A majority of voters say they support slapping a 10 percent tariff on all imports, an exclusive new poll finds, in a boost to President Donald Trump.The United States’ plan to reduce American dependence on foreign producers.

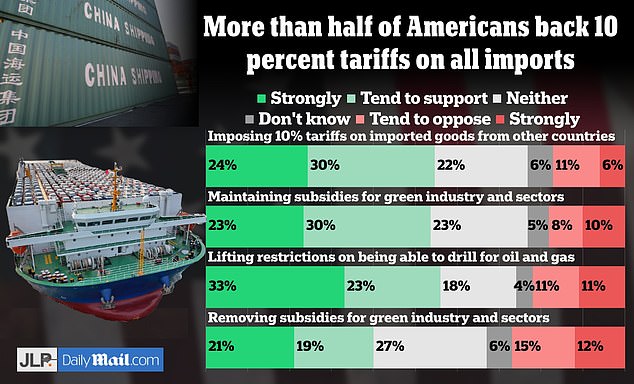

According to the latest JL Partners/DailyMail.com 2024 poll, 24 percent of likely voters strongly support the policy proposal, while another 30 percent tend to support it.

Only six percent strongly oppose imposing 10 percent tariffs on all imports, while 11 percent tend to oppose it.

It shows how perceptions about tariffs have changed in recent years, as fans of the former president favor populist and protectionist sentiments in the United States.

But economists warn that such a move would lead to higher costs for all Americans as the country is still plagued by persistent inflation.

A majority of likely voters support Trump’s proposal to impose a 10 percent tariff on all imports, according to the new poll of 1,000 likely voters. Margin of error: 3.1 percent

Donald Trump proposed a 10 percent tariff on all imports to the US last summer and has actively promoted the imposition of tariffs while running for president.

‘Voters are not in the details of the economy. For them, it’s instinctive: Protecting the United States and putting in tariffs if other nations don’t play fair is a popular proposition,” said James Johnson, co-founder of JL Partners.

“European capitals and businesses may be trembling at the idea of Trump 2.0 on tariffs, but the American people welcome the policy.”

The poll examined the opinions of 1,005 likely voters on March 21. It has a margin of error of 3.1 percent.

Speaking to CNBC earlier this month, Trump declared, “I’m a big believer in tariffs.”

“I fully believe in them economically when other countries take advantage of you,” the Republican presidential hopeful told Squawk Box in an interview.

The comments came after he first proposed 10 percent tariffs on all imports last year.

“When companies come in and sell their products in the United States, they should automatically pay, let’s say, a 10 percent tax,” Trump said at the time in an interview with Fox Business. “I like 10 percent for everyone.”

Trump has argued that the tariffs target China, but a blanket 10 percent tariff would not only affect imports from China.

While the United States receives the largest amount of its imported goods from China, the country only supplies 16.5 percent of total imported goods, according to the U.S. Trade Representative’s office.

Some of the other largest importers from the United States are Mexico, Canada, Japan and Germany.

Trump has proposed 10 percent tariffs on all imports and has said he is considering imposing 60 percent tariffs on Chinese goods.

The Tax Foundation, a center-right organization, concluded that a 10 percent tariff would raise taxes on Americans by more than $300 billion a year and warned that, if imposed, the tariffs would lead to retaliatory tax increases. on American exports.

“Americans would see higher prices for a variety of goods that are imported across the border, whether they are consumer goods or whether it is a company that is trying to purchase intermediate inputs that are used to produce its final products,” said Erica York, chief economist at the Tax Foundation.

It estimated that a 10 percent tariff on imports would reduce the size of the economy by 0.7 percent and eliminate more than half a million jobs.

Including retaliatory tax increases, the measure would shrink the U.S. economy by 1.1% and threaten more than 825,000 jobs, the Tax Foundation estimated.

‘Often when we see Trump talk about this proposal, he says he’s going to tax foreign companies. It seems like if you tax foreign business, you get less foreign business and more domestic business, but that’s not how tariffs work at all,” York said. “They are taxes paid by the company in the United States that imports the products.”

A separate analysis of the 10 percent tariff proposal by the Democratic-founded Center for American Progress Action Fund found that it would amount to an annual tax increase of about $1,500 for the typical U.S. household.

That would include a $90 tax increase on food, a $90 tax increase on prescription drugs and a $120 tax increase on oil and petroleum products.

Trump speaking before signing a memorandum imposing tariffs on products from China in March 2018

Container ships in China in 2018 when Trump proposed additional tariffs, escalating the trade dispute with the country. In September of that year, his administration imposed tariffs on $200 billion worth of goods from China. Additional tariffs were also imposed in 2019.

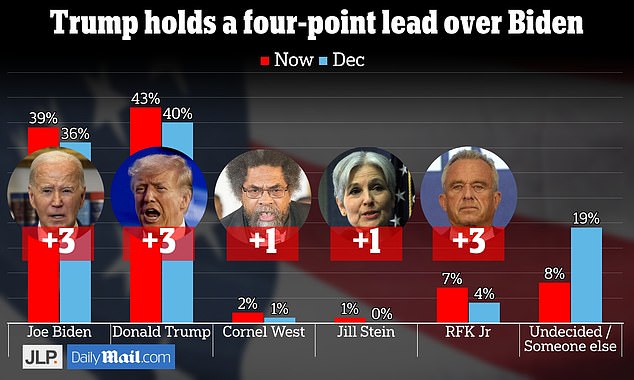

JL Partners also surveyed 1,000 potential voters from March 20 to 24 via landline, mobile, SMS and apps. It found that Trump had a four-point lead over Biden.

During his four years in office, Trump imposed a series of tariffs on China, Mexico and the European Union, including a 25 percent tariff on steel and a 10 percent tariff on aluminum.

In total, the tariffs imposed during the Trump administration represented an $80 billion tax increase on $380 billion in imports, according to the Tax Foundation analysis.

Multiple studies found that the measure made it difficult to do business in the United States because it raised input costs for manufacturers.

Meanwhile, the Biden administration maintained most of the Trump administration’s tariffs.

23 percent strongly support maintaining such subsidies and 30 percent tend to support them. Only 10 percent strongly oppose maintaining subsidies, while 8 percent tend to oppose it.

At the same time, the majority also supports lifting restrictions on the ability to drill for oil and gas. 33 percent strongly support lifting restrictions, while 23 percent tend to support lifting such restrictions.

In late 2023, the United States broke its record for the highest crude oil production in the country’s history when weekly oil production reached 13.3 million barrels per day, according to the US Energy Information Administration.

Since then, oil production has remained near that record weekly production level.