Table of Contents

- HMRC estimates show you could receive £10.4bn in tax on savings interest

- This is a 58% increase in the tax on savings interest between 2023 and 2024

- In 2021, the amount of savings interest tax received by HMRC was £1.2bn.

HMRC expects an additional £3.8bn in revenue from savings tax this financial year, its latest figures show.

The amount tax savers pay in interest on their savings will rise to £10.37bn in 2024/25, up from £6.6bn in 2023/24, new estimates show.

This is an increase of almost £3.8bn, an increase of 58 per cent over the course of a year.

It means the amount of savings interest savers have paid since 2021, when the Bank of England began raising interest rates, has risen by 740 per cent.

Savings squeeze: the tax authorities are willing to collect much more tax in this financial year through savings interest

Between 2021 and 2022, savers paid £1.2bn in tax on their savings interest, according to HMRC’s income tax liability statistics.

This more than doubled in 2022/23, when the amount of savings interest tax paid soared to £3.4 billion.

What is behind the increase in the tax on the interest on savings paid?

One reason for this is rising interest rates, combined with a second brutal factor: the Personal Savings Allowance (PSA) which remains frozen since its introduction in 2016.

HMRC said: ‘Income from savings is significantly higher in 2024-25 (about six times higher than in 2021-22), largely due to actual and projected changes in bank and building society interest rates following large reductions in bank and building society interest rates until the end of 2021.’

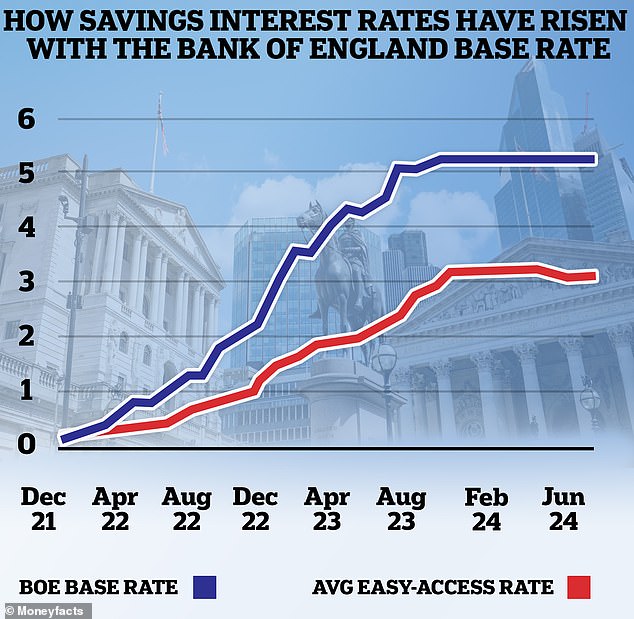

The Bank of England’s base rate began rising from a record low of 0.1 percent in December 2021 and was increased 14 times between then and August 2023 to its current level of 5.25 percent.

This meant that the interest earned on savings rates also increased. For example, at the beginning of December 2021, the main easy-access account offered paid 0.75 percent; today it is 5.2 percent.

Meanwhile, the PSA, available to basic rate taxpayers who pay no tax on the first £1,000 of taxable interest per year and higher rate taxpayers, who have a PSA of £500 per year, has remained frozen since its implementation in 2016, and the cash ISA allowance has also remained at £20,000.

As the Bank of England base rate has risen since December 2021, savings rates have also risen.

HMRC figures show that of the £10.4bn it expects to receive in tax on savings interest, £1.14bn will come from basic rate taxpayers, £2.4bn will come from higher rate taxpayers and £6.8bn will come from taxpayers. with additional type.

In December 2021, a base rate taxpayer could deposit £526,315 into the average easy access account or £125,000 into the average one-year fixed rate bond before exhausting their PSA, Moneyfacts Compare data shows.

Currently, a basic rate taxpayer could top their PSA with £32,051 in an easy access account or £21,786 in a one-year fixed rate account. An abysmal difference in the space of just two and a half years.

Anna Bowes, co-founder of Savings Champion, said: ‘With interest rates rising so much while the PSA has stayed the same, savers are fully utilizing their PSA with much lower deposits and therefore paying more tax, even if they are now also using their cash ISA.

‘For example, at a rate of 0.75 per cent, a basic rate taxpayer would need a deposit of £133,000 to breach the £1,000 PSA. At a rate of 5.2 per cent, only £19,231 would fail to meet the allocation.’

Cash Isas could provide the antidote

Millions more savers have been using Isas to protect their savings from a tax charge as interest rates have risen.

Savers funnelled a record £11.7bn into cash Isas in April, official Bank of England data showed.

This led to cash ISAS receiving the largest inflows at the start of the tax year since the tax-free accounts were launched in 1999.

Jeremy Cox, of Coventry Building Society, said: ‘The antidote to paying tax on savings is the cash Isa. You can save from £1 to £20,000 each tax year and you won’t pay a penny in tax on the interest earned.’

It helps that some of the best cash Isa loans now pay 5 per cent or more, now in line with their easy-to-access, no-notice counterparts. Historically, cash Isa loans have offered lower interest rates.

> See This is Money’s selection of the five best Isas.

SAVE MONEY, EARN MONEY

Savings offers

Savings offers

Premium fares plus £50 bonus until 15 July

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

free share offer

No account fee and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Fiber broadband

Fiber broadband

BT £50 Reward Card: £30.99 for 24 months

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.