GameStop shares are rising again in a disconcerting sequel to the two-part frenzy of 2021, with the rally seen on the heels of a cryptic tweet from the man who started it all.

Keith Gill, the man who inspired that year’s short squeeze, resurfaced on Sunday after three years, posting a screenshot of what could be his portfolio in the process.

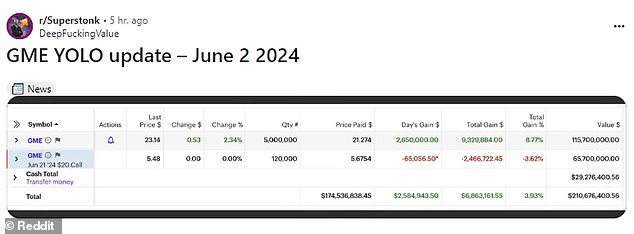

In that, A significant amount of GameStop common stock and call options can be seen – the first post on the trader’s famous ‘DeepFu**ingValue’ Reddit account since April 2021.

The screenshot showed that he bought 5 million GME shares for $115.7 million and put $65.7 million into options that GME said would cost at least $20 per share by June 21.

It also shows that he has made more than $9.3 million from his GME holdings, just over three years after he sent shares of the then-beleaguered video game retailer soaring.

Keith Gill, the man who inspired that year’s short squeeze and is also known by his online pseudonym Roaring Kitty, resurfaced on Sunday after three years, posting a screenshot of what could be his portfolio in the process. He is seen here back in 2021.

In it, a significant amount of GameStop common stock and call options can be seen – the first post on the trader’s famous ‘DeepFu**ingValue’ Reddit account since April 2021.

‘GME YOLO Update: June 2, 2024,’ the post begins, offering the screenshot that has since been upvoted more than 52,000 times.

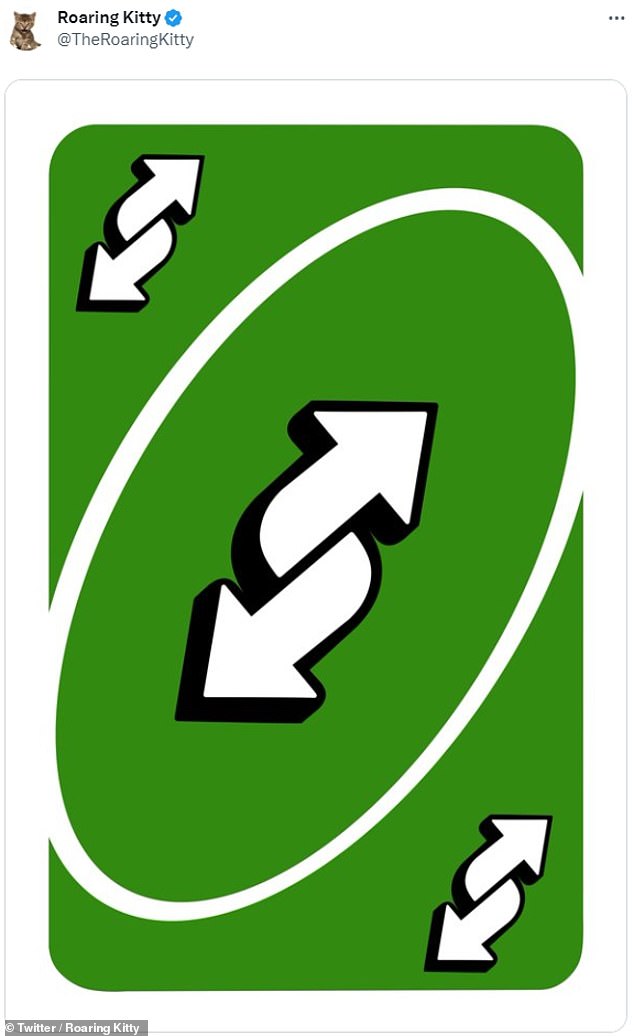

Around the same time, Gill posted an image of a reversed card in the ‘Uno’ game, garnering nearly 30,000 likes on X.

As for the Reddit post and unconfirmed screenshot, it was the first from the account in three years.

It shows five million shares purchased at $21.27 each, a display that almost instantly sent the relatively dormant stock higher once again.

