Two more Wells Fargo customers have revealed how they lost their life savings to scammers as the bank faces a series of lawsuits questioning the strength of its anti-fraud measures.

Retired opera singer Jolinda Crocker, 63, claims criminals swindled her out of $60,000, while accountant Judy Burr, 75, says she lost $23,000 in an eerily similar scheme. Neither woman – both grandmothers – has received a refund from the bank.

Wells Fargo has received a series of lawsuits in recent months accusing its security measures. of not being fit for purpose.

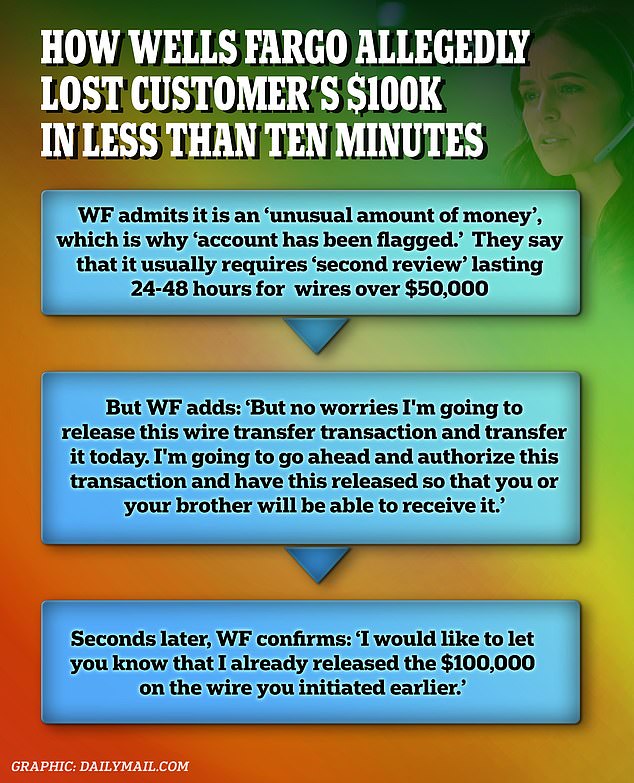

DailyMail.com has uncovered audio transcripts of a case that allegedly highlights the moment a bank employee allowed a fraudster to steal a customer’s life savings of $100,000 in less than ten minutes.

Court documents a second claim that the bank’s own security systems raised red flags about a fraudulent transfer, but employees ignored the concerns.

Cybersecurity experts are now calling for an update to industry regulations to hold banks more accountable for fraud incidents.

Jolinda Crocker, 63, claims to have been scammed out of $60,000 by criminals who had gained access to her account.

Judy Burr, 75, says she lost $23,000 in an eerily similar affair. None of the grandmothers have received the refund from the bank

Jolinda, from California, was teaching at one of the music schools she owns in Italy when she says she received a message from Wells Fargo asking her to call them.

He obediently called bank staff, who told him they needed to verify whether he had made two transfers totaling $24,973 and one worth just under $10,000 in September 2021.

The scammers had apparently moved the money between their accounts and sent it to five different recipients.

Jolinda claims she then filed an online fraud report, as recommended, and believed the issue had been resolved.

But ten days later, when she pursued the bank, she says staff accused her of authorizing the transfer herself.

DailyMail.com has seen statements showing that she had been transacting from a device located in Italy.

That same day, someone logs into your account from an address in California where the transactions take place. Later, Jolinda accesses her account again from Italy.

‘I would never transfer such a large sum of money in my life. I run a small music school,” he told DailyMail.com.

Two years later, he’s still fighting to get his money back, and even hired his own detective to work on the case.

Judith Anderson, of Chula Vista, San Diego, was scammed out of her savings, which she uses to fund her husband’s palliative care. She is pictured, right, with her daughter Tracy Martinez, left.

He added: “It feels like everyone is rolling their eyes.” $60,000 is nothing to Wells Fargo, but it’s my life savings.

