The products presented in this article are independently selected by This is Money’s specialized journalists. If you open an account using links that have an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

Savings and investment app Chip has launched a new cash Isa account with instant access.

He Cash with instant chip access*Isa pays a rate of 4.75 per cent and represents your first dip into the Isa cash market. Only a handful of providers offer higher rates.

The account is fully flexible, allowing savers to deposit and withdraw their money instantly, without restrictions and without affecting their Isa allowance.

This means savers can replace any money they withdraw from their Isa without it counting towards their annual Isa allowance, as long as they replace the money in the same tax year.

Chip does not currently allow savers to transfer funds from another cash Isa. This will be limiting, particularly given that current rules only allow savers to open one cash Isa each tax year.

However, this will be simplified from April, with the introduction of new rules that will allow multiple Isas subscriptions of the same type each year.

A new instant access to cash* Isa product has been launched today by savings and investment app, Chip

All money deposited into the Chip deal is held by ClearBank and is eligible for Financial Services Compensation Scheme protection of up to £85,000 per person.

This FSCS protection means savers’ cash is protected up to £85,000 per person if the company goes bankrupt.

The app already offers stocks and shares Isa and Chip Instant Access Account* which pays a slightly higher 4.84 percent.

The Chip Isa pays just 0.09 percentage points less interest than this standard instant access account.

But as this is an Isa, all interest earned on the money held in the account (up to the annual Isa allowance of £20,000) will be tax-free.

Someone depositing £20,000 into Chip’s 4.84 per cent instant access account would earn £968 interest in a year, compared to £950 interest in 4.75 per cent instant access Isa chips*.

While a basic rate taxpayer would not exceed their annual tax-free savings allowance of £1,000 with a £20,000 deposit, a higher rate taxpayer (someone earning between £50,271 and £125,140 a year) would easily exceed their lowest allowance of £500.

On £968 of annual interest, a higher rate taxpayer gets the first £500 tax-free, but will pay 40 per cent tax on the remaining £468, meaning they would end up with £780.80 after tax .

Simon Rabin, chief executive of Chip, said: “This is a great moment for Chip and is the next step in our mission to become a trusted and unique destination for generating wealth.”

‘Rising interest rates have changed the landscape, so our priority was to develop a product that gives our users a tax-efficient way to get the most out of their money, with all the conveniences they expect from us.

“We have a lot in store for 2024 and this launch is just the beginning.”

How does it compare to other duty free offers?

Ultimately, the fact that Chip still doesn’t allow savers to transfer an existing cash Isa to it will be seen as a big drawback.

However, for anyone looking to set up a new cash Isa this tax year or perhaps for the first time, it could be a good option. Just remember that you can’t open two cash Isa accounts in the same tax year, even just yet.

In terms of fees, although Chip’s new instant access Isa comfortably beats the average fee of 3.32 per cent, according to Moneyfacts, it is still beaten by 10 other cash Isa providers.

However, many of them come with one or two drawbacks.

For example, Coventry Building Society’s Four Access Isa at 5.05 per cent limits savers to four free withdrawals a year.

Similarly, the MoneyBox 5.09 per cent cash Isa includes a 0.94 per cent bonus rate for the first 12 months and limits savers to three free withdrawals a year.

Zopa Bank is currently offering another great, easy-to-access cash Isa offer.

Its Cash Isa offers 5.08 per cent, including a 0.5 per cent bonus rate until 6 April.

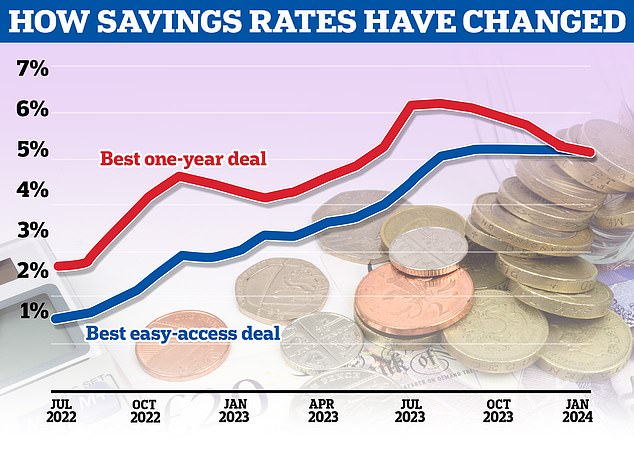

Savings rates peaked above 6 percent, but have fallen sharply since fall

That said, the Zopa smart Isa is a hybrid cash Isa, combining easy access and fixed-term functionality under one roof.

It also allows savers to transfer from another Cash Isa provider, which is a big plus.

At a time when savings rates have fallen from their summer highs and there is speculation about when the Bank of England will start cutting the base rate, savers may prefer to have this option in one app.

The best fixed-rate cash deals are now just under 5 percent. In August, NatWest was offering 5.7 per cent on a one-year fix and 5.9 per cent on a two-year fix.

For savers, the question is whether they should take the opportunity to stockpile rates and lock them near 5 percent now, before they’re all gone.

At the moment, the best easy-to-access rates are above the best fixed-rate deals, but these rates are variable and could therefore change quickly if the Bank of England starts cutting the base rate.

Last week, the Bank of England again kept the base rate at 5.25 percent, remaining at the level it has been at since August last year.

Read: When will interest rates fall? Forecasts on when the base rate will drop

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.