Table of Contents

Insurer Direct Line has revealed an accounting error, dealing an embarrassing blow to its new boss, Adam Winslow.

The FTSE 250 firm misjudged a measure of its financial strength late last year, just five months after Winslow was tasked with reviving the struggling insurer’s fortunes.

The former Aviva executive took over in March, days after receiving a £3.1bn takeover offer from Belgian rival Ageas.

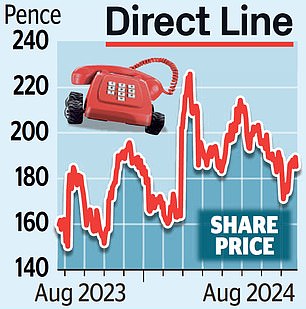

Changes in sight: The FTSE 250 firm miscalculated a measure of its financial strength late last year

He rejected the offer, but was forced to develop a new strategy for the company.

The proposals include a £100m cost cut by focusing on motor, home, commercial and rescue cover, and exiting other sectors. It also outlined a plan to pay out about 60 per cent of operating profits as dividends.

But yesterday it cut its solvency capital ratio to the end of 2023 following an accounting error, sending Direct Line shares down 2 per cent, or 3.8p, to 185.2p.

The ratio has been recalculated to 188 percent, up from 197 percent previously. A lower solvency ratio can limit the amount of excess capital an insurer must return to shareholders through share buybacks or dividends.

It is used to assess an insurance company’s ability to cover its short- and long-term financial obligations. The company said the recalculated figure remained above its target range of 140 to 180 percent.

The company also said it had tightened its controls after detecting the error. The company is scheduled to present its half-year results on September 4.

Its solvency capital ratio for the half is expected to reach 200 percent, saying this follows good capital generation in the first half from operating profits, extraordinary benefits from partnerships and market movements.

Winslow replaced Jon Greenwood, who became interim chief executive in January 2023 after Penny James abruptly resigned a fortnight after the company spooked investors by issuing a profit warning and scrapping its final dividend.

This came as insurers struggled with the impact of rising inflation that drove up the cost of payments and prompted consumers to cancel policies to save money.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.