All workers should automatically sign up for a £1,000 emergency fund on top of their pensions, according to proposals put forward by an influential think tank.

The new easy-access cash pot could be created from increased pension contributions, and as soon as it reached £1,000, any surplus would be diverted into people’s retirement funds.

The one-size-fits-all approach in the first decade of automatic enrollment was successful in getting people to save, but a more flexible approach is needed now, according to the Resolution Foundation.

Emergency fund: A new, easily accessible cash fund could be created from increased pension contributions, according to Resolution

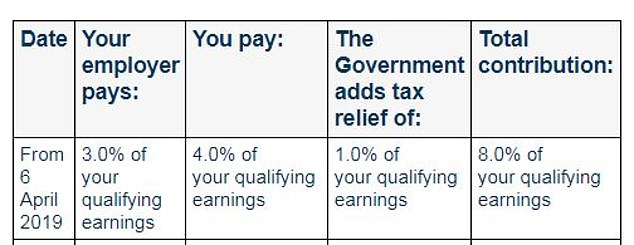

The think tank proposes an increase in minimum pension contributions from 8 per cent of qualifying earnings – made up of personal and employer contributions, plus Government tax relief – to 10 per cent.

This would help fund new rainy-day savings funds that could be used to manage small cash flow shocks, Resolution suggests.

Under a more ambitious plan, people would be allowed to borrow £15,000 or 20 per cent of their pension fund, whichever is lower, to protect themselves against bigger financial shocks such as unemployment.

The money going into the emergency fund would not be topped up by the Government’s pension tax relief, but the tax relief would be added to any surplus cash being transferred into a pension.

Fund manager Schroders and the Institute of Pension Management are pushing a scheme that would similarly help people build an emergency fund, while saving for retirement and a first home.

Both the Resolution and the Schroders and PMI plans aim to increase financial resilience, while building on the success of automatic pension enrollment.

Who pays what: Breakdown of contributions to minimum pensions by self-enrollment. (Qualifying income is between £6,240 and £50,270 salary)

The resolution says the combination of auto-enrolment and the new state pension means average earners – earning £37,000 in 2024-25 – now manage to replace at least 45 per cent of their salary at retirement.

That was the minimum retirement income replacement target proposed by the official Pensions Commission two decades ago.

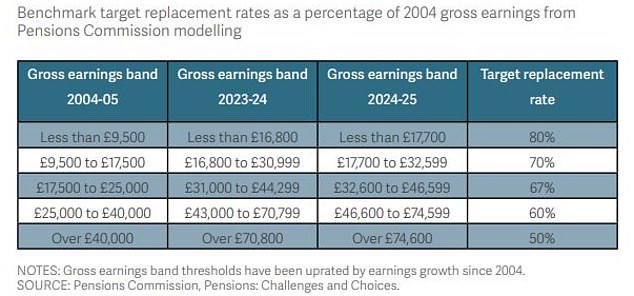

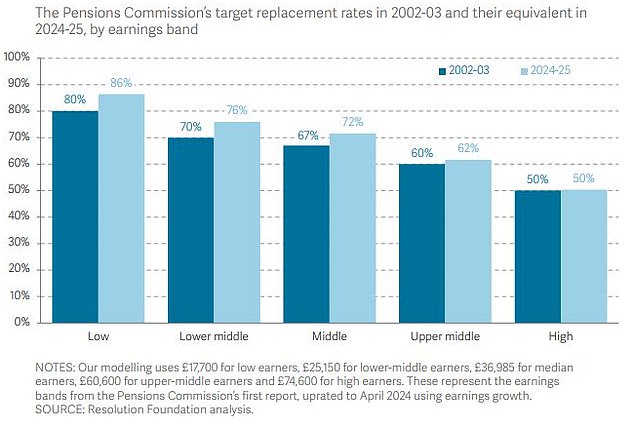

But the Commission wanted people to reach higher replacement targets: 80 percent of wages for low-income workers, 67 percent for middle-income workers and 50 percent for high-income workers.

“Fully enrolled low-income individuals are automatically on track to reach their target replacement rates at retirement,” Resolution says. “On the other hand, people with middle and high incomes are a little out of place.”

But he notes that this does not necessarily mean that all middle- and high-income earners will face an income shortfall, because many will use other financial assets to supplement their savings.

“A typical middle-income person, aged around 50, currently has enough disposable wealth, in addition to their pension savings, to ensure an adequate income in retirement, although people without broader financial assets remain at risk.”

And Resolution says: ‘While low-income people may be on track to reach their target replacement rates in retirement, they face other savings challenges during their working lives.

“One in three working-age adults live in families with affordable savings of less than £1,000.”

He adds: “There are many reasons for this lack of financial resilience, but the UK’s inflexible system for saving into pensions is clearly not helping.”

‘Today, people must choose between consuming today, saving for preventive purposes and saving for retirement.

The Resolution report, which was funded by pension provider People’s Partnership, also argues that wage replacement rates should now be higher for all but the highest earners, due to tax changes over the past two decades ( see below).

The Pensions Commission used wage replacement targets to help people understand how to smooth their income throughout their working lives and into retirement.

More recently, influential industry standards have analyzed what income individuals and couples need for a minimal, moderate, or comfortable retirement.

The annual Pension and Life Savings Association The study assumes you are entitled to a full state pension, which increased to £11,500 a year in April, but the figures do not include income tax, housing costs (if you rent or are still paying a mortgage) or care costs.

The new Government has launched a wide-ranging review of pensions following the election, and there is much speculation about possible changes to the Budget on 30 October.

Molly Broome, economist at the Resolution Foundation, says: “Twenty years ago, and amid widespread concerns about poverty in old age, the Pensions Commission set benchmarks for how much people would have to save during their working lives to enjoy of a decent income in retirement. .

‘Policies such as the new state pension and automatic enrollment have achieved their goal of giving everyone a decent minimum level of retirement income. But the work is incomplete.

‘And that’s why the Government’s new Pensions Review, which could set policy for the next decade, should focus on addressing the different savings challenges faced by people on low, middle and high incomes.

«In addition to continuing to boost pension savings, automatic enrollment must also be more flexible.

“It should allow people with low incomes to build up emergency savings that they can draw on before they retire, while higher contributions for people with higher incomes could help them get closer to maintaining their standard of living until retirement.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.