Baby boomers are investing their savings in Bitcoin, driving the value of the cryptocurrency to its highest level in more than two years.

Younger Americans have been able to purchase Bitcoin for years using smartphone apps like Robinhood and Cash App.

But the approval of the ETF last month made it much more accessible to the less tech-savvy generation, born between 1946 and 1964 and aged between 60 and 78.

Bitcoin ETFs track the price of the cryptocurrency, but they can be bought and sold on traditional stock exchanges, like stocks and other funds.

They mean that retirement savers can now take a position in Bitcoin by rolling those ETFs into their 401(k)s or buying them through old-school brokerages like Schwab.

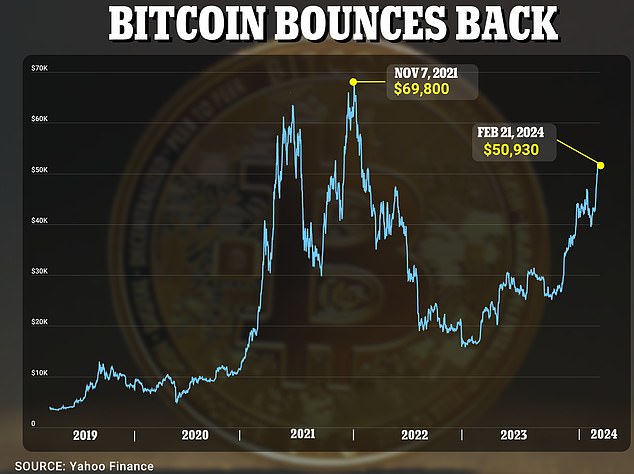

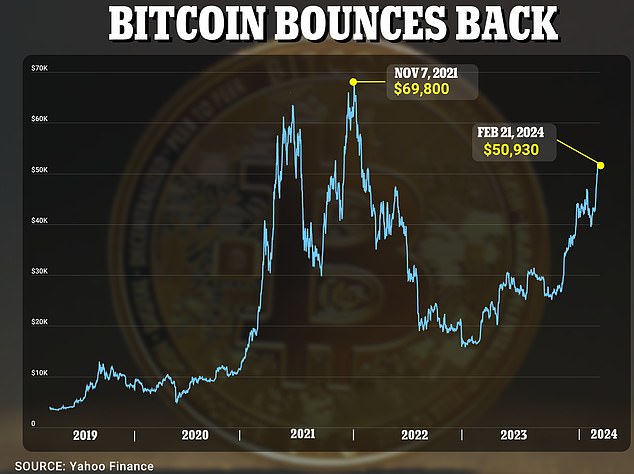

The value of Bitcoin, the flagship cryptocurrency, has risen more than 20 percent over the past month to more than $51,000. That’s less than $20,000 from its all-time high of around $69,000.

Michael Novogratz, CEO of cryptocurrency investment firm Galaxy Investment Partners, said boomers are getting their first easy access to Bitcoin thanks to the ETF’s approval in January.

Bitcoin’s value has risen more than 20 percent over the past month to more than $51,000, nearly $20,000 shy of its all-time high.

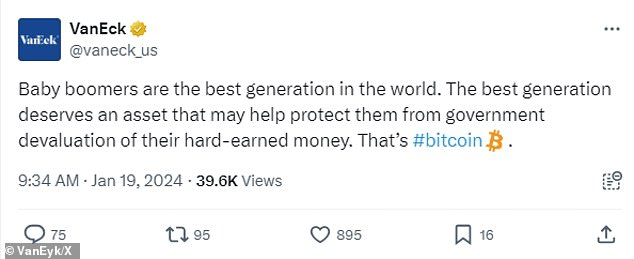

A tweet posted last month by investment firm VanEck, which offers a Bitcoin ETF, described baby boomers as “the greatest generation in the world.”

And since SEC approval on Jan. 11, the ten or so ETFs on the market have attracted net inflows of $5.2 billion so far, according to Bloomberg.

“I don’t think this is going to stop,” said Michael Novogratz, CEO of cryptocurrency investment firm Galaxy Investment Partners. he told CNBC On Wednesday.

“Baby boomers own the majority of the wealth in America and they are getting their first easy access to Bitcoin and they are seeing it through these ETFs,” he said. Boomers own 51 percent of American wealth, according to the Federal Reserve.

He predicted that within six months twice as many financial advisors will be able to recommend Bitcoin products to their clients. And those investments are made for the long term, he said.

After federal regulators approved Bitcoin ETF trading last month, older Americans became prime targets for investment firms looking to grow their funds.

Through clever advertisements and financial planners, Bitcoin has been presented as a futuristic asset immune to government intervention, similar to gold, that can generate long-term returns.

“Gold hasn’t had a great run, partly because of the substitution of Bitcoin,” Novogratz said.

Investment firms VanEck, Bitwise, Wisdom Tree and Grayscale spent approximately $300,000 on television ads that aired during financial segments between Jan. 11 and Jan. 30, the Wall Street Journal reported.

ETFs that began trading after SEC approval last month have attracted net inflows of $5.2 billion so far, according to Bloomberg.

Retirement Savers Can Now Add Bitcoin to Their 401(k)

VanEck tweeted in January: ‘Baby boomers are the greatest generation in the world. The greatest generation deserves an asset that can help protect them from government devaluation of their hard-earned money. That’s Bitcoin.’

Another ad he ran showed a mother asking her son how to invest in Bitcoin. In response, she tells him: “Now it’s easy… There are ETFs.”

“What you will continue to see from us is an effort to try to contextualize digital asset investing for an older generation of investors,” Chris Glendening, head of marketing at crypto company Hashdex, told the Journal. “It’s a long game.”

Novogratz acknowledged that confidence in Bitcoin was still recovering after a crash in mid-2022 that saw its value fall by almost two-thirds.

“Cryptocurrencies scared the hell out of people 18 months ago, so there’s still scar tissue left,” he said. “That said, Bitcoin still ends the year much higher.”