According to Rightmove, the typical monthly mortgage payment for a first-time buyer has increased by 61 per cent since the last election year.

It revealed that over the past five years, the average mortgage payment for a typical first-time home buyer has risen from £667 per month to £1,075 per month, a staggering increase of £408.

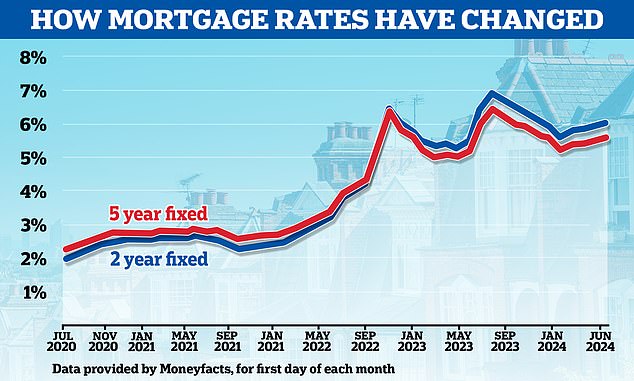

Much of the change came in 2022, when the Bank of England raised interest rates to combat high inflation and mortgages on offer became more expensive.

Expensive times: High home prices and mortgage rates have thwarted many first-time buyers’ attempts to get on the ladder and squeezed the budgets of those who have already done so.

Mortgage rates have remained elevated since then and there are few signs that they will fall substantially in the immediate future.

Last week, the Bank of England once again opted to keep the base rate at 5.25 percent, even though inflation fell to its 2 percent target for the first time since July 2021.

Markets predict there will be only one or two base rate cuts by the end of this year.

The average five-year fixed mortgage rate for someone buying with a 20 per cent deposit is now 5.09 per cent, compared to 2.24 per cent in 2019, according to data from UK Finance.

Meanwhile, the average home for a first-time buyer now costs £227,757, which is an increase of 19 per cent since 2019.

The Rightmove study also highlighted that the increase in average mortgage payments for first-time buyers has not been accompanied by wage growth.

Over the same five-year period, average salaries increased 27 percent compared to a 61 percent increase in mortgage costs.

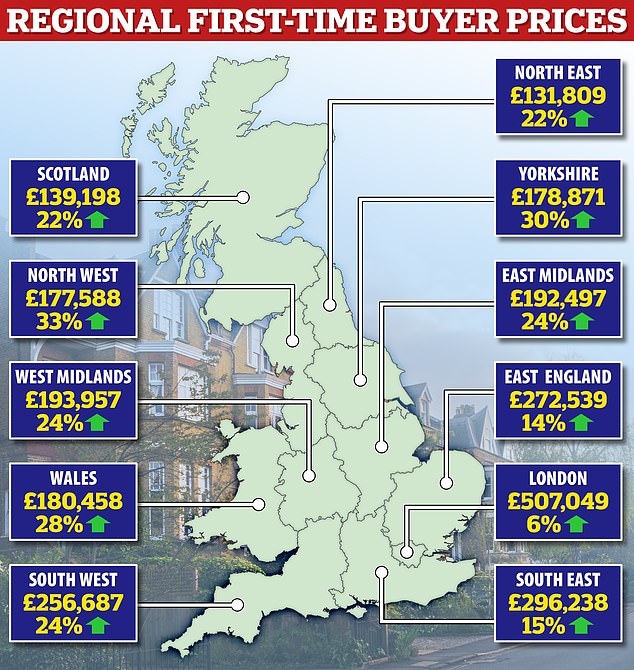

Regionally, the North West has seen the biggest rise in first-time buyer prices, up 33 per cent above 2019 levels, while London has seen the smallest rise of just 6 per cent in five years.

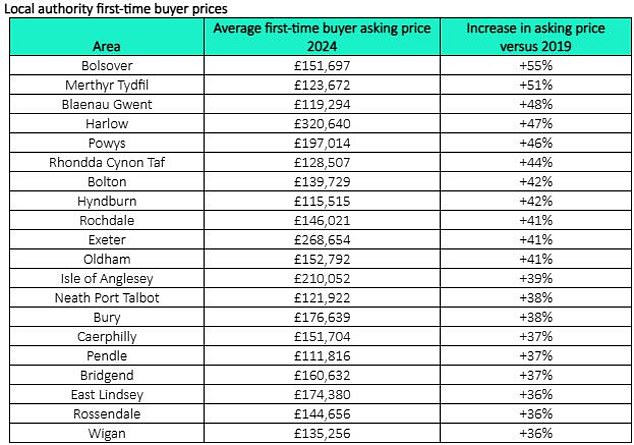

Rightmove found that 16 of the 20 areas that have seen the biggest rise in first-time buyer prices are in the North West and Wales, although Bolsover in Derbyshire tops the list with a 55 per cent rise in average home prices. sale.

How average first-time buyer prices in each region have changed since the 2019 election

Mark Harris, chief executive of mortgage broker SPF Private Clients, says an increasing number of first-time buyers are relying on family support to buy their first home.

He said: ‘Getting on the housing ladder is virtually impossible unless buyers have some help from the Bank of Mum and Dad or other family members due to the huge gap between incomes and property prices.

‘Most first-time buyers we see receive some help in the form of a cash deposit, a parent acting as guarantor or buying together through a sole proprietor mortgage.

“Recent research shows that first-time buyers are aging and applying for longer-term mortgages because this is often the only option if they want to get on the housing ladder.

“Affordability is a big concern for first-time buyers and is only going to get worse with rising rents and the high cost of living.”

Mortgage rates have remained high since 2022, putting pressure on first-time buyers trying to get on the ladder.

Experts urge rate cut to help first-time buyers

Rightmove property expert Tim Bannister is urging the Bank of England to cut rates to ease pressure on first-time buyers.

He believes this will have an almost immediate benefit for those trying to get up the ladder, should it, as expected, lead to lower mortgage rates.

“As rates have risen over the past five years, the amount a typical first-time buyer pays each month for a mortgage has outpaced the pace of income growth,” Bannister said.

‘Some first-time buyers are considering extending their mortgage terms to 30 or 35 years to reduce monthly payments, or looking at cheaper homes for sale so they will have to borrow less.

‘If mortgage rates are reduced, this will help first-time buyers in the short term more than electoral housing promises.

Bannister would also like to see the next government prioritize long-term solutions to help more first-time buyers get on the ladder, rather than short-term policies that only help very small groups of people.

He added: “We hope the next government can support first-time buyers with thoughtful policies, which address the difficulties of saving a large enough deposit and being able to borrow enough from a lender.”

This is a view shared by Nathan Emerson, chief executive of Propertymark, a membership body representing companies across the property industry.

“The rising interest rates and inflation of recent years have had a strong impact on the housing market,” Emerson said.

‘With the next general election now less than two weeks away, we are keen to see targeted support for first-time buyers at the earliest opportunity of any incoming government.

“The potential of homeownership should never be a prospect that is out of reach for people.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.