Table of Contents

The government faced its first rebellion on Tuesday when seven MPs voted against maintaining the cap on the two-child benefit.

The policy, introduced by the Conservatives in 2017, caps the amount of Universal Credit given to families with more than two children born after April 2017.

Smaller parties have pushed for the cap to be scrapped, arguing that it pushes more families into poverty.

So what is the two-child benefit cap, why is it so controversial, and what would happen if it were eliminated?

Two-child cap: The benefit cap limits the amount of Universal Credit a family with more than two children can claim

What is the benefit limit for two children?

There has been some confusion about what the two-child benefit limit actually means for parents.

The benefit limit being discussed is independent of the child benefit, which is a payment made for each child you have.

You will receive £25.60 per week for your first child and £16.95 for each subsequent child.

There are some rules for higher earners, meaning that once you earn £60,000, child benefit is clawed back through the High Earner Child Benefit Charge. Once you earn £80,000, you effectively lose child benefit.

We explain how the High Income Child Benefit Charge works.

However, the two-child limit voted on this week relates to what parents can claim through Universal Credit or tax credits.

Low-income families typically receive an extra £3,455 a year in Universal Credit or tax credits for each child they have.

But the two-child limit means applicants will not receive more for a third or subsequent child born after April 6, 2017.

There are some exceptions, including if you have triplets or are responsible for children adopted from local authority care.

You will also be entitled to additional support for each disabled child, regardless of the total number of children in your household.

Confusingly, there is also a maximum amount of benefits you can claim, which affects a range of benefits including Universal Credit, tax credits and Child Benefit, depending on your living situation and where in the UK you live.

Certain benefits, such as carer’s allowance or if you are over state pension age, may not be covered by the benefit limit.

You can check The gov.uk website to see if the benefits you claim are included within the limit.

Eduin Latimer, of the IFS, said: ‘The two-child limit is one of the most significant welfare cuts since 2010 and, unlike many such cuts, it becomes more significant every year as it is extended to more families.

‘It has a particularly large impact on the number of children living in poverty for two reasons: it affects the poorest households the most and, by definition, its effects are concentrated entirely on families with at least three children.’

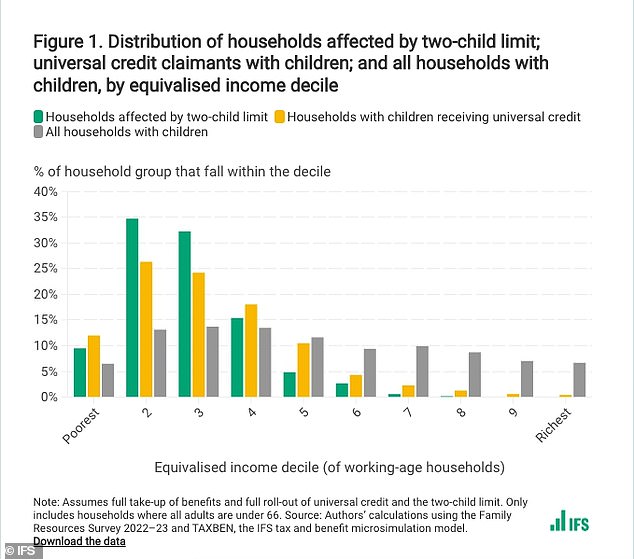

The IFS says the two-child limit affects 23% of households with children in the poorest fifth of the income distribution.

Why is the limit on the two-child allowance controversial?

The two-child limit has been controversial, with both the Liberal Democrats and the Green Party pledging to abolish it in their election manifestos.

Labour has said it will abandon the policy once fiscal constraints allow, but some MPs are pushing for an earlier exit.

The main criticism of this policy is that it pushes more families into poverty and negatively affects single parents.

HMRC figures show that by 2023, half of all families affected by the two-child limit were single parents.

The Institute for Fiscal Studies says that on average, affected households lose £4,300 each year, equivalent to 10 per cent of their average income and 22 per cent of their average benefit income.

“The two-child limit has an (even more) outsized impact on children living in low-income households, since, by definition, a household affected by the two-child limit has at least three children,” the think tank noted.

“It affects 23 percent of households with children in the poorest quintile of the income distribution, but 38 percent of children in the poorest quintile of the income distribution.”

Mubin Haq, chief executive of the abrdn Financial Fairness Trust, said: ‘The number of children affected by the two-child limit will rise by a third over the next five years.

‘The cap has contributed significantly to child poverty among large families during a period when poverty among families with one or two children has been declining.

‘This policy is inherently unfair as it only affects children born after 5 April 2017. Most of the families affected are working or have caring responsibilities for disabled relatives or young children.’

How would removing the limit on the two-child benefit affect you?

If the policy is eliminated, nearly 800,000 households will see an increase in the benefits they receive each month.

The IFS estimates that around 790,000 households (equivalent to 10 per cent of working-age households with children) and almost one in five children would be affected.

While the policy currently affects 550,000 households, the IFS says a further 250,000 will be affected by the policy next year and a further 670,000 by the end of the next parliamentary term.

The IFS gives the example of a single father of three living in a social housing scheme that costs £500 a month and is not working.

They will receive £3,721 in Universal Credit, £6,000 to cover housing and, in the absence of the two-child limit, £10,365 for their children.

They also receive £3,102 a year in child benefit, giving them a total income of £24,188 without the two-child limit.

If the two-child limit remains in place, they would receive £3,455 less each year in Universal Credit.

It is claimed that while other benefit cuts hit large families, removing the two-child limit would reduce child poverty by around 500,000.

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

You have 365 days’ notice

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.