Table of Contents

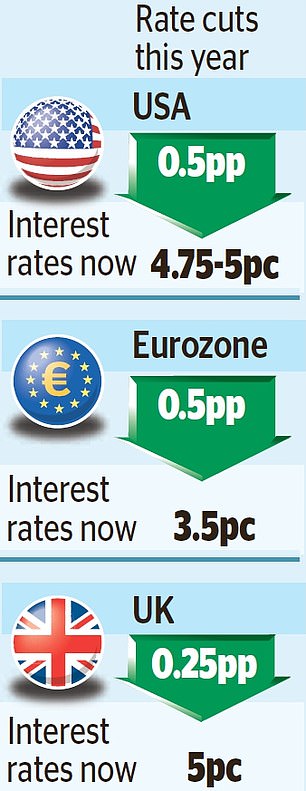

The US central bank announced a massive half-percentage point interest rate cut last night as it seeks to achieve a “soft landing” for the world’s largest economy.

It was the first rate cut by the US Federal Reserve in four years and sent the dollar tumbling against the pound, which hit a new two-and-a-half-year high of just under $1.33.

The last Fed cut came in 2020, when the US economy was in the grip of the pandemic. Since then, it has had to raise rates to cope with rising inflation.

‘In good shape’: Federal Reserve chief Jerome Powell (pictured) says US economy is growing at a solid pace

Now, however, inflation has fallen back to 2.5 percent, its lowest level in three and a half years, and the Fed has turned its attention to concerns about the declining labor market.

This has raised fears that high rates could be pushing the world’s largest economy into recession.

Federal Reserve Chairman Jerome Powell said: ‘This recalibration will help maintain the strength of the economy and the labor market, and continue to allow for further progress on inflation.

“The U.S. economy is in good shape. It’s growing at a solid pace. We want to keep it that way.”

Powell denied that the Fed had taken too long to cut rates. “We don’t think we’re late, we think it’s timely,” he said.

“But I think this can be taken as a sign of our commitment not to be left behind: it is an important step.

“We are trying to achieve a situation where we restore price stability without the painful rise in unemployment that sometimes accompanies disinflation.”

He said the labor market had “cooled from its previous overheated state” and the Fed now projected unemployment at 4.4 percent by year-end, up from 4.2 percent currently.

The Fed has also lowered its inflation expectations.

And projections released by the central bank indicate that rates will fall another half percentage point later this year, another full percentage point in 2025 and a final half point in 2026.

Expectations of a rate cut intensified last month when Powell told a meeting of central bankers: “The time has come to tighten policy.”

In recent days, market bets have increasingly pointed to the likelihood of a half-percentage point move rather than the more traditional 0.25 percentage point move.

Last night’s decision saw the Fed cut rates from a range of 5.25 percent to 5.5 percent to a range of 4.75 percent to 5 percent.

Its goal has been to try to bring inflation down to its 2 percent target without having to push the economy into contraction, what is called a “soft landing.”

The Fed said it had “gained greater confidence that inflation is moving sustainably toward 2 percent.”

Isaac Stell, investment manager at Wealth Club, a brokerage, said: “The market was asking for it and the Fed delivered.

Many might wonder what the Federal Reserve sees on the horizon to push for such a bold move.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.