Table of Contents

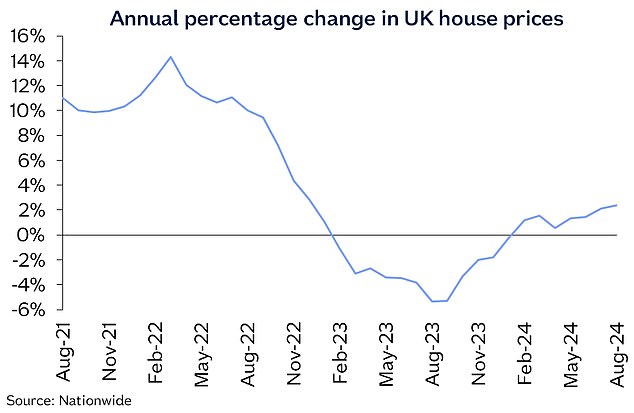

- Despite the monthly drop, it was the largest annual increase since December 2022

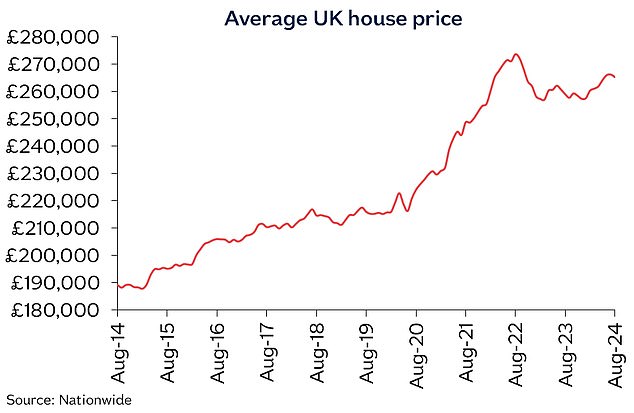

House prices fell in August, according to the latest figures from Nationwide.

Britain’s largest building society said that while average prices fell 0.2 percent this month, they had risen 2.4 percent in the year to August, up from 2.1 percent in July.

This, he said, was the fastest pace of annual growth since December 2022.

The last time prices fell on a monthly basis was in April of this year.

Ups and downs: House prices fell 0.2% month-on-month in August, after adjusting for seasonal effects, but annual house price growth continued to increase slightly

Nationwide said the reason for this statistical quirk (monthly prices falling and annual prices rising) is that there was also a drop last year between July and August.

Nationwide also uses seasonal adjustment to smooth out the typically busiest and slowest months in the housing market, and without that adjustment the average fell 0.36 percent between July and August this year.

While home values may have increased year-over-year, prices are still about 3 percent below the all-time highs recorded in the summer of 2022.

Robert Gardner, Nationwide’s chief economist, said: ‘UK house prices fell month on month in August, after taking into account seasonal effects, but the annual rate of house price growth continued to rise slightly.

‘While house price growth and activity remain subdued by historical standards, they nonetheless present a picture of resilience in the context of a higher interest rate environment and where house prices remain high relative to average incomes.’

What will happen to housing prices?

Most real estate market organisations and experts now forecast that prices will end the year slightly higher.

Property portal Zoopla predicts house prices will end the year 2.5 percent higher.

Real estate firm Knight Frank is forecasting a 3 percent increase in annual growth from December onwards.

Looking further ahead, Knight Frank expects similar growth over the next four years.

A further 3 percent increase is forecast next year, followed by annual growth of between 4 percent and 5 percent between 2026 and 2028.

Recent high: Average prices rose 2.4% year-over-year, a slight rebound from 2.1% in July and the fastest pace since December 2022

The slightly more optimistic mood around property prices is due to the fact that mortgage rates have been falling in recent months.

The lowest five-year fixed rates, reserved for those with 40% deposits, are below 4%. Those buying with 20% deposits can get a five-year fixed rate of as little as 4.19% and those buying with a 10% deposit can get a five-year fixed rate of as little as 4.59%.

Jonathan Hopper, chief executive of Garrington Property Finders, said: “The summer holidays are traditionally a slow time for both viewings and offers on properties, but buyer sentiment has been boosted by the growing realisation that we are finally in a cycle of lowering interest rates and cheaper mortgages are appearing every week.”

Hopper says prices are rising in the more affordable parts of the country, but are still falling in the more expensive areas.

He said: ‘On the front line we are still seeing prices coming down in the more expensive areas of London and the south-east.

‘In contrast, prices are steadily rising in the most affordable locations and this has driven Nationwide’s annual price inflation rate to levels not seen since 2022.

‘Now that many buyers have returned from the holidays and have set themselves the goal of moving before Christmas, demand is likely to pick up noticeably in the coming months. But the supply side of the equation should keep price increases in check.

‘With many buyers spoiled for choice and sellers eager to close a deal, deep discounts can still be had.’

Tom Bill, head of residential research at Knight Frank, added: ‘The property market is in a better place than last summer, with inflation under control and lenders cutting rates.

‘Financial markets are pricing in another cut this year and as mortgage rates fall this autumn, this should support transactions and modest single-digit price growth, which does not necessarily match recent warnings from the Government about the state of the economy.’