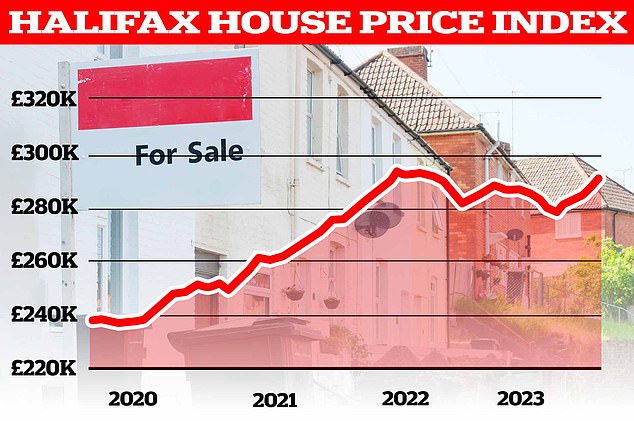

Median house prices have risen for the fourth month in a row, according to the latest figures from Halifax.

The mortgage lender revealed that average prices increased by 1.3 per cent in January alone.

A typical house now costs £291,029, almost £4,000 more than in December.

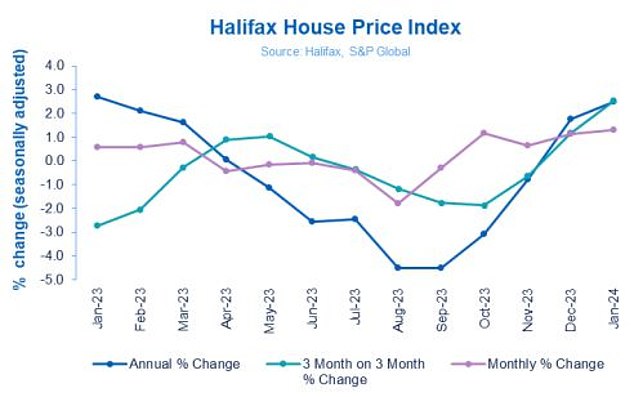

The resurgence in prices in recent months means that year-on-year house prices are up 2.5 per cent, according to Halifax data.

On the rise: The average house price in January was £291,029, an increase of 1.3% or, in cash terms, £3,924 compared to December 2023.

Kim Kinnaird, director of Halifax Mortgages, said falling mortgage rates helped reverse consecutive monthly falls in house prices seen between April and September last year.

Mortgage lenders began cutting rates starting in September and this rate cut continued through 2024. In January alone, more than 50 mortgage lenders reduced their residential rates, some more than once.

While cuts have largely stalled over the past two weeks, and some lenders have raised their rates, borrowers who get the cheapest deals can now get a rate of just under 4 percent when fixed for five years or just over 4 percent. by fixing for two years.

Kinnaird said: ‘Lenders’ recent reduction in mortgage rates as competition increases, coupled with easing inflationary pressures and a still resilient labor market, has contributed to greater confidence between buyers and sellers. “This has resulted in a positive start to the 2024 property market.”

However, Kinnaird said pressures on affordability remain as mortgage rates remain much higher than before rates first spiked in 2022.

He added: ‘Although property activity has increased in recent months, interest rates remain high compared to the record lows seen in recent years and demand continues to outstrip supply.

‘For those looking to buy a first home, the average deposit raised is now £53,414. Not surprisingly, nearly two-thirds of new buyers setting foot on the ladder now shop under joint names.

“Looking ahead, affordability issues are likely to persist and further modest declines should not be ruled out, against a backdrop of greater uncertainty in the economic environment.”

Annual increase: After a fourth consecutive month of rising house prices, the annual growth rate is now 2.5%.

The market is on the rise according to real estate agents

Real estate agents are widely reporting that Halifax’s numbers align with what they are seeing in the housing market.

In fact, some believe that housing prices could begin to rise sharply in some areas.

Simon Gerrard, managing director of Martyn Gerrard Estate Agents, said: “Last year, many people put their property searches on hold to weather wider economic turbulence.

‘Now, however, the economy has begun to stabilize, and it is encouraging that the big lenders are responding in the right way to controlling inflation, by lowering interest rates.

“Although housing affordability at the moment is quite good, rapid population growth and a complete lack of new housing supply means prices will start to rise sharply, especially in London.”

Jeremy Leaf, a north London estate agent and former chairman of Rics residential, added: “The result has been more valuations, listings and, especially, viewings at our offices.”

Marc von Grundherr, director at Benham and Reeves, said: “The general view is that 2024 will be a much more fruitful year for the UK property market and we are already seeing the first signs of this, with a fourth consecutive monthly rise in prices. house prices and a sharp increase in both new sales listings and the number of buyers submitting offers.

“It’s really all systems go right now and as market activity continues to increase, property values will continue to mature.”

Verona Frankish, chief executive of online estate agency Yopa, also believes the property market will continue to gain momentum as the year progresses.

“Looking ahead, not only is the housing market likely to have bottomed out from the decline in house prices seen last year, but interest rates are also likely to have peaked,” Frankish stated.

“This combination of factors will excite both buyers and sellers, and as the year progresses, we expect further momentum to build.”

Momentum generation? Agents say they are seeing more activity in the housing market.

Different real estate markets

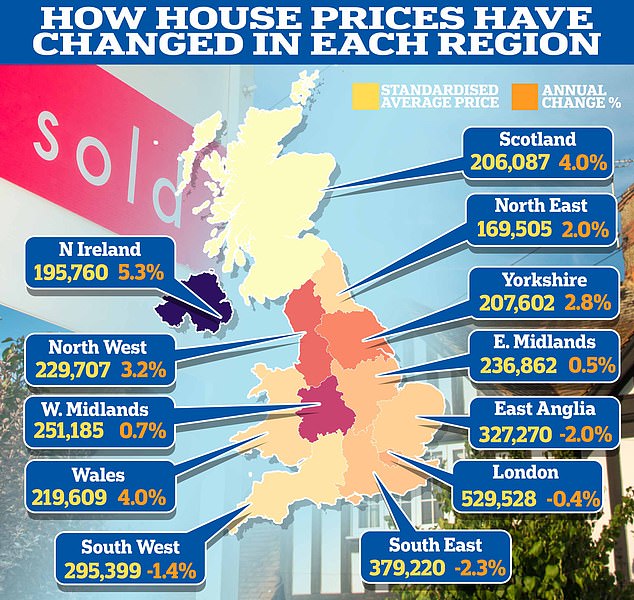

The average price of a house in the UK will not reflect everyone’s experience, as the property market is made up of thousands of independent micro-markets.

Even when looking at different regions of the UK, it is already possible to see significant differences.

Northern Ireland recorded the highest growth of any country or region in the UK, according to Halifax. House prices there rose 5.3 percent year on year.

Scotland and Wales experienced positive growth of 4 per cent annually, according to Halifax.

Typical prices in the northwest of England rose by 3.2 per cent, while in Yorkshire and the Humber prices rose by 2.8 per cent.

Prices in the South East fell the most last month compared to other regions of the UK, with homes selling 2.3 per cent less at this time last year.

While London maintains the top spot for the highest average house price across all regions, at £529,528, prices in the capital have fallen by 0.4 per cent year-on-year.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.