Table of Contents

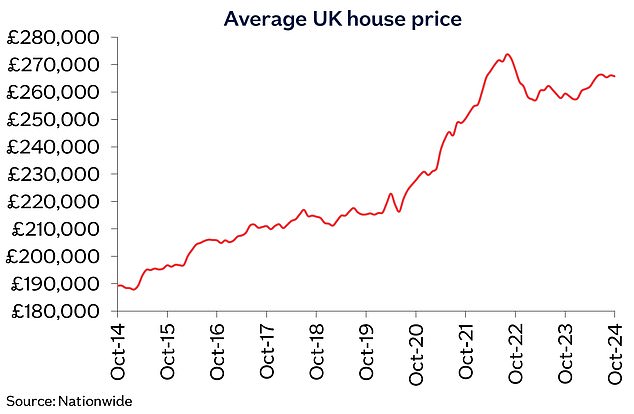

House price growth slowed in October, according to the latest figures from Nationwide.

Britain’s largest building society said average prices rose just 0.1 percent last month, but the rise was due to a statistical quirk.

The monthly increase was due to seasonal adjustment, which aims to smooth out months that tend to be more and less active.

The unadjusted median house price actually fell 0.1 per cent, from £266,094 to £265,738 between September and October.

Year over year, Nationwide says the typical housing stock rose 2.4 percent, representing a modest slowdown from the 3.2 percent annual pace recorded last month.

Little by little: Prices rose just 0.1% on an adjusted basis in October, after a 0.7% increase the previous month, according to the latest national house price index.

Robert Gardner, chief economist at Nationwide, said: “Housing market activity has remained relatively resilient in recent months, with the number of mortgage approvals approaching levels seen before the pandemic, despite the rising rate environment. significantly higher interest rates.

‘Strong labor market conditions, with low levels of unemployment and strong income increases, even after accounting for inflation, have helped underpin a steady rise in activity and house prices since the start of the year.

“If the economy continues to recover steadily, as we expect, housing market activity is likely to continue to gradually strengthen as affordability constraints are eased through a combination of modestly lower interest rates and earnings outpacing asset growth. housing prices”.

What the budget means for house prices

Mortgage costs could rise after Rachel Reeves’ budget led to a rise in swap rates, which influence the price of fixed-rate mortgages.

This, in turn, could prevent home prices from rising in the coming months, as higher mortgage rates make it more expensive to purchase.

The price of fixed rate mortgages is largely based on Sonia swap rates, the interbank interest rate, based on expectations of future interest rates.

When Sonia swaps rise high enough, it often results in fixed mortgage rates rising, and vice versa when they fall.

Yesterday, five-year swaps rose to 4.04 per cent, up from 3.87 per cent on October 29, the day before the Budget. They have increased from 3.7 percent a week ago.

Anthony Codling, European head of housing and building materials at investment bank RBC Capital Markets, believes it is too early to determine the impact of this week’s budget on house prices.

However, he suspects we will see a few quieter months in the market.

“Prior to the Budget, house prices were resilient and mortgage approvals and home transactions were on an upward trajectory,” Codling said.

‘Bond yields and swap rates have risen since the budget and, if these increases are sustained, mortgage rates are likely to rise, dampening house price growth and housing market activity as as we enter a traditionally quieter period of the year for the UK property market. ‘

Stamp duty changes could affect the market

In the Budget, the Chancellor also confirmed that the temporary increase in nil-rated stamp duty thresholds would expire on 31 March 2025 and return to their previous levels, as originally set by the previous Government.

Since the end of 2022, a first-time buyer purchasing a property worth up to £425,000 has not paid any stamp duty. If your house is more expensive, you only pay tax on the part above £425,000.

However, when this limit reverts to the old £300,000 threshold from April 1, it will mean that the same £425,000 purchase will be subject to a tax bill of £6,205.

It leaves would-be first-time buyers with five months before having to shell out thousands of pounds more.

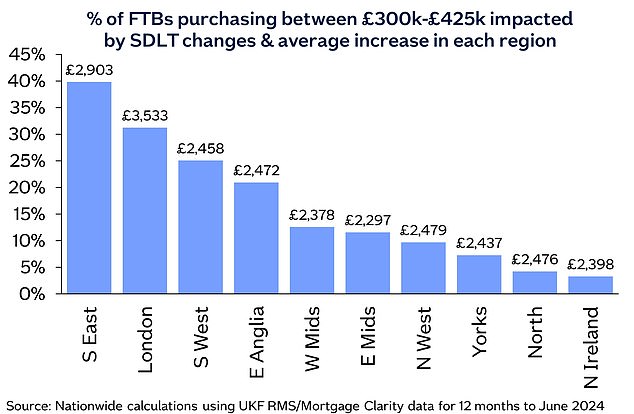

The biggest effects are likely to be in the south-east of England, where 40 per cent of first-time buyers paid between £300,000 and £425,000 for their homes, where the change will increase the cost of moving for first-time buyers affected by an average of 2,900 pounds.

Duty increase: This graph shows the percentage of first-time buyers who are likely to pay stamp duty after the thresholds increase, but wouldn’t today, and what their average bill would be.

For all other buyers, the stamp duty threshold will be reduced to £125,000 from the current level of £250,000.

According to analysis by Leeds Building Society, buyers will have to pay stamp duty on 93 per cent of properties on the market in England.

Currently, buyers only pay stamp duty on 70 per cent of homes on the market.

“The main impact of the stamp duty changes is likely to be on the timing of property transactions, as buyers look to ensure their home purchase is completed before the tax change comes into force,” Mr Gardner said. .

‘This will lead to an increase in transactions in the first three months of 2025, and a corresponding period of weakness in the following three to six months, as occurred following the previous changes to stamp duty.

“However, swings in activity are likely to be somewhat less pronounced in this case, given that the stamp duty reduction has been in place for some time and its expected expiration was well known.”

The chancellor also increased the stamp duty surcharge for second home buyers and investors.

These buyers were already facing a 3 per cent surcharge on top of what those buying a property to live in currently pay.

However, from today that figure will rise to 5 per cent, adding thousands of pounds to the cost of buy-to-let and buying a second home.

Under current rules, a £300,000 property with the surcharge included would cost £11,500 in tax.

It will now rise to £17,500 and the surcharge will rise to 5 per cent.

Nationwide says, based on data for the year to June 2024, this would affect around 194,000 transactions, around one in five residential transactions in England and Northern Ireland.

“We estimate that for a typical buy-to-let this would add approximately £4,000 to stamp duty costs,” Gardner says.

“Therefore, this may dampen demand in this part of the housing market.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.