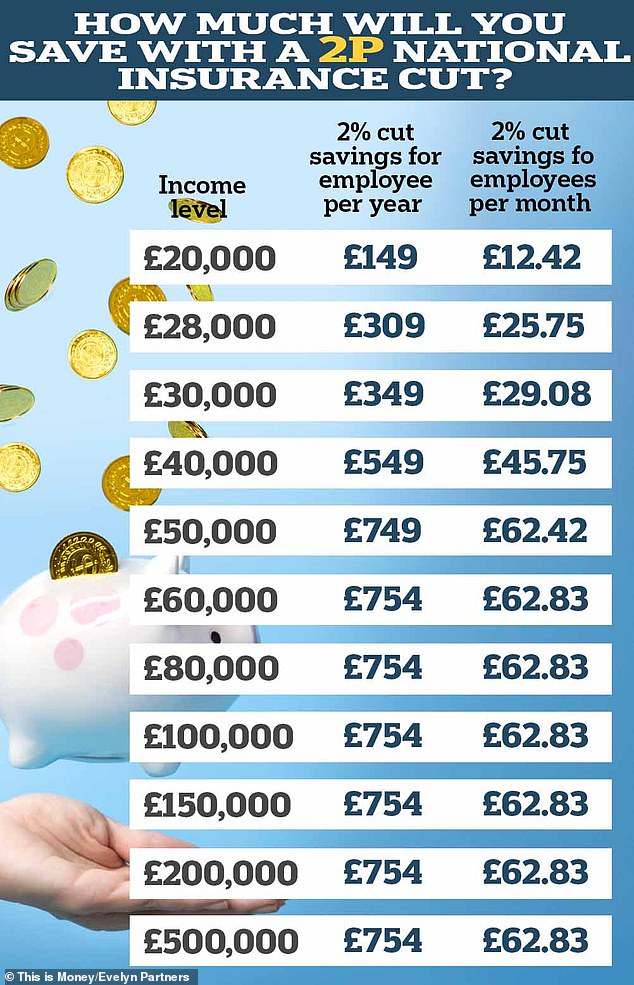

A 2p cut in National Insurance contributions will save the average worker £25 a month (Figures from Evelyn Partners)

Why is Hunt going to cut National Insurance again?

Since the Autumn Statement there has been a lot of rumors about tax cuts.

Millions of workers have been affected by tax increases that have reached their highest level since records began 70 years ago, according to the Institute for Fiscal Studies.

However, reducing taxes can be costly. While Conservative MPs have called for income tax to be slashed, implementing a 2p cut is estimated to cost the Treasury £13.7bn.

By comparison, the cost of cutting national insurance by 2p is around £10bn a year.

The Times reported that Hunt and Rishi Sunak decided not to cut income tax after the Office for Budget Responsibility lowered the amount of fiscal space available for tax cuts.

There were also concerns that an income tax cut could be inflationary and the latest reading still had CPI higher than the Bank of England’s 2 per cent target.

How a 2p tax cut will affect your take-home pay

Another cut to NI will be welcomed by workers, who will see another small increase in their monthly take-home pay, following the 2p cut that came in January.

A 2p cut would equate to an extra £149 a year (or £12.42 a month) for someone earning £20,000, according to figures from Evelyn Partners.

While someone earning £30,000 would have £309 more a year, or £29.08 a month.

Those earning £40,000 will be £549 better off, while higher and additional rate taxpayers will save £754 a year.

The average employee earning £28,000 a year would receive £309, or £25.75 a month.

This, together with the 2p cut introduced in January, could be a big tax cut for workers, but it will not benefit those who pay income tax but not NIC.

The decision to keep tax thresholds frozen at their current level means that many taxpayers will not see much benefit in their take-home pay.

Increasing the current thresholds with inflation would actually have a larger impact on take-home pay than IN and Income Tax as a whole for some taxpayers.

Keeping the thresholds in line with September’s CPI reading of 6.7 per cent would increase the personal allowance from £12,570 to £13,412 and increase the highest rate tax threshold from £50,270 to £53,638.

Anyone earning more than this revised higher rate threshold would be £842 better off a year according to AJ Bell’s analysis, while basic rate taxpayers would save £168 a year.

An income tax cut would best benefit basic rate taxpayers, says AJ Bell. A 1p cut would save £224 for someone earning £35,000 a year, while a 2p cut would reduce their tax bill by almost £450 a year.

A cut to 18 per cent for top earners would save them £754, while changes to the threshold would increase their take-home pay by £842.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.