Table of Contents

Under-21s looking to hit the road face far higher costs than their parents faced, new data shows.

In what should be a time of enthusiasm and independence, this has turned into a financial obstacle too great for many.

It costs an average of £7,609 for a 17-20 year old to hit the road and drive in the first year, according to the latest edition of MoneySupermarket’s Household Money Index.

In 1989, the average young motorist had to pay £1,285 (£3,234 adjusted for inflation) to get on the road. This means an increase of 135 percent in 35 years.

This will cost young people in 2024 a whopping 135 per cent higher than the rate of inflation over the last 35 years, compared to 1989, when it cost £3,234 (adjusted for inflation).

These figures vary by 13 per cent across the UK: in London the most expensive price costs an average of £8,422, while in Cardiff it costs £7,309.

Nearly half of young people said they couldn’t afford to drive without financial help from their parents.

And the majority of under-25s (53%) who had delayed learning to drive said they avoided it because it was too expensive.

Many children hope their parents will be able to chip in and help them, but in a blow to keen drivers, parents who took part in the study estimated they could only contribute £990, or 13% of the amount necessary.

While most people would have found a job on Saturdays to cover the cost of classes or undertaken small jobs around the home and local area to earn some pocket money, this is no longer enough these days.

HMI found that a 17-year-old would need to work more than 1,188 hours to cover the driving costs of their first year on the road.

While 17-year-olds earn a minimum wage of just £6.40 an hour, teenagers are expected to spend more than half their annual income on driving.

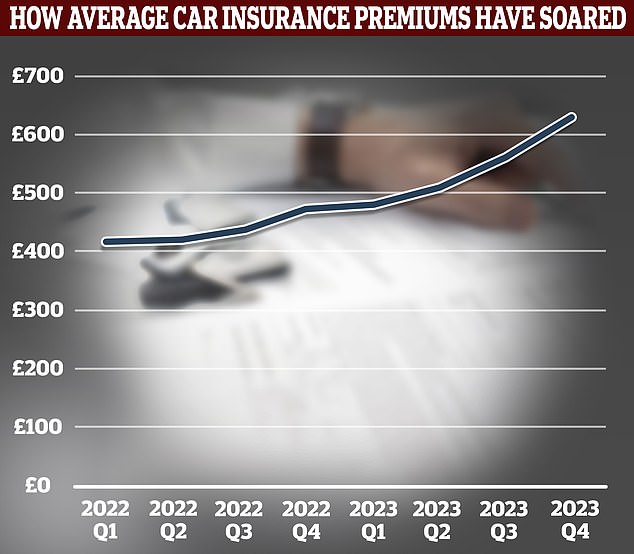

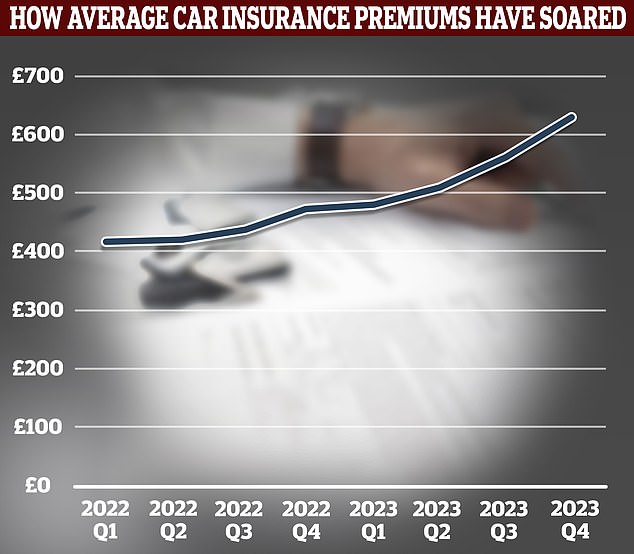

The main reason for rising costs came from massively rising insurance premiums – something This is Money has covered in detail.

To calculate the costs of taking the road, MoneySupermarket’s HMI – one of the most in-depth analyzes of the costs of taking the road – took into account the purchase of a license, lessons and review, as well as the cost of actual driving – buying a car. , insurance, fuel and charges such as ULEZ and parking tickets.

The main reason for increasing costs is rising insurance premiums.

According to data from the comparison site, insurance has grown five times faster than the rate of inflation – 27 percent since 2019.

In 2023, the average car insurance premium increased by 25%, with the Association of British Insurers (ABI) reporting the average premium was £543, up from £434 in 2022.

In 2019, the average insurance quote for a 17-20 year old was £1,240 – today it is £1,700.

Although driving your children may seem like a cost-effective alternative, once you factor in the time loss, HMI shows that it makes more sense, if you can afford it, to contribute to your child’s learning. child to drive and buy a car.

So is driving your children a better solution?

MoneySupermarket found that the average parent in the 17-20 age group spends 9.3 hours per month or 4.6 days per year transporting their children, costing them £1,336 per year.

Spread over three years between ages 17 and 20, the value of the lifts parents give their children would pay for 31 percent of their total automobile travel costs over the same period.

But HMI reckons it’s a better investment (if you can afford it) to put that money towards paying your children to drive rather than becoming a taxi service.

Paying for your children’s driving license, lessons and first year of insurance averages £3,658, allowing them to manage the cost of the car plus fuel, taxes themselves and costs. And parents will get back this well-deserved time.

Sara Newell, from MoneySupermarket, said: “Parents of today’s young drivers generally had a much cheaper experience when it was our turn to hit the road.

“95 per cent of those surveyed underestimated how much it costs young drivers today – not surprising given that the cost is 135 per cent higher than the rate of inflation over the past 35 years.

“When you’re faced with the decision of whether to start a taxi service or financially help your children hit the road, it’s not a simple choice – as our latest Household Money Index shows” .

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.