Table of Contents

Property sale prices fell from their all-time high this month, but only by £21, according to Rightmove.

It means the average property on the market is now for sale for £375,110, although they typically sell for less, with the average asking price of a property at just under £289,000 according to the latest data from Halifax.

Compared to June last year, asking prices increased by 0.6 per cent or £2,251, according to Rightmove.

Not much has changed: average sales prices barely changed in June, while most buyers and sellers said they were not worried about the impact of the upcoming general election.

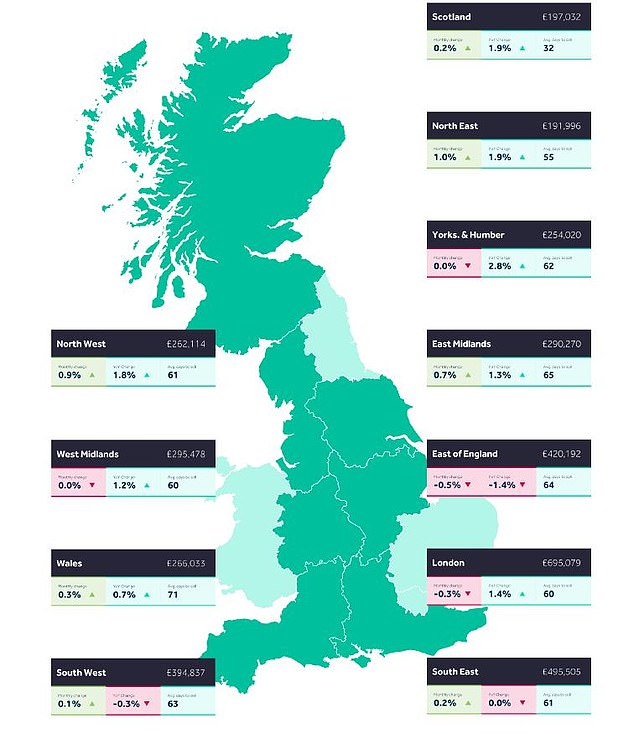

However, in some areas prices rose more, particularly in the less expensive regions of the north of England.

Five of the six cheapest areas hit new price records, including the North East, where prices rose 1 per cent over the month, the North West, where they rose 0.9 per cent, and the East Midlands, where they rose 0. .7 percent.

Yorkshire and the Humber saw the highest year-on-year growth at 2.8 per cent, although prices remained stable month-on-month.

By contrast, the most expensive regions of the East of England and London were the only ones to experience monthly price falls, of 0.5 per cent and 0.3 per cent respectively.

What happened to the price of your home could also depend on its size.

‘Top of the ladder’ properties, comprising five bedrooms and four self-contained bedrooms, saw a price fall of 0.6 per cent over the past month and the smallest annual increase of 0.1 per cent, Rightmove said.

Marginal move: sales prices up just £21 compared to May figure

Budget Break: Larger homes saw the biggest sales price declines this month, perhaps because the amount many buyers can spend on a property is limited by higher mortgage rates.

The average home in this category now costs £689,810, with the month-on-month drop being partly attributed to higher mortgage rates that are straining some buyers’ budgets.

Second homes, comprising three and four beds, now cost £343,947 on average, having increased by 0.2 per cent in the last month and 0.4 per cent over the year.

First-time buyer properties, which Rightmove classifies as two bedrooms or less, fell 0.1 per cent on the month to an average of £227,757, although prices rose the most over the year at 0.6 per cent. .

Buyers keep calm and carry on amid elections

The property portal said the impending general election had not had a significant effect on the property market, apart from perhaps a small decline in the number of higher-priced homes coming up for sale.

In the two weeks since the surprise election announcement, the number of high-end sellers coming to the market was 3 per cent lower than a year ago, compared to 11 per cent higher in the previous two-week period, Rightmove said .

However, buyer demand has remained stable and is now 5 percent higher than in June last year.

In a Rightmove survey of more than 14,000 people, the vast majority (95 per cent) of those planning to move home said the election would not affect their plans.

Tim Bannister Rightmove, head of property science, said: “The vast majority of respondents say they will continue with their moving plans.

‘However, some potential sellers appear to be watching and waiting rather than taking action, as evidenced by a drop in the number of new sellers coming to the market, particularly at the top end.

“This is understandable when many of these sellers have more flexibility in how they act, but overall, it seems to be business as usual for the mass market.”

Ian Baker, managing director of estate agent group Preston Baker in Leeds, added: “The Government’s decision to call a general election has made no appreciable difference to market conditions.

“We saw a small drop last week in the number of listings, but this is easily explained as the traditional drop we would normally see in half-term week, when more families decide to leave.”

It’s not so gloomy: locations in the north of England saw more significant sales price growth

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.