Table of Contents

I was one of the unlucky people who had to refinance my mortgage after the 2022 mini budget.

I ended up taking a two-year fixed rate of about 6 percent on my mortgage with a loan-to-value ratio of 75 percent, in November 2022.

It’s almost time to refinance my mortgage again and I’m noticing that mortgage rates are dropping.

Are they likely to go down further? I really don’t want to be unlucky again and get stuck with a high rate when I could have gotten a cheaper one a few months later.

When should I start refinancing? Would it be better to wait until the last minute to allow more time for rates to fall?

Mortgage Help: In our weekly Navigate the Mortgage Maze column, broker David Hollingworth answers your questions

Or should I consider continuing with my lender’s standard variable rate for a few months, hoping that rates will drop further from their current level?

Is there anything I can do between now and November to ensure I get the best possible rate?

I’m still in the 75 per cent loan-to-value band, have 18 years left on the mortgage term and about £220,000 to pay off.

SCROLL DOWN TO FIND OUT HOW TO ASK DAVID HIS MORTGAGE QUESTION

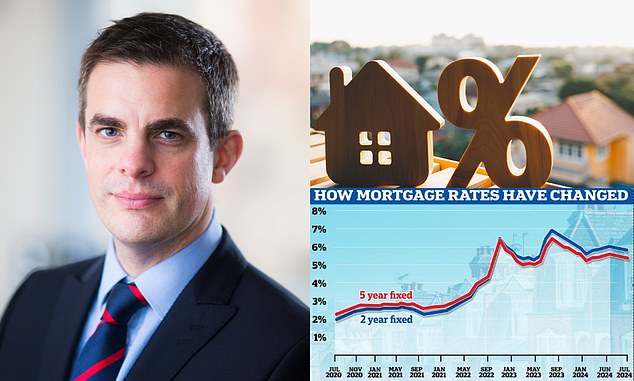

David Hollingworth responds: It seems like a long time since the mini budget sent markets into a frenzy. Expectations that inflation and interest rates would soar caused fixed mortgage rates to follow suit.

When it comes to mortgages, timing is all important, and your deal must have ended at the worst possible time.

Rates rose again last summer, but we are now in a very different situation and the Bank of England’s cut in the base rate in August has led to further falls in fixed rates.

When to refinance a mortgage

The first thing you should do is check when your current fixed rate ends. Many deals are fixed until a certain date, rather than exactly two years after they end.

It would also be worth looking into any early redemption charges (ERCs) that apply during the fixed rate period.

The ERC is usually charged as a percentage of the remaining amount payable on the mortgage, but this can decrease as the fixed rate progresses. In some cases, it might be worth getting out of the current deal early if you can get the money back through a better rate.

Note the date: It’s a good idea to know when your current mortgage renewal is due, and it may not be the exact date you started it.

The shorter the remaining period, the less likely it is that the ERC will be worth incurring, and the numbers need to be done carefully.

You can consider locking in a new rate up to six months before your current deal ends, but since rates have been falling, shopping around three to four months before your deal ends should give you enough time to ensure a smooth switch.

Your advisor will not only review the options available from other lenders, but will also be able to compare them to the offers offered by your current lender.

Some lenders will even allow an ERC waiver in the last three months of the deal, which could allow you to move to a new deal with a lower rating sooner without incurring the penalty.

Should you take the risk of the standard variable rate?

It’s completely understandable that you want to avoid locking yourself in at a point where rates could fall again.

There are no guarantees as to what may happen with interest rates, although the current expectation is for a continued but gradual decline in the base rate.

Therefore, taking a holding position on the standard variable rate (SVR) may seem like an option that could open the door to a better interest rate.

However, lenders’ SVR rates are much higher than the current rates on offer, often well above 8 percent, so I would caution against this approach.

If rates only drop slightly, you could have been paying 4 percent more than you need to for several months, which will offset a small cut in a new deal.

If you want to keep your options open, a tracker agreement may be a better option.

These will have lower fees than an SVR and can be found without any ERCs at any time, so you can switch to a solution when you feel the time is right.

Just keep in mind that if you pay an hosting fee, you may have to pay another fee when switching to a fixed solution.

It’s also worth noting that if your preference is to fix it again and you manage to get a deal early and rates continue to drop, you should still be able to move to the new rate until shortly before the refinance is complete.

So, agreeing to a deal now means you already have something in place, but you can still take advantage of lower rates before you close it.

Protected from rate hikes: Locking in a fixed contract guarantees monthly mortgage payments for a set period of time, but this reader is concerned about locking in a price when rates are falling.

Getting the best mortgage rate

You’ve identified that the loan-to-value ratio range will have an influence and the lowest rates tend to be offered up to 60 percent of LTV – in other words, for those who have 40 percent equity in their home or more.

However, the 75 percent LTV rates you can get will be only slightly higher. Make sure you factor in fees rather than focusing solely on the rate and think carefully about what type of deal suits you best.

Five-year fixed rates are currently lower than two-year rates, but given your concern, you may still want to consider the shorter-term rate if you want the opportunity to review it again in a couple of years.

Navigate the mortgage labyrinth

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.