Table of Contents

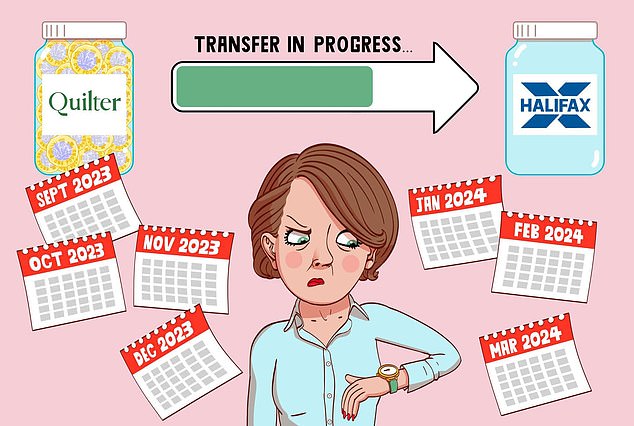

Almost all my savings – around £190,000 – is in an individual savings account with wealth manager Quilter. At the beginning of September last year I decided to transfer the balance to a cash Isa at my bank, Halifax.

Long story short: after five months and numerous attempts to open the new account, the transfer still hasn’t happened. My money is basically trapped in this fiasco. Please help.

GA, Horwich, Lancashire.

Sally Hamilton replies: It may be Isa peak season, with savers and investors debating where to stash their annual allowance of up to £20,000 towards the end of the April 5 tax year deadline, but transferring an Isa is a year-round challenge. activity because people are looking for better deals. or, like you, change their savings strategy.

Never in a month with Sundays did you expect that it would take almost a month of Sundays to arrange your transfer. The crazy delays had you so distracted that you were tempted to just cash out your Quilter shares and shares Isa and then open a cash Isa separately.

But this, as many readers will know, could be a big mistake as the tax protection of the Isa would disappear immediately and normally only £20,000 of new money can be put into Isas each tax year.

To switch providers and ensure the tax shelter is retained for the entire amount, plan holders must initiate the process by completing an Isa transfer form with the new provider, who will then contact the current company .

You have followed this procedure by completing a transfer form at Halifax. Rules say that anyone switching Isa can expect it to be completed within a certain time: this is 15 working days for a cash-to-cash transfer, or 30 calendar days for another type of transfer, such as your switch from a shares and share transfer. to cash Is.

You started the process, tried it online first, but ran into a hurdle because the Quilter address in the drop-down menu on the Halifax form was different than the address you knew.

The Halifax Helpline has decided that you should try a paper form instead. This was sent to you and once you completed it, you brought it to your branch to be countersigned by an employee. The branch didn’t know what to do with you or your paperwork, and guess what, and told you to fill out the application online.

You went home to think about this proposal, but came back the next day to try again with the paper form. This time a staff member helped you complete the form, including checking for the correct Quilter address. He said he would forward the form to the appropriate department.

Five weeks passed and you heard nothing. You have made an appointment at your branch to discuss the matter. By then it was October 10th. Shortly afterwards you were told that the time for your first Isa transfer request had run out so you had to start over.

You did this with the help of a Halifax employee via a video call. More weeks passed and again nothing. On November 28, you returned to the office where you had to fill out a third form. Nearly a month passed and there was still no progress, so you filed a formal complaint.

Again, silence. You contacted me out of desperation.

I contacted Halifax to ask what on earth went wrong with what should have been a relatively simple transaction. This was mid-January.

A few days later they contacted you and, without any explanation, sent you another transfer form – warning you that it could take up to 30 days for the transfer to be completed. Argh!

It wasn’t until March 1 that I received confirmation that your transfer had finally been completed. The root of the problem, it turned out, lay primarily in the fact that Quilter does not accept wire transfers. Yet you sent two completed paper forms that the bank admitted did not go to the correct department. No one seems to know where they went.

The money is now in your account, with interest backdated to September 7, when you first attempted to open it. Halifax has also paid you £450 as an apology for the poor service.

Fortunately, your Isa investments had increased in value in the time it took to complete the switch, so you weren’t left short-changed by the ups and downs of the stock market.

A spokesperson for Halifax said: ‘We are really sorry that your reader’s Isa transfer has taken longer than it should. Her new Isa is now open and as well as ensuring she doesn’t run out of money, we have also made a payment because the service we provided was below the level she rightly expected.’

Meanwhile, reader AW from Hertfordshire has also been struggling to get his money since the beginning of December 2023. Isa has moved from Halifax to Metro Bank. He asked me to help find his ‘missing £80,000’. I asked both banks to go on a treasure hunt.

It looks like Halifax was at fault again, with a little help from the Postal Service. After the transfer was activated, Halifax issued a check for the total balance as requested by Metro Bank, but it never arrived. Although reader told Halifax in January that the money had not been received, nothing was done.

Metro Bank pursued Halifax several times, eventually suggesting the money be sent electronically. Halifax kept hanging on, and it wasn’t until I reached out the first week of March that the company finally sent the money (cancelling the original check).

Halifax added £1,026 to AW’s balance, including lost interest and an additional amount as an apology.

I came from Australia for a holiday in Edinburgh and stayed in an Airbnb apartment for the entire month of January at a cost of £2,200. Together with some family members, I climbed the 36 stairs to the apartment with my luggage. But the stairs were poorly lit and dirty and had no handrails. This was dangerous, especially since I am 79 years old. I decided I couldn’t stay in the accommodation as I couldn’t get myself up and down the stairs safely. We all descended the stairs, using the light of a cell phone.

I tripped on the way down and was only prevented by my brother-in-law supporting me. I have moved to a Holiday Inn hotel, at a cost of £2,000 for that period, so I am now out of money.

AC, Brisbane, Australia.

That wasn’t a great way to start your holiday in Britain. You came to Edinburgh to enjoy the history and architecture of what was once your hometown – and to escape the high temperatures of the Australian summer.

But you didn’t expect to have to walk up the stairs in the semi-darkness to reach your accommodation. Once away from the property, your brother-in-law contacted Airbnb to file a complaint, forwarding a video of the offending darkened staircase.

This resulted in the property’s host offering a £500 refund and promising to fix the lights. But you felt this was not enough and therefore contacted me. I thought you had a point, because without the right lighting things could have gone very wrong for you on the stairs.

I have asked Airbnb to shed some light on your complaint and consider refunding the full £2,200 as you had no intention of returning to the property. I’m pleased to say it came back quickly to agree the refund of your full bill. Fortunately, it was also confirmed that the lighting has now been repaired, so hopefully other guests won’t be affected in the same way.

An Airbnb spokesperson said: ‘Our original handling of this matter fell below our usual high standards and we have contacted the guest to apologize and offer a full refund. Issues on Airbnb are rare and our community support team is available 24 hours a day to help.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.