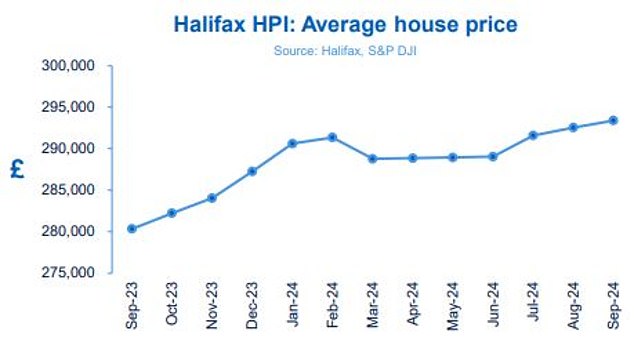

House prices rose for the third consecutive month in September, according to the latest figures from Halifax, putting the average house within £108 of the 2022 peak.

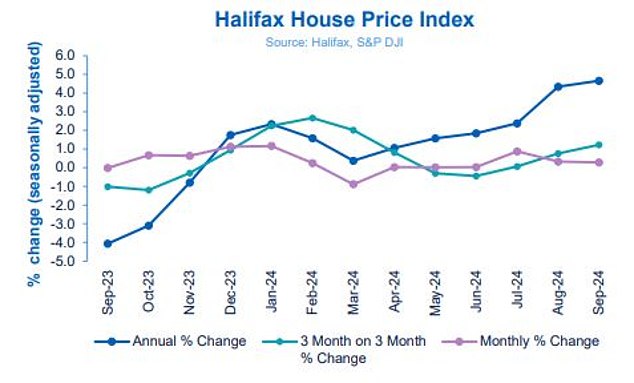

Property values rose 4.7 percent year-on-year, according to one of Britain’s biggest lenders, the biggest rise since November 2022.

While the typical house price has increased by around £13,000 over the past year, this increase is largely a recovery of ground lost over the previous 12 months.

The typical house now costs £293,399, which is the highest recorded since June 2022, when prices peaked at £293,507.

On the rise: Year-on-year prices rose 4.7%, according to Halifax, the highest rate since November 2022

Halifax mortgage director Amanda Bryden says prices have been helped by improving market conditions over the summer and early fall.

“Mortgage affordability has been eased by strong wage growth and falling interest rates,” Bryden said.

‘This has boosted confidence among potential buyers, as the number of mortgages agreed has increased by more than 40 per cent in the last year and is now at its highest level since July 2022.

He adds: ‘While improving mortgage affordability should continue to support buyer activity (boosted by anticipated further interest rate cuts), housing costs remain a challenge for many.

“As a result, we expect house price growth for the remainder of this year and next to remain modest.”

Mortgage rates have been falling steadily over the past few months.

Last week, five major mortgage lenders announced rate cuts on the same day.

Since the beginning of July, the lowest five-year fixed-rate mortgage has fallen from 4.28 percent to 3.68 percent.

Meanwhile, the two-year lowest fix fell from 4.68 percent to 3.84 percent during that time.

Tom Bill, head of UK residential research at Knight Frank, said: ‘The last two years have highlighted the close relationship between mortgage rates and house prices – when one goes up, the other goes down.

‘We expect low single-digit price growth this year as rates continue to fall, with the budget being the main cause of uncertainty on the horizon.

“If it is better than feared, there is likely to be a rebound in activity before Christmas that extends into next spring.”

Recovery: Higher annual growth continues to reflect underlying impact of weaker prices a year ago, says Halifax

Where house prices are rising the most

Northern Ireland continues to record the fastest price growth of any UK region, with average homes there rising 9.7 per cent year-on-year in September.

The North West recorded the highest house price growth of all English regions, with the average house increasing by 5.1 per cent over the last year to £234,355.

House prices in Wales also recorded strong growth, according to Halifax, up 4.4 per cent on the previous year.

However, Scotland has seen a more modest rise in house prices, with a typical property now costing £205,718, which is just 2.1 per cent more than the previous year.

The most expensive property market, London, where the average house now costs £539,238, is up 2.6 per cent compared to last year.

This is still well below the capital’s maximum property price of £552,592 set in August 2022.

House prices rose for the third consecutive month in September, with a slight increase of 0.3 per cent, or £859 in cash terms.

Jonathan Hopper, chief executive of Garrington Property Finders, said: “The recovery is real, but not rocket-propelled.”

‘Average house prices across the UK are again within striking distance of the all-time high recorded by Halifax in June 2022, but the pace of progress varies widely across the UK.

‘There is a clear north-south divide in England, with prices in the north-west rising at twice the rate of those in London. In the capital’s prime and superprime markets, we are seeing prices remain stable and even fall in some areas.

‘Data from Halifax shows that the average house in London is currently worth more than £13,000 less than it was in August 2022.

‘The reason for this regional split is that while buyer appetite is increasing, many buyers remain very price sensitive and strong value is key.

“Prices are rising faster in more affordable locations as buyers, fed up with waiting, look for more homes for their money.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.