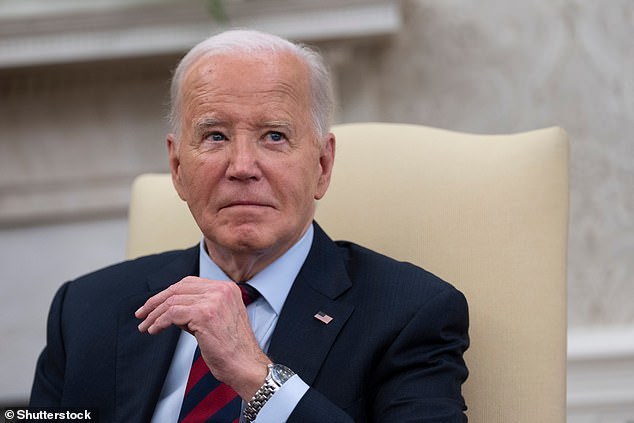

Joe Biden’s student debt relief plan suffered a major blow Monday when two federal judges partially blocked a measure of a plan that is costing the nation $160 billion.

On Monday, two federal judges in Kansas and Missouri sided with several Republican-led states and blocked the Democrat from moving forward with a key student debt relief initiative.

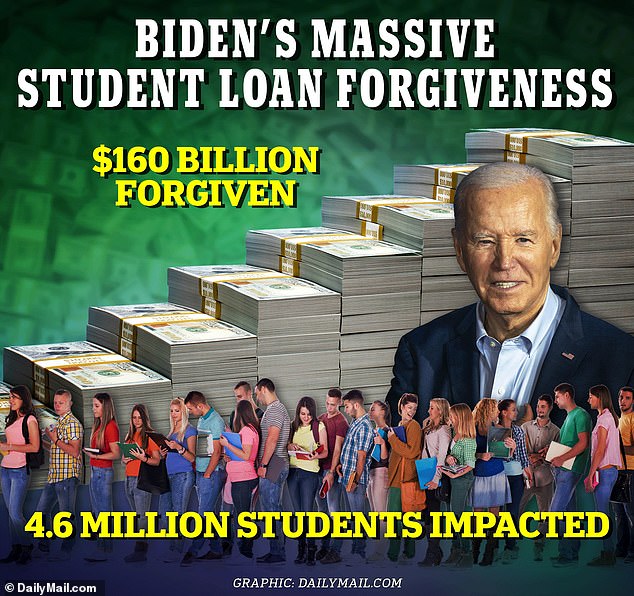

In total, the Administration has already approved nearly $160 billion in aid to nearly 4.6 million borrowers.

U.S. District Judge Daniel Crabtree in Wichita, Kansas, blocked the U.S. Department of Education from proceeding with parts of a plan that was set to take effect July 1 and was designed to reduce monthly payments and speed up loan forgiveness for millions of Americans.

It ruled shortly before U.S. District Judge John Ross in St. Louis, Missouri, issued a preliminary injunction barring the department from granting further loan forgiveness under the administration’s Savings for a Valuable Education (SAVE) Plan.

Joe Biden’s student debt relief plan suffered a major blow Monday when two federal judges partially blocked a measure of a plan that is costing the nation $160 billion.

The SAVE plan is intended to tie monthly payments to the borrower’s income and family size.

This measure has already been used by eight million people, and more than half with payments reduced to $0, according to CNN.

The plan was devised by the Biden administration after the Supreme Court halted its initial loan forgiveness program.

As part of the rulings, the White House must stop canceling federal student debt for enrollees.

Biden and the Department of Education have not yet commented on the rulings.

The lawsuit picks up a court showdown between the Biden administration and Missouri, which was a central figure in the Supreme Court case that overturned the Democratic president’s first attempt to cancel a loan last year.

So far, Biden has provided $160 billion in student loan forgiveness to 4.6 million borrowers.

In that case, the Supreme Court determined that loan discharge would harm Missouri because of its affiliation with a quasi-state loan servicing company, MOHELA, which was at risk of losing revenue generated by federal student loans.

The new lawsuit makes a similar argument. Biden’s new SAVE Plan accelerates an existing path to loan cancellation, which the lawsuit claims would deprive MOHELA – the Missouri Higher Education Loan Authority – of “up to 15 years in servicing fees.”

Arkansas, Florida, Georgia, North Dakota, Ohio and Oklahoma also joined the lawsuit.

Congress created income-driven repayment plans in the 1990s to help borrowers who were struggling to make their student loan payments.

Those plans limited payments based on the borrower’s income and promised to pay off any remaining debt after 20 or 25 years.

In addition to the damage to MOHELA, the lawsuit alleges that Biden’s plan makes it difficult for states to hire and retain employees.

The repayment plan is so generous, according to the lawsuit, that it undermines the public service loan forgiveness program, which allows borrowers to pay off student loans after 10 years of working in public service positions.

It’s an important recruiting tool for states, the lawsuit says: Of 13 law school graduates hired by the Missouri attorney general’s office last year, nearly all said public service loan forgiveness influenced their decision. to work in the public sector.

“However, once the final rule takes effect, PSLF will not be as attractive compared to other income-based repayment programs,” the lawsuit says. “Their comparative advantage will shrink or disappear completely.”

The states point out that more than half of the plan’s borrowers pay nothing. ‘This is not a student loan program. It is a grant program that Congress never authorized,’ according to the lawsuit.

Combining student loans into one large federal debt consolidation loan is a necessary step for graduates with private loans to qualify for forgiveness programs.

Additionally, a key factor in determining forgiveness is how many years Americans have been actively paying off their loans.

Depending on the program, this could be ten or 25 years, so having a complete record may also bring them closer to the threshold of forgiveness.

“The Department is working quickly to ensure that borrowers get credit for each month they have legitimately earned toward forgiveness,” said U.S. Deputy Secretary of Education James Kvaal.

As college costs skyrocket, more students are turning to loans to finance their degrees. But millions are struggling to get their money back in the face of interest that keeps the total high even as payments are made.

This is a developing story.