Her story echoes that of Judy Burr, 75, who was scammed out of $23,865 by criminals posing as Wells Fargo’s fraud investigations team.

The criminals asked him to verify some transactions that they claim had been made from his account. Alarmingly, they had their Social Security number along with other personal information that made it look like they were real employees of the bank.

When they tried to access Judy’s account, the bank sent a unique authorization code to her phone. The scammers ordered him to read it to them.

In the eyes of Wells Fargo staff, this meant that she had personally authorized the transaction.

Judy, an accountant from Las Vegas, told DailyMail.com: “I was so embarrassed I didn’t even want to meet my friends for dinner.” I feel like an idiot.

‘I was a Wells Fargo customer for over 20 years, but they refused to take any responsibility. They put me through endless loops trying to get my money back.’

Victims of wire fraud find themselves caught between huge regulatory cracks that make it difficult to receive refunds.

Revealed: How a Wells Fargo employee let scammers steal $100,000 of his customers’ money in less than ten minutes

It is the second lawsuit to come to light this month that accuses Wells Fargo’s security measures of not being fit for purpose.

Rules outlined by the Consumer Financial Protection Bureau (CFPB) stipulate that banks are required to reimburse victims of unauthorized electronic funds transfers (EFT).

The agency’s Regulation E guidelines define an unauthorized transaction as “from a consumer’s account initiated by a person who is not a consumer with actual authority to initiate the transfer and from which the consumer receives no benefit.”

However, the EFT definition does not cover electronic transfers, meaning banks are not required to reimburse victims who lose money this way.

However, Wells Fargo’s own card agreement states that the bank will not hold customers responsible for unauthorized use of their account.

Brian Filas, fraud expert and founder of Patron Partners, told DailyMail.com: ‘We will continue to see similar stories until wire transfer laws are updated in the United States. These rules were written long before the average consumer could send $50,000 from their phone.

‘Although most banks do a great job of preventing fraud before it happens, losses still occur. Unfortunately, if bad actors use a wire transfer to steal money, some financial institutions may try to use these outdated regulations to return the loss to the customer.’

Victim Alice Fries, 59, was contacted by criminals posing as the bank’s fraud department and tricked her into handing over her personal information which they then used to gain access to her account.

So far this year, DailyMail.com has published three articles accusing Wells Fargo’s anti-fraud controls of failing customers.

Recordings filed in a lawsuit document a phone call in which a Wells Fargo employee allegedly overrides the company’s own security measures to allow scammers to transfer victim Alice Fries’ savings.

In the call, the staff member is said to recognize that this is an “unusual amount of money” and that is why “the account has been flagged.” The mother of one has not received any refund from the bank beyond an offer of a $50 “courtesy credit.”

Similarly, victim Thomas Murrer was scammed out of more than $30,000 by criminals posing as bank employees.

Court documents allege that Wells Fargo’s systems had flagged the scammers’ calls as coming from a number that didn’t belong to Murrer, but approved the transactions anyway.

Surprisingly, the Murrer V Wells Fargo lawsuit claims that after the scammers attacked Murrer’s accounts, they called from the same number three months later posing as another customer.

Even though that number was clearly used for fraud before, the criminals were again granted access to the account.

A fifth victim, Judith Anderson, 74, also lost $150,000 to criminals, although she received a refund after her story went viral on TikTok.

In all three cases, the scammers managed to spoof the number of Wells Fargo’s fraud investigations team and pretended to act on behalf of the bank. The money in each case was also sent by bank transfer.

It is the latest in a series of scandals affecting the bank, which in 2020 was forced to pay $3 billion after its employees were discovered to have created millions of fake accounts for its clients.

A Wells Fargo spokeswoman told DailyMail.com: ‘Fraud and scams are an industry-wide concern. Protecting our clients’ assets is our top priority and we have robust security protocols and measures in place.

‘As scams continue to change and evolve, we continue to invest in technology and training to stay ahead of emerging threats.

“We are also actively working to raise awareness about scams through various resources, including ongoing customer-focused educational efforts.”