The rise of 40-year mortgages is putting first-time buyers’ retirements at risk and could cost around £100,000 more in interest.

Ultra-long mortgages will “come home to win” as households will be left with less money for retirement, banking trade body UK Finance said.

Borrowers are taking out more mortgage loans lasting up to four decades as they struggle to get a foot on the real estate ladder amid high home prices and rising mortgage rates.

Long-term mortgages cost much more: £200,000 is borrowed over 40 years instead of 25, generating £112,000 in extra interest.

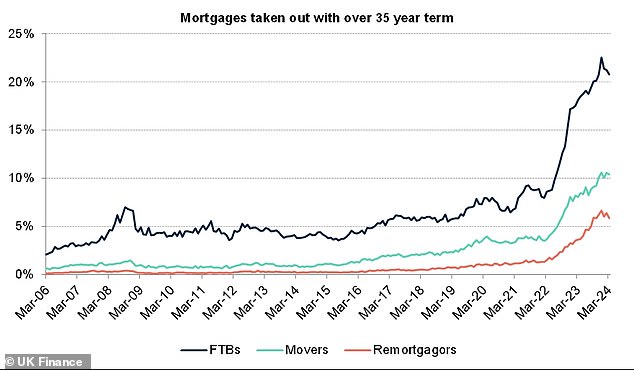

One in five mortgages for first-time buyers have a term of more than 35 years, double the proportion seen just two years ago.

Longer Mortgages: UK Finance report shows how as interest rates rose, terms on longer mortgages soared dramatically

Borrowers are taking out longer-term loans to reduce monthly payments and fit credit criteria based on affordability, but they can introduce longer-term financial risks and costs.

UK Finance warned in a report: ‘The longer a customer needs to make their mortgage payments, the less free income they will have during this period for other important considerations, including contributions to their pensions.

“This longer-term borrowing trend has the potential to have broader social implications, although these may not become a reality for some years.”

UK Finance figures show the average first-time buyer is now borrowing £200,000 at a loan-to-value ratio of 75 per cent, with a term of 31 years.

This is Money’s long-term mortgage calculator that highlights how, while extending the term of a mortgage reduces monthly payments now, it costs much more over the life of the loan.

For example, a typical £200,000 mortgage for a first-time buyer, with an average rate of 5 per cent, over 25 years would cost £151,000 in interest, but over 40 years £263,000 in interest charges would accrue.

Before the financial crisis, the standard term for a mortgage was 25 years, but it has started to increase and the average term for first-time buyers is now 31 years.

By extending this to 40 years, interest charges skyrocket.

A £200,000 loan over 31 years at an average rate of 5 per cent would generate £194,000 in interest.

But borrowing over 40 years would incur £263,000 in interest, costing first-time buyers an extra £69,000 over the life of their mortgage.

The UK Finance report said: ‘The small but growing minority of both moving and remortgaging customers taking out loans for these longer terms points to more deep-rooted affordability issues.

‘Rather than simply extending terms as a means of improving affordability to enter the housing market, more clients need to do this in subsequent mortgage transactions, later in their homebuying process and in their working lives.

“This longer-term borrowing is carried out within the FCA’s responsible lending rules, including those cases where the term extends into retirement.”

Long-term mortgages soared as interest rates soared as Andrew Bailey and the Bank of England tried to tackle rising inflation.

Long-term mortgages began to rise sharply as interest rates rose in 2022 to cope with rising inflation and soared further in the wake of Liz Truss’ mini-Budget in September that year, when borrowing rates soared. They shot.

At the beginning of that year, loans over 35 years represented just 8 percent of mortgages for first-time buyers. But that figure rose to 17 percent by the end of 2022 before peaking at 23 percent in December last year.

Although mortgage rates have fallen from their highest levels, the proportion of extra-long agreements only fell to 21 percent in March.

UK Finance said the proportion of loans with terms of up to 40 years “remains much higher than we have seen in the past” for “all types of borrowers, but most significantly among first-time buyers”.

David Hollingworth, associate director at brokerage L&C Mortgages, said: ‘Taking out a longer-term mortgage can help with initial monthly payments, but the cost will increase substantially over time.

‘Borrowers should be disciplined in checking the deadline, or overpaying where possible, to reduce that burden.

“If not, it will continue to have a larger impact on disposable income for longer, which could have knock-on consequences for savings and retirement resources.”

Former Pensions Minister Baroness Altmann said: “If the only option for people is to take out a longer-term mortgage, then for many that is better than paying rent, which will also prevent them from saving.”

“The issue for me is ensuring that lenders don’t profit from these long-term loans, as borrowers end up paying more the longer the term.”

> Check how much a mortgage could cost you with our best rate calculator

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.