As mortgage rates continue to fall, it is now cheaper to buy a home than to rent in some of America’s largest cities.

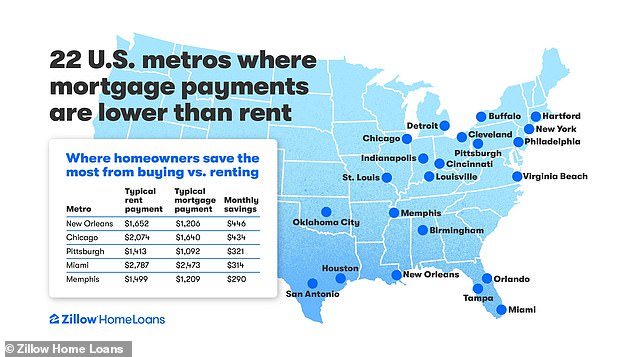

A monthly mortgage payment is less expensive than rent in 22 of the 50 largest metropolitan areas, according to a new analysis by Zillow.

Mortgage rates have fallen to their lowest level since February 2023, significantly reducing homeowners’ monthly payments.

New Orleans and Chicago offer the best value for homebuyers, with monthly savings of more than $400 on a typical mortgage payment compared to renting.

“This analysis shows that homeownership may be more attainable than most renters realize,” said Zillow senior mortgage lending economist Orphe Divounguy.

New Orleans offers one of the best deals for homebuyers, with monthly savings of over $400 on the typical mortgage payment compared to renting.

In New Orleans, homeowners can save nearly $450 a month by paying a mortgage instead of renting, according to Zillow.

In Chicago, renting an apartment for $2,074 a month is the norm, but the monthly mortgage payment is $1,640.

This represents a savings of $434 per month for homeowners.

Meanwhile, in Pittsburgh, Americans can save $321 a month by paying the typical mortgage payment instead of the average rent payment.

In Miami, homeowners could save $314 a month, or $290 in Memphis.

These savings are even more surprising when you consider that homes for sale tend to be larger than typical rental homes, Zillow noted.

Mortgage payments are also lower than rent in Cleveland, Detroit, Tampa, Oklahoma City, Houston, Cincinnati, Orlando and Philadelphia, among other major cities.

Homeowners even have an advantage in New York City, saving $72 a month on a mortgage compared to renting.

But despite falling mortgage costs, coming up with a down payment remains a major barrier for many prospective homeowners, in addition to the additional costs that come with purchasing a property.

The study compared the cost of rent and mortgage payments, before taxes and insurance, and assuming a buyer can afford a 20 percent down payment.

“Coming up with a down payment remains a major hurdle, but for those who can afford it, homeownership can mean lower monthly costs and the ability to build long-term wealth in the form of home equity, something you miss out on as a renter,” Divounguy said.

‘With mortgage rates falling, it’s a good time to look at how your ability to pay has changed and whether it makes more sense to buy rather than rent.’

In Chicago, renting an apartment for $2,074 a month is the norm, but the monthly mortgage payment is $1,640.

In Pittsburgh, Americans can save $321 a month by paying the typical mortgage payment instead of the average rent payment.

Mortgage rates have now fallen to their lowest level since February 2023, significantly reducing monthly payments for homeowners.

“With mortgage rates falling, it’s a good time to look at how your affordability has changed and whether it makes more sense to buy than rent,” said Zillow senior mortgage economist Orphe Divounguy.

Mortgage rates have fallen more than half a percent in the past six weeks as expectations of a rate cut by the Federal Reserve this month rise.

The average 30-year fixed mortgage rate is now 6.20 percent, according to Freddie Mac’s latest data as of Sept. 12.

Although interest rates do not directly affect mortgage rates, mortgage borrowing costs tend to fall when benchmark borrowing costs fall.

While rental growth has slowed from pandemic-era highs, prices continue to rise.

The typical rent is 3.4 percent more expensive than a year ago and nearly 34 percent more expensive than before the pandemic, according to Zillow.

Meanwhile, the housing market offers opportunities for buyers heading into the fall, but high property prices are still discouraging some Americans.

Beyond monthly rent or mortgage payments, there are additional costs to both renting and homeownership that need to be considered, Zillow noted.

Homeowners pay taxes, insurance and utilities on a monthly basis and must be prepared to face ongoing maintenance costs.

Renters also typically require insurance and often pay extra for parking, pets and utilities.