- Renewable energy production falls 15% due to bad weather and plant outages

SSE has maintained profit expectations for the year despite a double-digit drop in its renewables performance as bad weather hampered production.

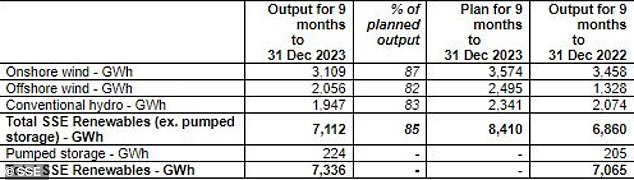

The FTSE 100 power generator and network operator’s renewables output in the first three quarters of its financial year was around 15 per cent below expectations due to “mixed weather”, short-term plant outages and the “rescheduling of flexible hydroelectric production.”

SSE told shareholders on Thursday that it is still on track to achieve adjusted earnings per share of “over 150p”, but with a “narrower range of likely financial results”.

However, it said full-year performance depends on factors such as plant availability, supportive market conditions and “normal” weather during the final quarter, with January continuing to offer “mixed” weather conditions.

The bad weather has also affected the installation of turbines at Dogger Bank A, which is the world’s largest wind farm and partly owned by SSE.

SSE’s total renewable energy production during the first nine months of the year was 7,336 Gigawatt hours (GWh), which is still higher than the previous year’s 7,065 GWh, as its offshore wind and pumped storage operations offset a decline in onshore wind and conventional hydropower.

The bad weather has also affected the installation of turbines at Dogger Bank A, which is part of the world’s largest wind farm and partly owned by SSE.

It said: “Following notification of increased vessel unavailability in the coming weeks, there is an increasing possibility that full operations will not be achieved until 2025, although this is not expected to materially change the outcomes of the project.”

“The company is working closely with its supply chain partners to improve current turbine installation rates, and a further update on progress will be provided in May with the release of FY24 results.”

The renewable energy sector has also been battling sharp cost increases and supply chain issues hampering wind turbine production, with major players in the sector including BP and Orsted recently reporting multibillion-dollar write-downs, huge losses and long delays.

In November, SSE raised capital spending expectations for its net zero program by around 14 percent over five years after half-year profits beat forecasts.

SSE increased its capital investment prospects in its Net Zero Acceleration Program Plus program to £20.5 billion, up from the previously allocated £18 billion.

SSE renewable energy production was higher year after year but lower than expected

Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said renewable energy production issues are unlikely to derail the SSE’s green transition.

And he added: ‘The transition of the ESS to become a renewable energy powerhouse continues apace.

‘The group’s five-year investment budget remains £20.5bn, which is higher than its current market value. Around 90 percent of this budget has been allocated to building its electricity networks and renewable energy infrastructure, driving progress towards a greener future. ‘

Elsewhere, the group also reported weaker-than-expected performance in its thermal division as a result of lower spark spreads (the difference between wholesale electricity prices and the cost of production) and market volatility.

But the group also praised an “increasingly supportive law enforcement environment,” and SEE highlighted “progress in developing routes to market” for carbon capture and storage, hydrogen and “long-range energy storage projects.” duration”.

Chief financial officer Barry O’Regan said: “The strength of our balanced business mix and the growth opportunity it provides are aligned with a policy environment that increasingly recognizes the essential role that renewables, grids and networks will play. electricity and flexible energy in the energy system of the future”. .

“Our long-term strategy remains unchanged and will deliver sustainable value for shareholders and society.”

ESS actions They were down 2.1 per cent to 1,618.5 pence in early trading, taking 2024 losses so far to 11.9 per cent.

Commenting on SSE’s performance, Quilter Cheviot equity research analyst Tom Gilbey said: ‘SSE has reaffirmed its confidence in its financial performance and growth prospects, despite facing some headwinds in its renewable and thermal businesses. .

‘It is pleasing that the company has welcomed the supportive policy environment in the UK, which could allow it to take advantage of more opportunities in emerging technologies such as CCS, hydrogen and energy storage.

‘SSE’s valuation reflects its attractive dividend yield and integrated business model, which provides resilience and diversification. We believe that the ESS is well positioned to capitalize on the energy transition and deliver long-term value to its stakeholders.”