First-time buyers are shelling out up to £53,414 on average to get onto the property ladder, latest figures from lender Halifax reveal.

This amount fell by £9,057 last year, as the typical price paid by first-time buyers also fell by £13,869 to £288,136.

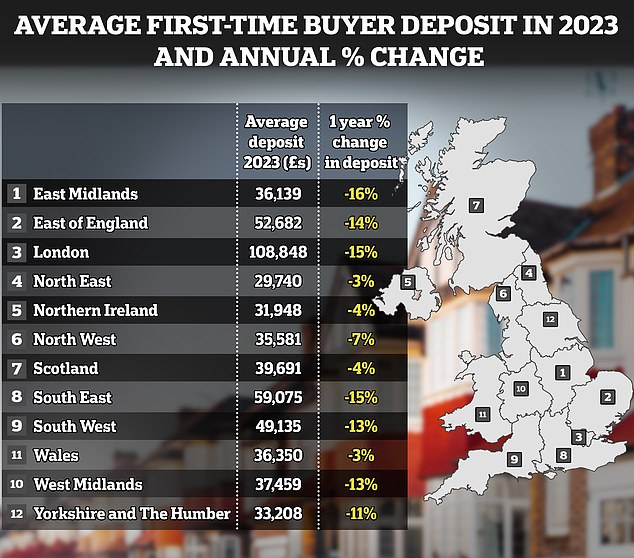

But the amount buyers pay varies wildly depending on where you are in the country.

Find your local authority in our table below to see how much first-time buyers put down as a deposit in your area and how much they typically pay for their home. The data is compiled by Halifax based on its own figures, as well as those of Lloyds Bank and Bank of Scotland, which are part of the same group.

Where first-time buyers need the most and the least

It is no surprise that London remains one of the most expensive places to gain a foothold in the market. If you want to buy in Westminster, an incredibly high deposit of £159,348 may be required for that £677,663 hole, which can only buy you a modest one or two-bedroom apartment.

Outside the capital, some of the best prices can be found in the north east, such as in the town of Middlesbrough. Here, beginners pay an average of £154,448 and require a much smaller deposit of £27,225.

With this you can buy a three-bedroom semi-detached house. A year ago, first-time buyer properties in Middlesbrough averaged considerably lower: £172,665 with a deposit of £31,302.

Climbing the ladder… for less: Typical home prices and deposits for first-time buyers fell last year, according to Halifax

Philip Mount, of east London-based estate agency Churchill Estates, says: ‘There is a shortage of supply for first-time buyers, which is keeping prices high. Unfortunately, these days most people need the support of their parents (some help from the bank of mom and dad) to get a foot on the real estate ladder.

‘Young people can end up paying £1,200 a month to rent a studio in the capital. Therefore, they struggle to have enough extra money to save for their first house deposit.’

Halifax research reveals that in London the average deposit for first-time buyers is £108,848 for a £492,234 home. Five years ago, before the pandemic, it cost £110,109 for a £422,006 first home in London.

Mount says: ‘The slight drop in the amount required for a deposit can only be good news. We expect this to be a better year with early signs that mortgage rates will fall if we control inflation and the Bank of England reduces base rates. Being a general election year, there may also be tax relief in the spring budget which could boost the housing market.’

A two-bedroom apartment on the ground floor of a Victorian house in Wanstead, east London, is for sale for £500,000

What first-time buyers get for their money

First home opportunities currently available through Churchill Estates include a two-bedroom apartment on the ground floor of a Victorian house in Wanstead, east London, for £500,000 and a two-bedroom period terrace property in nearby Woodford, Essex, which is priced at £475,000.

By contrast, property searches in Middlesbrough revealed that houses for sale through estate agency Clarke Munro found similar properties at much lower prices. For example, a two-bedroom semi-detached house can be purchased for £85,000, while a three-bedroom semi-detached house can be purchased for £155,000.

For £450,000 you can buy a modern three-bedroom detached bungalow or a four-bedroom semi-detached family home.

Halifax research found the lowest required deposits are in the northeast, having fallen 3 per cent in a year.

The biggest drop in the amount of deposit needed to buy a house was 16 per cent in the East Midlands, at £36,139.

In Leicester city, the average first-time deposit on a £244,995 home is £41,447. Last year, first-time buyers put down £3,032 more as a deposit in Leicester even though the average price wasn’t much lower – just £244,379.

Kim Kinnaird, director of Halifax Mortgages, says: ‘The fall in house prices last year will go some way to helping people get onto the property ladder for the first time. But these buyers are still reliant on housing supply and face continued pressure to save for a deposit.’

He adds: ‘Although the number of first-time buyers fell to around 293,000 last year, they still accounted for 53 per cent of all mortgage loans agreed. To afford to buy a property, 63 per cent of completions were done in joint names – the purchase was shared between two or more people. This represents an increase of one percentage point compared to the previous year.’

According to Halifax analysis, the average first-time buyer is 32 years old (up from 30 a decade ago) and properties purchased are 6.7 times the average UK salary of £43,257 a year.

Townhouses are the most popular properties among first-time buyers, accounting for 30 per cent of first homes purchased. But due to affordability, flats are often the first property purchased. In expensive regions such as London, they account for more than two-thirds of homes bought for the first time.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.