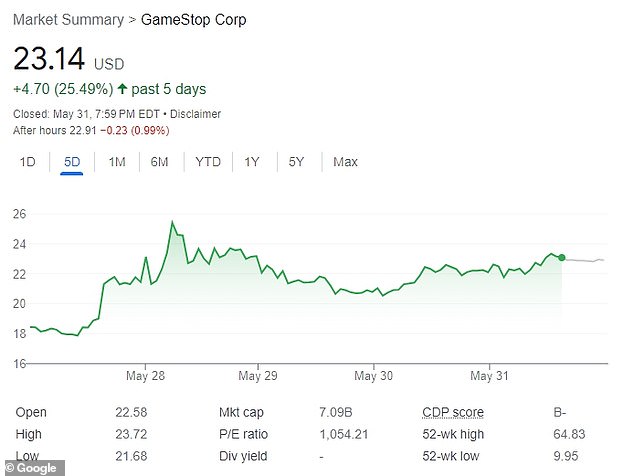

It soared more than 19 percent to $27.58 in overnight trading on Sunday, despite the market being closed for the weekend.

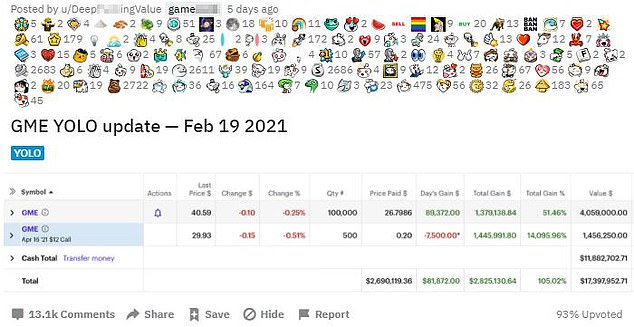

The move recalled the so-called meme trader’s fateful operation in January 2021, where he spent $2 million to buy 50,000 shares at an average price of $40.

The following month, a day after testifying before the House Financial Services Committee, Gill, who also uses the Internet pseudonym ‘Roaring Kitty,’ also revealed on Reddit that he had doubled the number of GameStop shares he owned. , from 50,000 to 100,000.

Gill, who at the time had already made around $13 million in profits from his trading, quickly became the subject of media fervor and scrutiny.

Around the same time, Gill posted an image of a reversed card in the ‘Uno’ game, garnering nearly 30,000 likes on X.

GME soared more than 19 percent to $27.58 in overnight trading on Sunday, despite the market being closed for the weekend.

As a result, GameStop shares soared, as retail investors, urged by the popular Reddit forum WallStreetBets, bought the stock as a way to punish hedge funds that had bet massively against it.

The pressure was “personally humiliating” bigwigs like Gabriel Plotkin of Melvin Capital, whose company was rescued with a $2.75 billion lifeline provided by Kenneth Griffin of the Citadel hedge fund and Steven Cohen of Point72 Asset Management.

It became the subject of a 2023 film titled Dumb Money, which featured Little Ms Sunshine’s Paul Dano as Gill.

Since then, the risky trading strategies seen by the trader and his contemporaries have drawn the ire of some investing legends, but as it emerged, it fizzled out within a few months.

Last month, Gil reignited that fervor by posting an image of a man sitting forward in his chair – a meme used by players when things get serious.

The stock was up an astonishing 119 percent at one point on Monday, despite not indicating a trade.

It also caused $1 billion in losses for so-called short sellers who continued to bet that the video game retailer would go bankrupt, years after GameStop suffered a “short squeeze” in its stock.

The move recalled the so-called meme trader’s fateful operation in January 2021, where he spent $2 million to buy 50,000 shares at an average price of $40, before buying another 50,000 the following month.

Last month, Gil reignited that fervor by posting an image of a man sitting in his chair, a meme used by gamers when things get serious.

A “short squeeze,” in this case, refers to when large investors who had bet against GameStop were forced to buy its rapidly growing shares to offset their huge losses.

The screenshot Gill posted on Sunday, if legitimate, shows that he has a nearly $2.5 million loss on his call options — the option to buy assets at an agreed upon price on or before a certain date.

Meanwhile, GameStop shares closed at $23.14 on Friday, May 31, up 38.8 percent year over year.

Much of this appears to be driven by Gill’s return, as Monday’s opening bell looms large.

The investor was a former marketer for Massachusetts Mutual Life Insurance. He and a group of retail traders he met online fueled the initial rally.