Table of Contents

De Beers boss Al Cook has one of the most pressured weeks of his working life ahead.

The diamond group is owned by Anglo American, whose boss Duncan Wanblad is busy fending off takeover bids from rival miner BHP.

To appease investors, Wanblad has said De Beers will be sold or spun off if Anglo remains independent.

Diamond Geezer: De Beers boss Al Cook expected to press ahead with unveiling turnaround plan

With that over his head, Whispers understands that Cook will press ahead with presenting a recovery plan on Thursday.

Expect more details on the job cuts, information on where it will cut costs and what its plans are for the Lightbox lab-grown diamond division.

A key question is how De Beers plans to make natural diamonds seem more attractive to those seeking cheaper, lab-grown rocks who are discouraged by the scandals that have plagued the mining industry.

In any case, Cook will need at least one big flare to attract potential buyers.

Wanblad eyes Woodsmith fertilizer mine

Speaking of Anglo, Wanblad has also targeted the Woodsmith fertilizer mine in North Yorkshire.

Woodsmith will remain part of the company, but funding has been cut, which could lead to job losses and a slowdown in construction.

But the local tourism industry could find a silver lining, as Anglo has block-booked many hotels and bed and breakfasts in Whitby and Scarborough for its staff.

Summer by the sea, anyone?

BT boss loves to squeeze short sellers

BT boss Allison Kirkby took the opportunity to say she “loves putting pressure on short sellers” after the company’s share price soared.

The market celebrated its new strategy and a rise in the dividend, hurting hedge funds who had bet £300m that BT shares would fall.

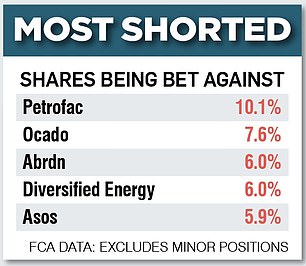

An increase in short selling may be an indication that trouble is brewing in a company. Ocado has seen the number of its shares lent to short sellers soar to 7.6 per cent, or £227 million.

But the hedgies burned in 2013 and 2017, when the online retailer made big bets against them but experienced a trading boom.

Will history repeat itself?

Who is behind the Project Giving Back foundation?

At tomorrow’s glitzy RHS Chelsea Flower Show charity gala, well-dressed guests will once again play the role of “who are the philanthropic couple?” guessing game.

The mystery couple is behind the Project Giving Back foundation, which sponsors 15 gardens at the fair. Grants range from £70,000 to £500,000.

Only the basic facts are known about this generous couple, who spread curiosity and speculation like weeds. Both are keen gardeners who got involved in 2022 after Covid interrupted the show.

Your funding is the gift that keeps on giving. After the show, the gardens will move to hospitals and schools, extending some of the Chelsea feel beyond London SW3.