Table of Contents

Savvy Brits are taking advantage of booming gold prices by selling the precious metal to the Royal Mint for a profit.

Gold prices rose throughout 2024 to reach an all-time high in April, hitting highs of $2,382 (£1,916) an ounce.

In response, the Royal Mint told This is Money that it has seen a “record number” of customers selling gold to take advantage of the rising price.

The Royal Mint is reserved when it comes to giving exact figures on how much gold it sells or buys, for commercial reasons.

But the Mint said the number of people selling gold increased 19 percent in 2024 compared to 2023.

Raising the bar: The price of gold bars, including bars like these, has risen to a record high

These customers sell Mint gold bars – physical gold, such as bars, coins, and ingots.

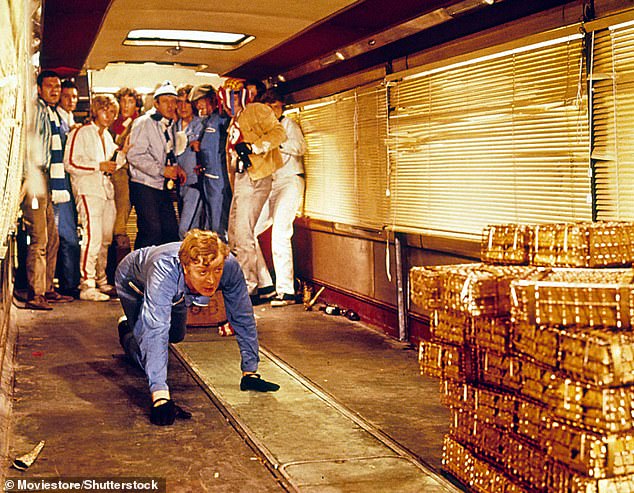

When we think of gold bars, we tend to think of solid gold bars, perhaps due to the influence of classic films such as The Italian Job, where a gang of British rogues conspire to steal $4 million in bullion (which today is worth around of £28 million).

But the reality, at least for most UK households, is that gold bullion purchases come in the form of smaller bars and coins, such as Britannias and sovereigns. The price of these smaller gold items ranges from £90 to £2000.

The Mint said that two-thirds of people selling gold had bought it themselves, and that the best-selling items are minted gold bars and coins. About 75 to 80 percent of these sellers were men.

The remaining third of those who profited from the gold rush had inherited gold, with sovereign coins being the most common item.

The Mint said the majority (54 percent) of people selling heirloom gold were women.

Rule Britannia: The 1oz Britannia gold bullion coin is a favorite among collectors, many of whom are now selling these £1,977 coins to the Royal Mint to cash in on higher gold prices.

How much can I earn selling gold to the Royal Mint?

The amount you can earn by selling gold is constantly changing; in fact, twice a day, except on Christmas Eve and Christmas Day.

This is because to set the price of bullion, the Royal Mint takes a price called gold fix, which is set by London’s biggest gold dealers every day at 10.30 a.m. and 3 p.m.

The Mint then adds a premium on top, and the final price is what a consumer or investor pays for the gold bullion.

The price of bullion purchased through the Mint tends to be higher than elsewhere.

Because the price of gold is always changing, the amount of profit you can make by selling gold is also constantly changing.

I had a great idea: many Britons decided to sell gold to the Royal Mint to make a profit, which would no doubt have resonated with the characters in the 1969 crime film The Italian Job.

But, as an example, someone buying a single 1oz Britannia gold bullion coin in December 2020 would have paid around £1,503 for it.

The value of that coin would have fallen to around £1,300 to £1,450 in 2021, as the price of gold fluctuated.

But today the same coin is worth £1,977, an increase of 37 per cent, or £474, since it was purchased in 2020.

The math here is simplistic, since, first of all, the Mint does not pay full price for the gold it purchases.

Instead, their general rule is to pay 90 percent of the weight price of gold, based on the latest gold fixation, or 98 percent if the gold is owned by the client but is already in safe custody at the Mint. .

The Mint also offers individual quotes for the gold, silver and platinum it purchases, which can further adjust the amount sellers can get.

The ‘cheapest’ gold you can buy

Rising gold prices are also changing the way customers buy gold at the Mint, with a clear trend toward smaller, cheaper purchases.

Of course, there is no such thing as cheap gold, but the Royal Mint said 65 per cent of its customers buy gold coins.

The Mint said that “1-ounce Britannia gold and Sovereign gold coins make up the majority of customer purchases.”

They cost around £1,977 and £1,941 respectively and when purchased individually. There is a small discount for larger orders.

It may look expensive, but it’s practically pocket change compared to even a 500g gold bar, which costs from £30,865.

Gold standard: This gold sovereign is worth around £460 when purchased individually from the Royal Mint, as it contains less gold than more expensive versions which sell for £1,941.

Ed Monk, associate director at Fidelity International, said: ‘Gold has proven its value over time as a store of value that maintains its purchasing power. In a “worst-case scenario,” gold remains the asset that many investors consider a safe haven option.

‘Importantly, gold tends to benefit from precisely the type of events that other assets like stocks and bonds don’t like. Therefore, it has the proven ability to act as an effective diversifier. It can help smooth out the returns of investment portfolios made up primarily of other assets.’

However, as gold prices rise, many gold buyers are choosing gold items that weigh less than the traditional 1oz size, such as the 0.235oz gold sovereigns (starting at £473.15) and the 1/10oz Britannia gold coin (from £228).

Customers on a budget also choose 1g gold bars, which will set them back £89.50 if purchased individually.

“They are attractive because of their lower price, because they contain less metal,” a Mint spokesperson said.

‘Cheaper’ option: Many customers are turning to lower cost 1g gold bars from the Royal Mint, which cost £89.50 and are the cheapest gold bars available for purchase.

How much does the Royal Mint make selling gold?

Gold is a huge growth area for the Mint in general.

The Royal Mint had revenue of £357 million from gold bullion in 2019/20, which increased by more than 360 per cent to £1.7 billion in 2023/24, according to its latest annual accounts.

Meanwhile, the weight of gold bars sold by the Mint in 2023/24 was 58 percent higher over the same period, although the company declined to give exact details.

The Mint’s move toward gold comes as it moves away from some of its traditional roles, such as making coins for other countries.

The Mint is the oldest company in the UK and began manufacturing coins overseas in 1325, 699 years ago.

But the Royal Mint will stop making coins for other countries this year, with 200 employees switching from coin making to gold recycling.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.