Table of Contents

Autumn styles are in stores and the fight to be on-trend intensifies on the High Street. John Lewis, Marks & Spencer, Next and Primark are all battling to increase their share of the £71bn-a-year market.

It arrives with a new focus on British style or #Britishcore, as it is known on Tik Tok. And Oasis’ reunion tour has sparked interest among a new generation in the band Cool Britannia’s signature 90s swagger.

As global tastes merge, UK street style appeals beyond these shores. This is reflected in the growth of overseas online sales for Next, which recently announced impressive figures.

The retailer, which could generate £1bn of profits for the full year, already has a 6.8 per cent share of the UK clothing market, as measured by analysts Global Data.

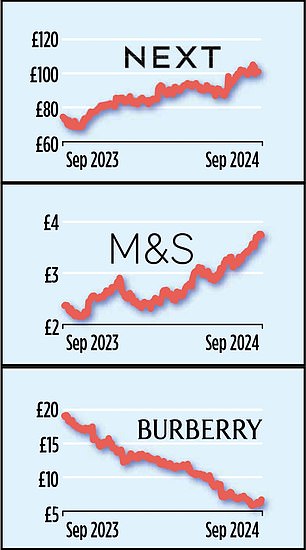

Fall from grace: Pessimists fear British fashion house Burberry will succumb to a US bid after its shares fell almost 50% this year.

The chain, valued at £12.8 billion on the stock market, has secured this position thanks to its logistics infrastructure, which optimizes the customer experience, both online and in stores.

Next, which offers both its own ranges and third-party brands, now plans to take advantage of this advantage to increase its share of the pie by targeting wealthier shoppers.

It ties into a key trend this fall: women want to dress up for the office again, with heels and pencil skirts becoming popular again. It translates into elegant but avant-garde advertising campaigns.

Big Autumn Energy is the slogan of the advert launched this month by M&S, which has won over a new, younger clientele thanks to updating its ranges and introducing more third-party brands.

There is also a new focus on British craftsmanship. The £350 double-breasted coat from M&S’s Jaeger collection is made from tweed spun in Guiseley, near Leeds, at the Abraham Moon mill, a brand established 185 years ago that provides fabrics for clothing and furniture.

“This turnaround strategy has returned M&S to the forefront of retail,” says retail analyst Wizz Selvey.

M&S shares are also hot, rising 60 per cent over the last year to a seven-year high of £3.76.

John Lewis, which aims to be seen as a major style contender, has launched a series of adverts produced by Saatchi & Saatchi. The campaign emphasizes the retailer’s heritage but also its style credentials.

The previously staid chain of stores now sells fashion brands such as The Kooples. It has also unveiled a collaboration with the avant-garde Awake Mode, worn by models Kendall Jenner and Rosie Huntington-Whiteley. These luxury pieces should find an audience.

Next said last week that shoppers were buying fewer but better quality items, which is good news for Reiss, the stylish tailoring group, which is 72 percent owned by Next.

However, despite evidence that some customers want to buy less and better, the shadow of Chinese online ultra-discount giant Shein looms over the High Street in all market segments.

So much so that Primark, the clothing division of Associated British Foods, has been forced for the first time to trial a click and collect option, where online orders are collected in stores.

Selvey says: ‘Despite being a champion of budget fashion for years, Primark long resisted the move to e-commerce. The question is: is it too late to go digital?

Shein’s stock market debut, in New York or London, should reveal figures that illustrate how much of the British market it now controls. At last count, Primark had 6.1 per cent, but Shein may have eroded that figure.

The battle for dominance on the High Street clashes with disarray at eminent British fashion house Burberry. Its fall from grace is reflected in a 49 percent drop in its shares this year, although there was a rebound on Friday following China’s promise to revive its economy.

Optimists say the combination of British designer Daniel Lee and new American boss Josh Schulman could revive Burberry’s glory days in the 2000s. Pessimists fear Burberry’s independence is threatened and it will succumb to a US bid. .

One frequently cited name is Schulman’s former employer, Tapestry, which encompasses brands like Coach. In the UK, Mike Ashley’s Frasers has been mentioned, but it is unclear if the retailer is interested.

Liam Gallagher, known for his love of parkas in the 90s, is the leader of the Stone Island brand, owned by the Italian luxury brand Moncler.

Perhaps Burberry can regain its mojo if it is seen wearing its coats. But at £1,990 for a nylon parka with faux fur trim, only well-heeled Oasis fans can afford it.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.