Table of Contents

Business leaders have criticised Rachel Reeves after she abandoned a number of key infrastructure projects in a bid to balance the books.

The Chancellor of the Exchequer told MPs yesterday that the Government will scrap several transport projects, including the A303 tunnel at Stonehenge, as well as improvements to the A27 Arundel bypass in the south-east.

Boris Johnson-era plans to reopen old rail lines also came under fire.

“If we can’t afford it, we can’t do it,” Reeves said.

The Chancellor of the Exchequer is trying to plug a £22bn black hole in the public finances left by the Conservatives. She accused the Conservatives of leaving the government’s accounts in an “even worse” state than she feared.

Deleted: The Chancellor told MPs the Government will scrap several transport projects, including the A303 tunnel at Stonehenge (pictured)

The cuts to the transport project will save the public purse £785m, Reeves added.

But business leaders have warned the move is “out of step” with Labour’s ambitions to grow the UK economy and invest in the future.

Rain Newton-Smith, head of the CBI, warned that Labour must avoid “taking a short-term view on critical infrastructure projects”.

“The government cannot afford to take a step back from its core mission of achieving the long-term sustainable growth the country needs,” he said.

Sam Richards, head of pro-growth campaign group Britain Remade, added that infrastructure cuts carried significant risks.

“Keir Starmer has made boosting economic growth and turning Britain into a clean energy superpower the two core missions of his government, but neither will be achieved if the clean infrastructure projects that drive the economy are delayed or cancelled,” he said.

Shadow Chancellor of the Exchequer Jeremy Hunt has questioned Reeves over her claims of a “black hole” and accused her of laying the groundwork for tax rises.

The Budget, due on October 30, will be “the biggest betrayal in history by a new chancellor”, Hunt added.

Paul Johnson, director of the Institute for Fiscal Studies research group, said the investment cuts “fit a little bit poorly” with Labour’s growth agenda.

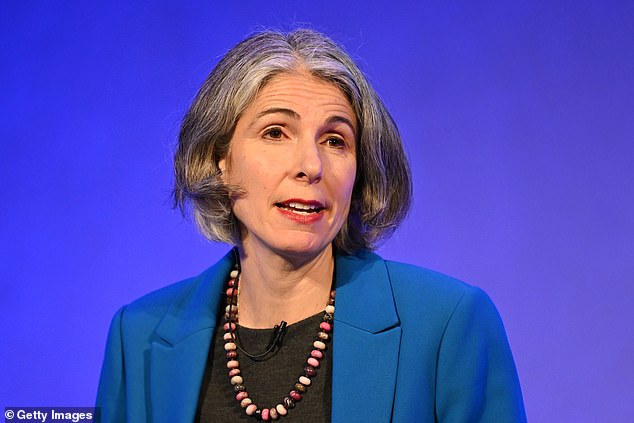

Rain Newton-Smith (pictured), head of the CBI, warned that Labour must avoid “taking a short-term view on critical infrastructure”.

The government has pledged an extra £9bn of spending to boost public sector pay, with junior doctors set to receive a 22 per cent pay rise to prevent further strikes.

Julian Jessop, a researcher at economics at the free-market think tank the Institute of Economic Affairs, warned that public sector pay rises would likely mean cuts in infrastructure spending.

“This is not a good image for a government that claims to prioritize growth,” he said.

And in a further blow to investment, Reeves revealed there was “£1bn of unfunded transport projects that had been committed to next year”.

Transport Secretary Louise Haigh has been tasked with reviewing these commitments.

Mr Reeves told MPs: “Ms Haigh has agreed not to go ahead with projects that the previous government refused to publicly cancel despite knowing full well they were unaffordable.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.