<!–

<!–

<!–

<!–

<!–

<!–

The Federal Reserve posted a record loss of $114.3 billion in 2023 as it struggled to manage its short-term interest rate target.

Last year’s loss came after net income of $58.8 billion in 2022, the agency said.

Officials have repeatedly emphasized that negative net income does not impede their ability to operate or conduct monetary policy as usual.

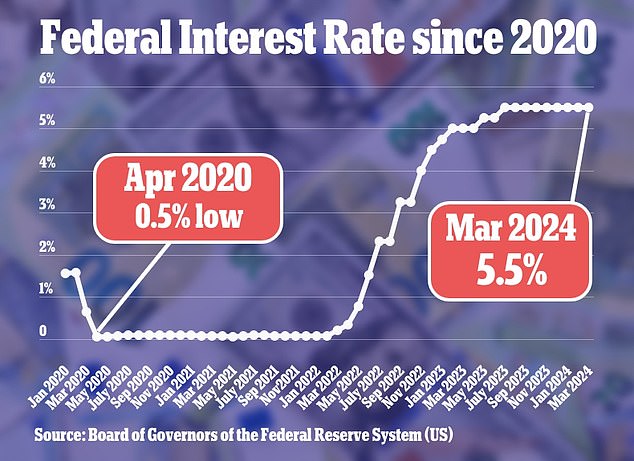

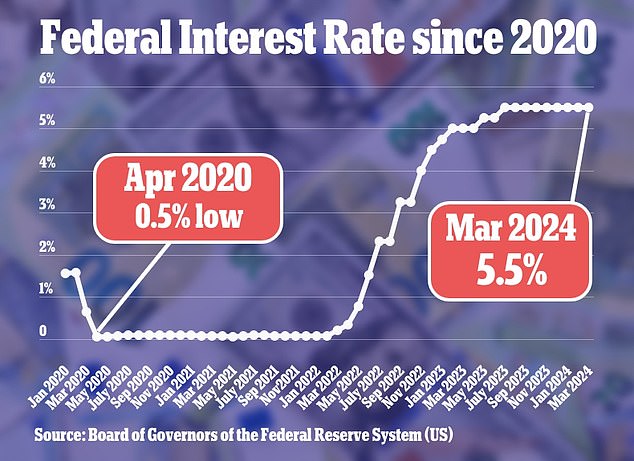

It comes after the Federal Reserve once again opted to keep interest rates steady at their current 23-year high during its March meeting.

The Federal Reserve’s benchmark funds rate, which has a knock-on effect on mortgages and credit card loans, will remain at its current level of between 5.25 and 5.5 percent, where it has been since last July.

In addition to the decision, authorities planned cuts of three-quarters of a percentage point by the end of the year.

The Federal Reserve posted a record loss of $114.3 billion in 2023 as it struggled to manage its short-term interest rate target. In the photo: Fed Chairman Jerome Powell at the Fed’s March meeting.

Last year’s loss came after net income of $58.8 billion in 2022, the Federal Reserve said.

The figures released were an audited count following preliminary figures reported earlier this year.

By law, the Federal Reserve gives all profits after covering operating expenses to the Treasury.

The Federal Reserve earns revenue from the services it provides to the financial system and from interest income on the securities it holds.

It has made significant profits in recent years amid very low rates and large levels of bond holdings.

The Federal Reserve’s decision to aggressively raise the federal funds rate starting in spring 2022 has upended central bank finances.

To cool inflationary pressures, the Federal Reserve raised the target from near-zero levels to its current range of 5.25% to 5.5%.

The Federal Reserve maintains that goal by paying banks, money funds and other financial companies to deposit cash at the central bank, and that means paying substantially more in interest.

The Federal Reserve’s audited interest expenses for banks’ reserve balances reached $176.8 billion last year, $116.4 billion higher than the 2022 level, while interest payments from its reverse repo facility They were $104.3 billion last year, up from $41.9 billion the year before.

Meanwhile, the income the Fed earned from the bonds it holds was $163.8 billion last year, little changed from 2022.

The Federal Reserve voted today to hold interest rates steady for the fifth consecutive meeting, but has indicated it will stick with its plans to cut rates multiple times this year.

The Federal Reserve can create money to fund its operations when it faces operating losses, meaning it faces no obstacles to operating. You capture your loss in an accounting device called a deferred asset.

The official level of deferred assets stood at $133.3 billion at the end of 2023. As of March 20, it had risen to $157.8 billion and it is unclear how much it will grow.

When the Fed becomes profitable again, it will use the excess profits to reduce the deferred asset and when it expires, the Fed will begin returning the excess profits to the Treasury again.

Federal Reserve officials have noted that they have returned substantial sums to the Treasury in recent years.

A St. Louis Federal Reserve report last year said it could be years before the Fed can return profits to the government again.