Table of Contents

The price of gold hit a record high as hopes rise for a US rate cut this summer, following weaker-than-expected economic data released last week.

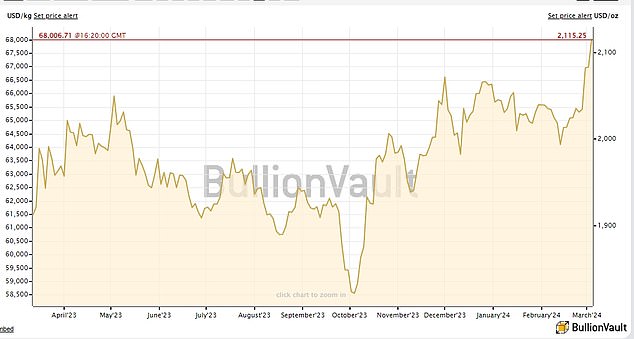

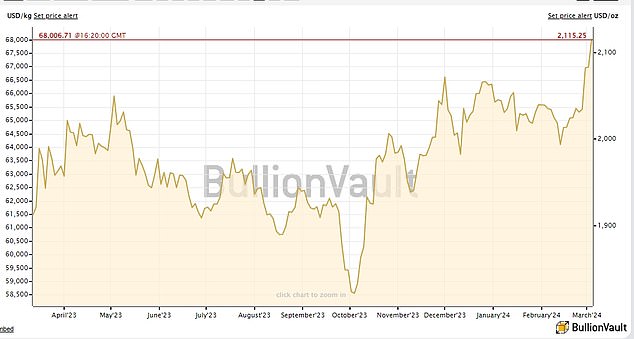

The price of the precious metal rose to $2,114 (£1,664) an ounce on the spot market, after steady increases over recent weeks.

This follows the release of US economic data last week that raised hopes that the Federal Reserve would deliver its first rate cut of the year in June.

All that glitters: Gold price soars on hopes of interest rate cuts this summer

Continued geopolitical and economic tensions are also pushing investors to seek safe haven assets.

We look at what’s behind the recent rise in the price of gold and how investors can get exposed to it.

Why is the price of gold rising?

On Monday, gold hit a new record of $2,110 after weaker-than-expected U.S. economic data sent the dollar and Treasury yields tumbling last week.

The precious metal tends to underperform in high interest rate environments because it does not generate income for investors.

Instead, investors tend to opt for bonds and cash, which typically offer better returns.

Jason Hollands, CEO of Bestinvest, said: “As a zero-yield asset class, holding bullion has an opportunity cost when US or UK Treasury yields are rising, but “Government bonds have peaked and are likely to retreat further as they go.” “As rate cuts approach, this headwind for gold has eased.”

Investment bank TD Securities said investors were “hesitant” about gold at the moment.

US economic data and elevated inflation readings have delayed the Federal Reserve’s dovish turn, and many analysts now predict it could delay cutting interest rates.

A harder landing for the United States could spark a flight to safe haven assets, including gold.

The price of gold during the past year. Source: BullionVault

However, expectations that the economic backdrop will begin to moderate over time mean that many money managers are building long positions in gold ahead of any rate cuts.

Beyond the US economic data, the biggest driver of gold’s recent rise appears to be its role as a safe haven asset during political and economic uncertainty.

Gold prices have remained above the $2,000 per ounce level since December amid geopolitical tensions, exacerbated by ongoing risk in Ukraine and the Middle East.

Axel Rudolph, senior market analyst at IG, says gold had risen “on flight flows to safety amid a speech by Putin in which he mentioned that Russian nuclear weapons are capable of hitting Western targets and that China , the world’s second largest global importer, continues to buy the precious metal, according to a Reuters article.

Hollands adds: ‘In addition, a large number of countries will go to the polls in 2024, including the US presidential election in November, adding a degree of uncertainty to the outlook for fiscal policy.

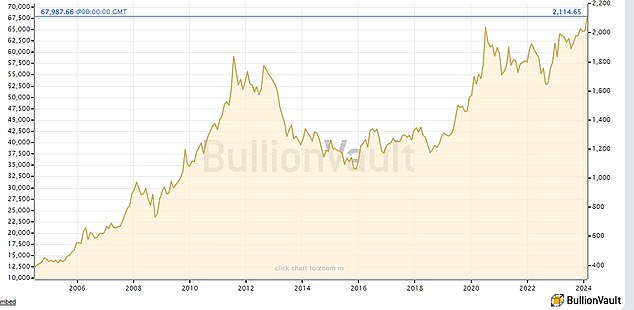

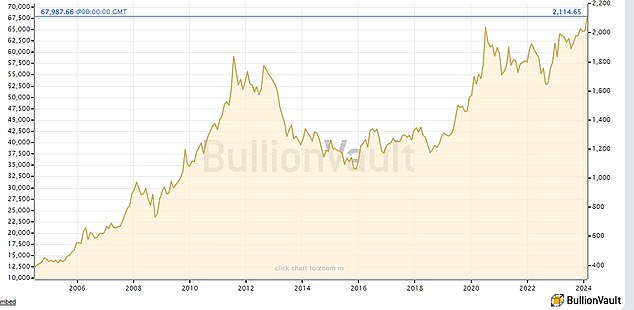

The price of gold over 20 years. Source: BullionVault

Will gold continue to rise?

While gold could be considered a safe asset during political and economic uncertainty, sustained interest rates could prevent the price from rising further.

ING commodities strategist Ewa Manthey says: ‘We believe the Fed’s wait-and-see approach will keep the rally in check. “We expect prices to average $2,025 per ounce during the first quarter.”

However, the bank predicts that gold will trade higher for the rest of the years.

‘We expect prices to average $2,150 per ounce in the fourth quarter and $2,081 per ounce in 2024, assuming the Federal Reserve begins cutting rates in the second quarter of the year and the dollar weakens.

‘Downside risks revolve around US monetary policy and the strength of the dollar. “The ‘higher for longer’ narrative could lead to a stronger dollar for longer and weaker gold prices.”

Capital Economics’ Kieran Tompkins predicts that “the price of gold will rise in each of the next two years, driven by the Federal Reserve cutting rates a little faster than markets are quoting,” falling U.S. Treasury yields and a weakening U.S. dollar.”

How to invest in gold

There are a few ways to get exposed to gold.

You can invest in gold through Exchange Traded Commodities (ETC), which track the price of gold and are no different from holding a passive investment in a stock index.

ETCs are publicly traded and provide investors with exposure to the price of gold, backed by physical holdings of gold bullion held in secure vaults.

Hollands first choice is the Invesco physical gold, etc.which has a current charge of 0.12 per cent and is collateralized by gold bullion held in the vaults of JP Morgan Chase Bank in London.

Bestinvest also has a roughly 5 percent allocation to gold in most of its ready-made managed portfolios.

You can also gain exposure to gold through multi-asset funds that hold a certain portion of your portfolio in gold-related investments.

Finally, you can invest in gold by purchasing physical bars or coins, which can be stored at home or kept in a secure vault, such as the Royal Mint, for a fee.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.