Table of Contents

A growing number of investors are using the Bed & Isa tactic to protect their assets ahead of a tax dump in April, industry figures reveal.

This oddly named maneuver involves selling investments held outside of an Isa and buying them back into a new or existing one, with the tedious trading business taken care of by your investment platform.

Demand for this service is expected to continue to rise ahead of sharp spring cuts to capital gains tax relief, reducing it from £6,000 to £3,000.

Meanwhile, the tax-free allowance on dividends will be reduced from £1,000 to £500.

Bed & Isa: Involves selling investments held outside of an Isa and buying them back into a new or existing Isa.

CGT and dividend allocations were already halved last April, from £12,000 and £2,000 respectively, which has focused investors’ minds on putting most or all of their wealth in the safety of a stock market Isa.

But you do have to weigh up the possible CGT bill for selling your investments and investigate the costs of the transaction.

Additionally, due to the trade and time involved, you should not leave the Bed & Isa until just before the end of the tax year. See below how Bed & Isa transactions work and what to consider first.

> How to choose the best (and cheapest) Stocks and Shares Isa and the Right DIY Investment Account

Online investment site DIY Interactive Investor says it has already seen a 7 per cent increase in Bed & Isa applications in January compared to the previous year.

This follows a 53 percent increase in 2023 compared to the previous year.

“Decreasing tax relief on capital gains and dividends is driving investors to invest through a tax-efficient wrapper if they haven’t already done so,” says Myron Jobson, senior personal finance analyst at II.

‘Transferring investments into an Isa protects future profits and dividends from the clutches of tax. Known as Bed & Isa, the process is a valuable tool as part of a broader portfolio clean-up strategy.

“The transfer, however, will involve the sale and repurchase of shares, which could trigger a capital gains tax bill.”

Graham Brodie, wealth planner at Succession Wealth, says: ‘An Isa is one of the most tax-efficient savings vehicles you can find. Within an Isa, any interest earned on cash savings and dividend income grows free of income tax. Investment gains are also safeguarded by CGT.

‘Investments made outside of an Isa may be subject to tax. Currently, the maximum amount that can be invested in an Isa is £20,000 per year and this allowance cannot be carried over to a new tax year. Any unused allocation in this fiscal year will be forfeited on April 5, 2024.

“Because of this, if you have investments outside of an Isa wrapper, it may make sense to use the Bed & Isa transaction.”

What impact will the changes to CGT and dividend tax have on investors?

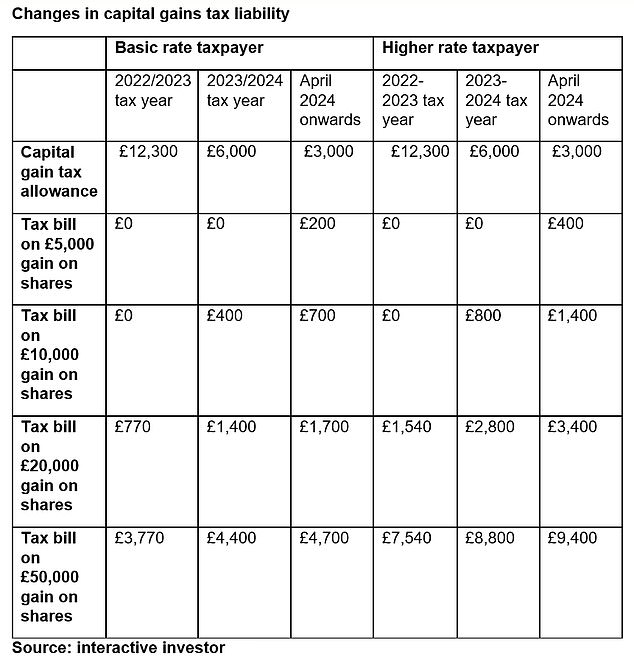

Interactive Investor analyzes how the changes affect different profit levels over three fiscal years.

What should you consider before embarking on a deal with Bed and Isa?

Graham Brodie of Succession Wealth offers the following advice.

1) The Bed & Isa process: Each tax year, existing investments are sold up to the value of any unused Isa allowance (the ‘bed’ part of the transaction) and the proceeds are used to open a new Isa account or top up an existing Isa account.

You can buy back the same investments within the Isa wrapper, choose other investments or simply keep the cash within your Isa.

Over the years, you will protect more of your portfolio from taxes. This can help provide tax-free income and reduce your CGT bill in future years.

2) Capital gains tax: When you sell your investments to start a Bed & Isa transaction, you may have to pay CGT if your profits for the year exceed the annual allowance (currently £6,000 in the 2023-24 tax year). This allowance will be reduced to £3,000 in the 2024-25 financial year.

If you suffer a loss, this could be offset by any other capital gains you may make this year or in the future.

Taxation of earnings above annual allowances is currently charged at 10 per cent for basic rate taxpayers and 20 per cent for higher rate taxpayers.

Additionally, UK investors using the Bed & Isa transaction do not have to wait 30 days before purchasing the same share or class of a specific fund as if they were selling and buying back shares outside the Isa wrapper.

3) Other costs: There will be costs involved if you use the Bed & Isa strategy. These will typically include trading fees, stamp duty, platform charges and a funds exchange cost or set-up charge.

Although costs are an essential consideration, in the long term the tax advantages of holding investments within an Isa will likely outweigh the charges.

4) Time out of market: Although the Bed & Isa process is quick, there is a risk that any time off the market could have a detrimental impact on your investments.

Shares are usually sold and repurchased simultaneously to limit potential price movements, but the sale and repurchase of funds may take a few days.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.