Table of Contents

When Mick Dillon looks for promising companies to add to the Brown Advisory Global Leaders fund he co-manages, his starting point is not the earnings they generate or the value they offer to shareholders.

Instead, think about your customers first.

“We look at how a company helps its customers – how it changes their lives or makes their work easier,” he says.

‘Economic theorists may disagree, but the most important person is not the shareholder, because if you don’t have a customer, you don’t have a business.’

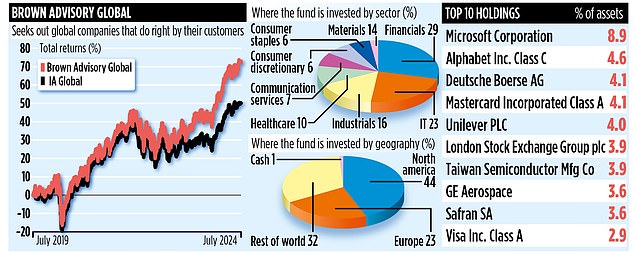

The result is a portfolio of 30 to 40 companies from various sectors, with major holdings including Microsoft, Alphabet (Google’s parent company) and Deutsche Boerse, the German stock exchange.

The fund, which was launched in 2015, has $3.06bn (£2.38bn) of assets under management.

Dillon and his co-manager Bertie Thomson prefer to buy and hold for the long term. Nearly half of the current holdings have been in the portfolio since its inception.

So they think long and hard before they buy, making sure they find companies at the right price. Often, that means passing up companies with great potential because they cost too much to fit their strategy.

“We want to get double-digit returns,” Dillon says. “The reason we’re aiming for that goal is that if we can compound our investors’ money at 10 percent a year, in seven years we’ll have doubled it. That’s a very high hurdle, which means we’re missing out on a lot.”

However, sometimes it’s just a matter of waiting for the stock price to drop and then taking advantage of it.

A similar opportunity arose earlier this year when animal health company Zoetis suffered a drop in its share price.

The company produces a drug that offers pain relief to dogs with osteoarthritis, but its share price fell after reports that some animals suffered side effects.

A clinical study showed it was safe with a low incidence of side effects, says Dillon, a dog lover for whom the company’s appeal was obvious.

“Of course it’s sad if your dog is one of those affected, but most animals enjoy fantastic results. We jumped at the chance to buy it.”

The fund’s long-term focus allows Dillon and Thomson to look at the short-term issues that distract some investors from seeking opportunities that may take some time to bear fruit.

That is why, during the pandemic, when international air travel came to a standstill, they doubled their investment in aircraft engine supplier Safran.

“We asked ourselves whether the circumstances that were affecting earnings would still be in place in five years and concluded that they would not,” says Dillon. “That’s why we were able to buy when, in the short term, it seemed like a surprising decision.”

The fund has returned 12.8 percent over five years, outperforming its benchmark index of global companies’ 11.7 percent return.

Dillon and Thomson are obsessed with behavioral investing and manage their own biases to ensure they don’t lead to bad decisions.

They remain alert to the endowment effect, in which people place greater value on things they already have than on things they don’t have.

They also protect against loss aversion, when people are willing to take more risks to avoid a loss than to make a gain.

Each quarter, the couple meets with a coach to discuss their successes and failures and analyze their processes. “This helps us learn from our mistakes and constantly improve,” Dillon says.

The fund’s current commission is 0.88 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.