Table of Contents

British climate change activists may think they have won the battle against fossil fuels.

But conflicts in the Middle East and Ukraine have underscored the importance of energy security to all of our lives.

BP, which yesterday posted its lowest quarterly profit in almost four years due to lower oil prices, is a company at the center of the conflict.

Under the previous boss, Bernard Looney, the movement’s leadership was firmly away from fossil fuels with ambitious targets to reduce oil and gas production.

But his replacement, Murray Auchincloss, has been under pressure to rethink his situation. Their decisions have huge consequences for BP shareholders and UK plc.

Untapped: The Labor government’s refusal to grant new oil licenses in the North Sea means the wealth of opportunities they offer have been left in the dark.

BP is showing signs of taking on green activists and politicians like Energy Minister Ed Miliband, whose obsession with banning fossil fuels is causing great harm to this country.

The oil giant also faces lobbyists and bigots who shame and smear British institutions for their links to energy companies.

In December last year, to the fury of eco-warriors, it signed a £50m sponsorship deal with the British Museum.

This despite it being revealed just months earlier that BP had been forced to stop supporting the museum after 27 years.

This followed a relentless campaign of protests by the green lobby against the blue-chip energy company.

What is surprising is that the British Museum appears to have changed its mind by welcoming back its former patron.

Wokery is doing great, until it starts costing you tens of millions of pounds in support.

Green activists have forced numerous cultural bodies to cut ties with their fossil fuel sponsors.

The Tate, the National Portrait Gallery, the Royal Shakespeare Company, the Scottish Ballet and the Royal Opera House have all ended decades-long funding partnerships with BP in recent years, having bowed to pressure.

The National Gallery was separated from rival oil company Shell, as were the London-based arts complex the Southbank Center and the British Film Institute.

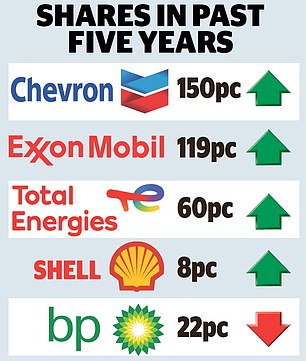

In the City, the oil giants have also been shunned, with some asset managers excluding them from our pension funds. This is despite the fact that they are among the largest payers of dividends to investors and of taxes to HMRC.

But the mood is finally changing. And it is the war in Ukraine and the escalation of the conflict in the Middle East that has helped catalyze this change.

They have forced the West to recognize how fragile our energy supplies are and that there is no prospect of renewable energy replacing them in the near future.

And so energy companies like BP are going back to basics around the world.

Except, of course, in the coastal waters of Great Britain. They are still rich in oil and gas, but the Labor government’s stubborn refusal to grant new oil licenses in the North Sea means the wealth of opportunities they offer have been left in the dark.

Miliband has slammed the door on new oil exploration in the North Sea. New drilling has been ruled out in favor of a green agenda of wind and solar energy, which will never meet our energy needs and will scar the landscape.

Proposed new taxes on existing North Sea oilfields are a blow to the UK’s refining and engineering capabilities. In a worst-case scenario, the industry estimates that up to 100,000 jobs could be at risk.

Labour’s claim that the launch of public company Great British Energy can fill the gap, with new manufacturing jobs in renewable energy, is pure fantasy.

Denmark is the world leader in sourcing and manufacturing technology for wind farms. Panels for solar farms and our homes are largely made cheaply in China. The heat pumps Labor want us to buy to replace gas boilers are mainly imported from Germany.

The damage caused by the Labor Party’s green fanaticism has been clear even in the short time it has been in power.

Thousands of job losses have been announced as a result of the closure of coal-fired steel blast furnaces in Port Talbot.

Under pressure: Boss Murray Auchincloss’s decisions have huge consequences for BP shareholders and UK plc

A new, more environmentally friendly electric arc furnace will not be in operation for several years. Meanwhile, Sir Jim Ratcliffe’s Ineos company has decided that oil refining at Grangemouth is no longer economical. The list goes on.

The folly of Labour’s approach is that it is very short-term. Big oil companies are happy to support the renewable energy revolution.

However, the best way to do this is to maximize profits now, so that they can invest more in green energy development for the future.

Under Looney, the energy giant set an ambition to transform itself into a greener company by 2030, sacrificing profits and dividends.

Following his departure a year ago, his successor, Canadian Auchincloss, returned to exploration and production.

And, unsurprisingly, given the dire prospects for fossil fuel development in the UK, it is looking elsewhere.

There are three new projects in Iraq, new plans in Kuwait and a return to the Gulf of Mexico, scene of the Deepwater Horizon disaster in 2010, where the company will develop a large and complex oil field.

Onshore in the United States it is expanding in the Permian Basin of Texas, where fracking has transformed the United States’ energy prospects, making it the largest exporter of natural gas on the planet.

BP is not the only one that recognizes that the path to a greener energy future involves redoubling oil and gas extraction, creating large strategic reserves.

Oil cash flows, if used wisely, can support the renewable energy revolution.

No one takes a dim view of Norway’s continued pumping of oil and gas, and it is among our largest energy suppliers through the Langeled pipeline.

Norway, already among Britain’s biggest foreign investors, recently announced that its state oil and gas company Equinor has bought a 10 percent stake in Danish energy giant Orsted.

Equinor operates vast offshore wind farms off the east coast of England and was recently a winner in the latest UK licensing round.

There can be no better example of how fossil fuel companies are creating the financial resources that, over time, are allowing the green energy revolution to take place.

In the United States, the presence of climate change experts on Exxon-Mobil’s board of directors has not prevented the company from doubling its exposure to oil.

Earlier this year it spent £46bn buying Pioneer Oil in Texas, one of the biggest beneficiaries of the US fracking revolution.

Also in the United States, Warren Buffett, the most famous investor in the world, showed no reluctance when it came to acquiring a large stake in Western oil.

Even woke college campuses are changing their minds.

Princeton University in New Jersey just reversed a policy that restricted funding of academic research by fossil fuel companies, saying the rule was hindering research on environmental challenges.

The fact is that this Labor government seems increasingly out of step with the world on fossil fuels.

And the dangers of making ‘Big Oil’ unwelcome here are manifest.

Wael Sawan, chief executive of Anglo-Dutch giant Shell, has warned that hostility in the UK towards oil exploration has led him to consider moving the company’s share listing from London to New York.

As one of Britain’s two largest corporations, Shell’s departure would be an unmitigated disaster for the City of London and the country’s tax base.

In 2023, it contributed £51 billion to governments around the world (including much of the UK) in the form of corporation taxes, royalties, excise duties and other levies. This is more than double Labour’s so-called black hole, valued at £22bn.

Last month it was revealed that more than 50 per cent of Britain’s energy now comes from renewable resources.

The path to a lower carbon future is being charted. But it makes no sense to demonize our big oil companies with windfall taxes and other taxes and drive them overseas.

It undermines the nation’s security (making us dependent on foreign imports) and could deprive Britain of the dividends and profits that can help drive a less disruptive transition.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.